Private equity firms have long been powerful players in the financial markets, known for their strategic acquisitions and significant returns on investment. Traditionally, these firms have focused on buying out parts of public companies, often revitalizing underperforming divisions. However, a recent trend has emerged, showcasing a pivotal shift in their investment approach—private equity is now setting its sights on larger prizes, acquiring whole public companies.

Historical Overview

At the dawn of the new millennium, the private equity landscape was markedly different. Firms were predominantly investing in business units spun off from public companies, allowing them to carve out niche markets and optimize these entities away from public market pressures. This tactic allowed for focused growth strategies and targeted operational improvements.

Analysis of the Data

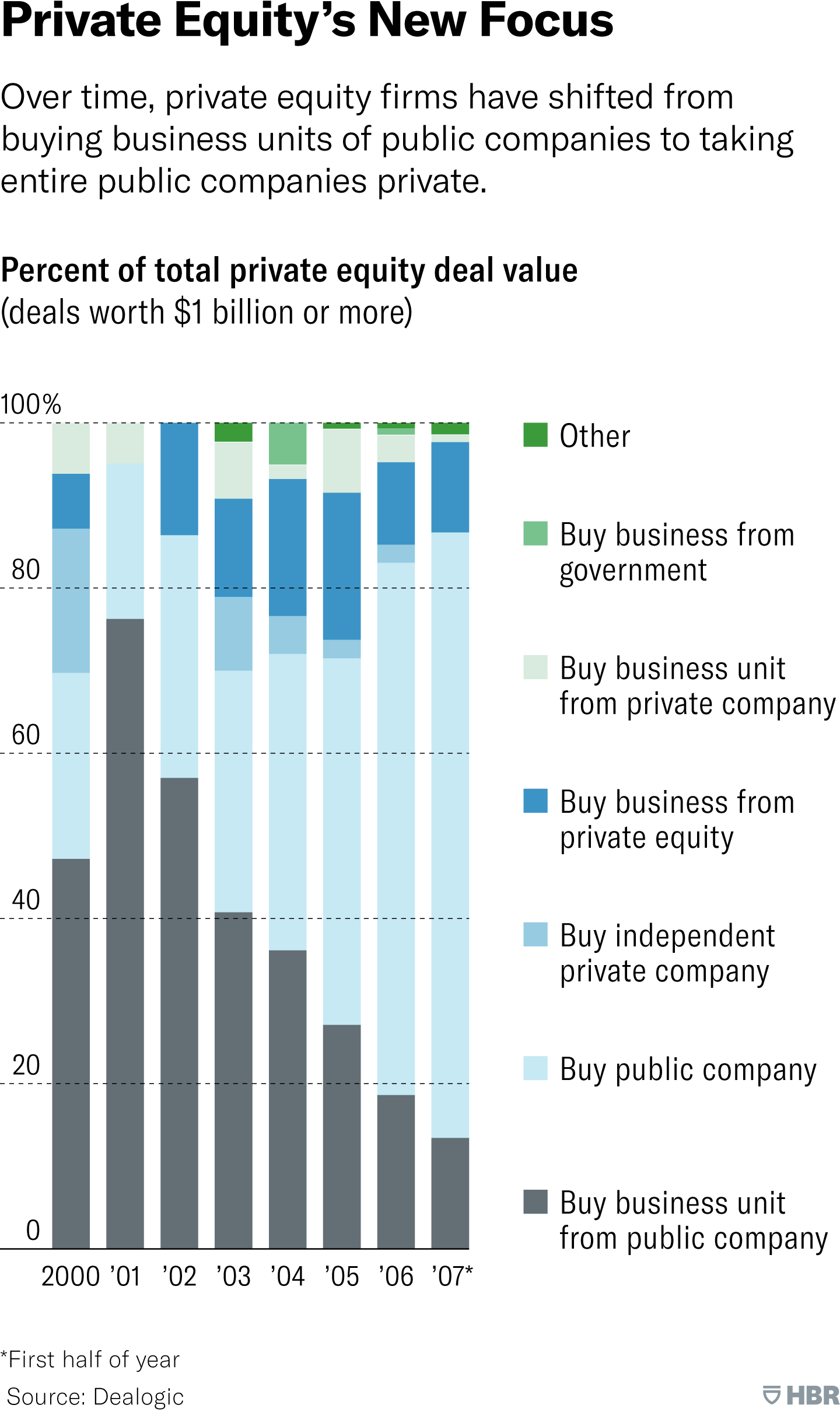

The graph below from the Harvard Business Review delineates a clear evolution in private equity investment focus. For deals valued at $1 billion or more, there has been a gradual decline in the acquisition of business units from public companies. In contrast, the move to buy entire public companies has seen a steady increase.

