In an era marked by rapid technological advancement and increasing regulatory complexities, businesses are under immense pressure to maintain robust audit systems that ensure compliance, transparency, and financial integrity. This evolving landscape demands an overhaul of traditional audit methodologies through the integration of digital tools. The revolution in audit strategies is not just about staying current; it’s about staying ahead. This article explores how digital tools are fundamentally transforming auditing, propelling gains in efficiency, effectiveness, and economic benefits.

The Shift to Digital Auditing

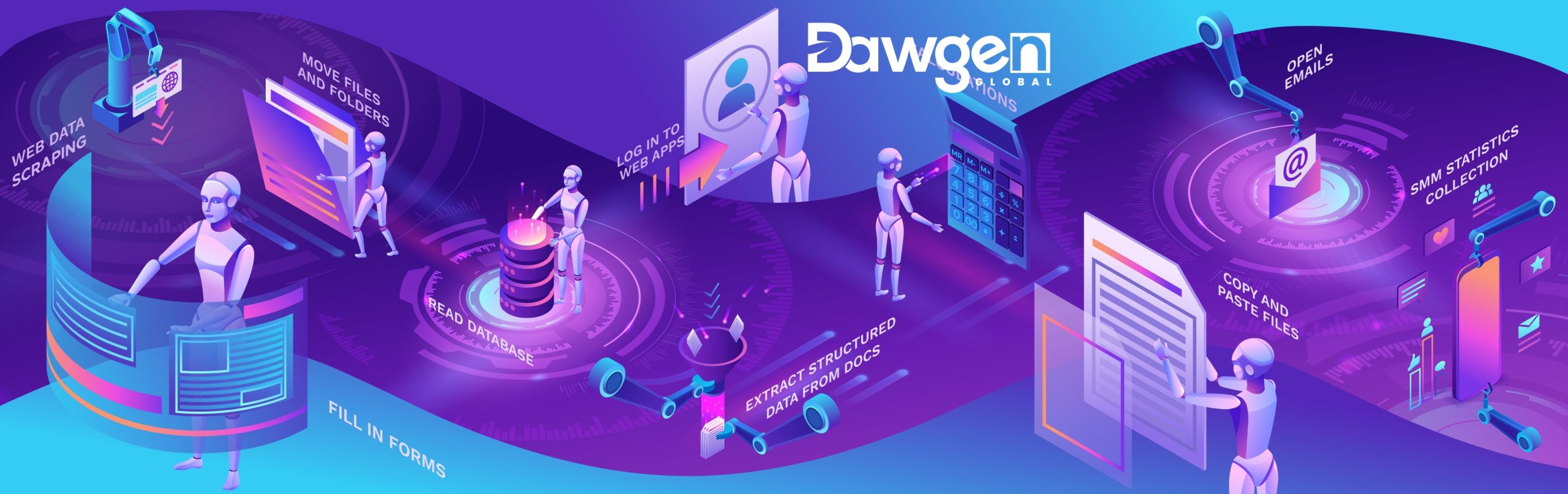

The audit profession is experiencing a significant transformation, driven by the advent of digital technologies such as data analytics, artificial intelligence (AI), robotic process automation (RPA), and blockchain. These technologies are not merely enhancing existing processes; they are redefining what is possible in auditing, allowing firms to tackle audits with unprecedented precision and insight.

Boosting Efficiency with Robotic Process Automation

Robotic Process Automation (RPA) is a game-changing technology in the world of auditing, primarily due to its ability to significantly enhance operational efficiency. RPA utilizes software robots, or “bots”, to automate routine and repetitive tasks that are typically performed manually by human auditors. This shift not only accelerates the pace at which these tasks are completed but also minimizes the likelihood of human error, resulting in more accurate audit outcomes.

Key Areas Improved by RPA

- Data Entry and Management: One of the most time-intensive tasks in auditing is data entry and subsequent management. RPA bots are programmed to perform these tasks efficiently and flawlessly, extracting data from various sources, inputting it into appropriate systems, and managing databases without fatigue or error.

- Transaction Reconciliation: Auditors often spend considerable amounts of time reconciling transactions manually. RPA can handle large volumes of transactions quickly by cross-verifying details from multiple sources, ensuring consistency and accuracy that surpasses manual efforts.

- Compliance Monitoring: Regulatory compliance is a critical component of the audit process. RPA can be configured to monitor compliance continuously, checking for deviations from established rules and standards. This not only speeds up the audit process but also enhances compliance accuracy, as RPA can operate around the clock without breaks or downtimes.