This transition is visually captured through the fluctuating color bands on the graph, each representing a different type of deal from the year 2000 through the first half of 2007. The rising prominence of the light blue band—indicative of full public company acquisitions—tells a story of growing ambition and expanding financial capacity within private equity firms.

Factors Contributing to the Shift: Several factors have contributed to this strategic realignment:

- Economic conditions: Low-interest rates have made financing large-scale buyouts more feasible.

- Market conditions: Volatility in the public markets has often led to undervalued public companies, ripe for private equity acquisition.

- Regulatory changes: A more conducive regulatory environment has reduced the hurdles for such buyouts.

- Valuations: As private equity firms have grown more sophisticated, they have become adept at identifying and unlocking value in whole companies rather than just parts.

Impact on the Market: The ramifications of this shift are profound:

- On the stock market: The buyout of public companies reduces market capitalization and the number of tradable assets, impacting indices and investor portfolios.

- On companies: Going private can free companies from quarterly reporting, enabling a longer-term strategic focus, often leading to restructuring and sometimes job cuts.

- On future market trends: This trend may continue, with private equity possibly becoming a more dominant force in shaping industries and the broader economy.

Current and Future Trends: The data from 2007 indicates an appetite for larger, more complex deals. Should this trend persist, we might expect to see an even more aggressive private equity landscape, with larger funds being raised and bigger targets being pursued. This could redefine the very essence of market dynamics, with private equity firms becoming the new behemoths of the business world.

Experts suggest that this shift could lead to more competitive bidding for companies, potentially driving up acquisition costs. It could also mean a tighter focus on operational efficiencies post-acquisition, as the stakes for ensuring return on investment have become significantly higher.

The private equity industry has evolved from a focus on buying parts of companies to acquiring them whole. This strategic shift has major implications for the stock market, the operation of the companies involved, and future market trends. As the landscape continues to evolve, stakeholders must remain vigilant, considering the broader impacts of these powerful financial entities on the economy.

Graphics and Visual Data

Accompanying this article is a telling graph that offers a visual representation of the strategic shift in private equity’s focus over a span of nearly a decade. This graph isn’t merely a collection of colored bars; it is a chronicle of changing economic tides and the adaptive strategies of financial titans.

Each colored band on the graph corresponds to a different type of acquisition deal made by private equity firms. For instance, the dark grey bands represent the purchase of business units from public companies, which was the prevalent trend at the start of the millennium. As you scan from left to right, notice the thinning of these dark bands—indicative of the strategy’s decline in favor of other types of deals.

The light blue bands tell the most compelling story of change—they mark the acquisition of whole public companies. Initially modest in size, these bands grow steadily over the years, demonstrating how private equity firms have increasingly taken to buying out entire public entities rather than their individual parts. This growth signifies not just a change in strategy but also an escalation in the scale and complexity of the deals being pursued.

Equally noteworthy are the shifts in the other colors—such as the teal bands (buy independent private company) and the lighter grey (buy business from private equity), which fluctuate over time, reflecting the ebb and flow of investment trends in response to market opportunities and internal competencies of private equity firms.

When observing these bands, readers should consider the broader economic context that influenced these shifts. For example, consider how market conditions, regulatory landscapes, and competitive pressures may have played a role in the expanding scope of these investments. Furthermore, reflect on the strategic implications—such as how the growing prevalence of full company buyouts reflects private equity firms’ confidence in their ability to manage and improve these larger entities.

This visual data isn’t just a backward glance at historical trends; it provides a foundation for forecasting and strategizing for the future. By understanding past patterns, investors, analysts, and corporate strategists can anticipate potential future shifts in private equity’s focus, preparing for the next wave of financial innovation and market reshaping.

In summary, the graph provides a layered insight into the evolution of private equity investment focus, one that illustrates not just past behaviors but also future possibilities. It is an essential tool for anyone looking to comprehend the intricate dance of private equity investment and the resultant financial and operational reverberations felt across global markets.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with DawgenGlobal. Together, let’s venture into a future brimming with opportunities and achievements.