Benefits of RPA in Auditing

- Increased Productivity: By automating routine tasks, RPA frees up auditors to focus on more complex and strategic aspects of the audit process, such as risk analysis and decision-making. This shift not only improves the quality of work but also enhances the auditors’ job satisfaction by eliminating mundane tasks.

- Cost Reduction: RPA reduces the need for additional human resources to manage peak loads, especially during the busy audit season. Automation can handle increased workload without the need for overtime costs or temporary staffing, which significantly reduces operational costs.

- Error Reduction: Manual processes are prone to errors, especially when handling large data sets. RPA operates with a high degree of accuracy and consistency, reducing the risk of mistakes and the need for time-consuming corrections.

- Scalability: RPA solutions are highly scalable. They can be adjusted to handle varying workloads and can be easily modified to adapt to new or changing audit requirements without significant disruptions.

Implementing RPA in Audit Processes

To effectively implement RPA, firms should start with a pilot project focusing on a specific area of the audit process where automation could have immediate impact. This allows the firm to gauge the effectiveness of RPA and make adjustments before a full-scale rollout. Additionally, it is crucial to have a clear understanding of the existing processes and to work closely with IT and audit professionals to design RPA solutions that seamlessly integrate with current systems.

In summary, RPA offers a profound opportunity to boost efficiency in auditing by automating routine tasks, thus allowing auditors to dedicate more time to strategic analysis and decision-making. As the technology continues to evolve and integrate with other digital tools like AI and data analytics, its potential to transform the audit profession becomes even more significant. Firms that adopt RPA not only position themselves as leaders in efficiency but also enhance their capability to deliver higher-quality and more insightful audit outcomes.

Enhancing Effectiveness with AI and Data Analytics

Artificial Intelligence (AI) and data analytics are revolutionizing the audit process by enhancing the effectiveness of audits through advanced capabilities in data handling and analysis. These technologies allow for a more profound, insightful examination of data, uncovering critical insights that can dramatically improve decision-making and risk management in auditing.

Deep Diving into Data with AI and Analytics

AI and data analytics extend beyond mere number crunching; they involve sophisticated algorithms capable of performing complex analyses that can detect inconsistencies, predict trends, and provide forecasts. Here’s how these tools enhance audit effectiveness:

- Pattern Recognition: AI systems are exceptionally good at recognizing patterns in large data sets. In an audit context, this means being able to identify unusual transactions or outliers that could indicate errors or fraudulent activity. This pattern recognition is done at a speed and accuracy that far exceeds human capabilities.

- Predictive Analytics: By using historical data, AI can help predict future outcomes based on existing trends. This is incredibly useful in audit risk assessment where predicting areas of higher risk can focus audit efforts more effectively, thus optimizing the audit process.

- Risk Assessment and Management: With the help of machine learning, AI systems can continuously learn from new data inputs, thereby improving their predictive capabilities over time. This leads to better risk management as the system becomes adept at identifying potential areas of risk before they become problematic.

- Enhanced Decision Making: Data analytics provide auditors with actionable insights, which are crucial for making informed decisions. By analyzing complex datasets, auditors can understand the financial status, operational efficiency, and compliance levels of an organization more comprehensively.

Real-Time Auditing

One of the standout features of integrating AI and data analytics in auditing is the ability to conduct real-time audits. This means that instead of periodic reviews, the audit systems continuously analyze transactions as they occur. Real-time auditing offers several benefits:

- Immediate Identification of Issues: Problems such as transaction errors or compliance breaches can be identified and addressed immediately, significantly reducing the potential for compounded errors and the ripple effects of financial discrepancies.

- Continuous Assurance: Stakeholders gain greater confidence as they receive ongoing assurance that the organization’s financial health is monitored and maintained rigorously.

Data Visualization Tools

Enhancing effectiveness is not just about processing data but also presenting it in a way that is easy to understand. Data visualization tools play a critical role in this aspect by turning complex quantitative information into easily comprehensible visual formats. Auditors can leverage these tools to present findings effectively to management and stakeholders, making the implications of data more accessible.

Challenges and Considerations

While the benefits are substantial, implementing AI and data analytics does come with challenges. These include the need for substantial initial investment, ongoing training for staff, and managing the change within the audit function. Moreover, data quality and integrity are paramount; the output is only as good as the input data.

The integration of AI and data analytics into the auditing process marks a significant leap towards more effective, insightful, and proactive auditing. By leveraging these technologies, auditors can enhance the quality of their audits, provide better risk assessments, and deliver more value to their clients. As the technology evolves, its integration into the auditing profession will likely become more prevalent, setting a new standard for how audits are conducted in the digital age.

Economic Benefits of Cloud Computing

The economic benefits of digital auditing are most evident in the adoption of cloud computing. By utilizing cloud-based audit tools, firms can reduce the costs associated with maintaining physical IT infrastructures. Additionally, cloud solutions offer scalability and flexibility, allowing firms to adjust resources based on specific audit needs. This scalability ensures that firms pay only for what they use, optimizing overall audit costs.

Case Studies and Success Stories

Across the globe, numerous firms have harnessed these digital tools to transform their audit processes. For instance, a leading multinational corporation implemented AI to automate risk assessment procedures, reducing the risk assessment time by over 50% and significantly cutting down on operational costs. Similarly, blockchain technology has been used by financial institutions to enhance the integrity and security of transaction records, greatly simplifying compliance with international standards.

Overcoming Challenges

While the benefits are clear, the path to digital transformation is not without challenges. These include the initial capital investment in technology, the need for ongoing training and development to ensure skills keep pace with technological advancements, and potential resistance to change within established audit teams. Successfully navigating these challenges involves careful planning, stakeholder engagement, and a commitment to continuous learning and adaptation.

The revolution in audit strategies through digital tools is not merely a trend but a fundamental shift in how audit services will be delivered in the future. By embracing these technologies, firms can not only enhance the efficiency, effectiveness, and economic efficiency of their audits but can also provide more insightful, proactive, and strategic audit outcomes. As digital tools continue to evolve, they will play an increasingly critical role in shaping the auditing landscape, making it imperative for audit professionals and firms to adapt and thrive in this new digital age.

Client Benefits from Dawgen Global’s Revolutionary Audit Strategies

Dawgen Global’s adoption of advanced digital audit strategies has not only transformed its internal processes but also brought substantial benefits to its clients across various sectors. By integrating cutting-edge technologies such as AI, data analytics, and RPA into their audit services, Dawgen Global ensures that clients receive more accurate, timely, and insightful audit results. Here’s how these innovative approaches have redefined the value that Dawgen Global delivers to its clients:

Increased Transparency and Reliability

Clients of Dawgen Global benefit from enhanced transparency in the audit process. The use of AI and data analytics allows for a more thorough examination and presentation of financial data, helping clients gain a clearer understanding of their financial position and operational efficiencies. This level of detail and transparency fosters greater trust between auditors and clients, ensuring that all stakeholders have a reliable basis for decision-making.

Faster Audit Cycles

With the implementation of RPA, Dawgen Global has significantly reduced the time required for routine auditing tasks, such as data entry and transaction reconciliation. This efficiency gain not only speeds up the audit process but also allows Dawgen Global to deliver audit results much faster to clients. Quicker audit cycles enable clients to react more swiftly to their financial insights, allowing for prompt corrective actions when necessary.

Enhanced Strategic Insights

The strategic use of AI in analyzing large data sets enables Dawgen Global to provide its clients with more than just compliance checks. Clients receive valuable insights into trends, risk areas, and opportunities within their operations. These insights are pivotal for strategic planning and decision-making, helping clients to navigate complex business environments and to capitalize on opportunities for growth and improvement.

Cost-Effectiveness

By automating many aspects of the auditing process, Dawgen Global reduces the labor-intensive elements of audits, which in turn lowers the overall cost of the audit for clients. These savings can be substantial, especially for large corporations that traditionally require extensive manual auditing work. Additionally, the enhanced accuracy provided by digital tools reduces the likelihood of costly errors or the need for re-audits.

Proactive Risk Management

The predictive capabilities of AI and analytics tools mean that Dawgen Global can offer its clients a more proactive approach to risk management. By identifying potential issues before they escalate, Dawgen Global helps clients to implement preventative measures rather than merely reactive ones. This proactive stance on risk management is invaluable for maintaining operational integrity and safeguarding against financial and reputational damage.

Customized Auditing Solutions

Dawgen Global leverages these technologies to tailor their auditing services to the specific needs of each client. By understanding the unique aspects of each client’s business through data-driven insights, Dawgen Global can focus on areas of highest impact, ensuring that the audit process is both thorough and relevant to the client’s specific operational context.

The technological innovations adopted by Dawgen Global have not only revolutionized its audit strategies but have also delivered substantial benefits to its clients. These benefits manifest as enhanced transparency, increased efficiency, strategic insights, cost savings, and proactive risk management, all of which contribute to a superior service offering. As Dawgen Global continues to push the boundaries of what is possible in auditing through technology, its clients can expect to remain at the cutting edge of compliance and business optimization.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements.