In the quest to measure and enhance business efficiency, Return on Invested Capital (ROIC) stands out as a pivotal metric. ROIC provides a snapshot of how well a company uses the capital invested by shareholders to generate profits. Understanding and optimizing ROIC is not merely about improving a financial ratio—it is about unlocking the potential of every dollar invested to enhance shareholder value.

In the quest to measure and enhance business efficiency, Return on Invested Capital (ROIC) stands out as a pivotal metric. ROIC provides a snapshot of how well a company uses the capital invested by shareholders to generate profits. Understanding and optimizing ROIC is not merely about improving a financial ratio—it is about unlocking the potential of every dollar invested to enhance shareholder value.

Understanding the Calculation of ROIC

Components of ROIC:

ROIC is calculated by dividing Net Operating Profit After Taxes (NOPAT) by Invested Capital. NOPAT represents the earnings a company generates from its operations after taxes but before financing costs and non-operating profits. Invested Capital includes all capital invested in the business, typically encompassing debt and equity.

Detailed Calculation Example:

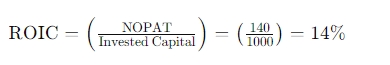

Consider a company with an operating income of $200 million and a tax rate of 30%. Its NOPAT would be $140 million ($200 million – 30%). If the company’s total invested capital is $1,000 million, the ROIC would be calculated as follows:

This 14% ROIC means the company generates $0.14 in profit for every dollar of capital invested.

Interpreting ROIC

Benchmarking ROIC:

A ‘good’ ROIC should exceed the company’s cost of capital, and it varies by industry due to differences in risk and capital intensity. For example, a technology company might have a higher ROIC than a utility company due to lower capital requirements.

ROIC and Value Creation:

A high or improving ROIC indicates efficient capital use relative to the company’s cost of capital, suggesting effective management and potential for higher shareholder returns. Conversely, a low or declining ROIC can signal inefficiencies or overly risky ventures.

Strategies to Optimize ROIC

Improving Operational Efficiency

Operational efficiency is crucial for maximizing NOPAT and, consequently, improving ROIC. Strategies to enhance operational efficiency involve meticulous scrutiny and refinement of various aspects of operations:

- Enhancing Production Processes: Companies can adopt advanced manufacturing technologies such as automation and robotics to increase production efficiency. Implementing lean manufacturing principles to minimize waste and streamline processes also contributes significantly to reducing costs and enhancing product quality.

- Reducing Waste: This strategy focuses on eliminating non-value-adding activities and materials in every process. Techniques such as Six Sigma can be instrumental in identifying and eliminating sources of waste, thus saving costs and improving profitability.

- Optimizing Supply Chain Logistics: By integrating advanced logistics solutions like just-in-time delivery, companies can reduce inventory costs. Additionally, renegotiating supplier contracts or consolidating orders to obtain better pricing can decrease procurement costs and improve margins.

These strategies not only boost NOPAT by lowering operational costs but also improve customer satisfaction and competitiveness in the market.

Capital Efficiency

Effectively managing the capital invested in business operations is another crucial strategy for optimizing ROIC. Several approaches can help enhance capital efficiency:

- Disciplined Capital Expenditure Decisions: Prioritizing capital expenditures (CapEx) that promise the highest returns relative to their risk is essential. This may involve conducting rigorous return on investment (ROI) analyses before committing to new projects and avoiding or postponing lower-yield investments.

- Improving Asset Turnover: Companies can increase asset turnover by better utilizing existing assets to generate more revenue. This might involve upgrading equipment to increase output or repurposing underutilized assets to expand into new product lines or markets.

- Divesting Non-core or Underperforming Assets: Regularly reviewing asset performance to identify and divest those that are not contributing to profitability or are outside the core business areas can release capital for better uses. This not only improves capital efficiency but also refocuses the company on its core competencies.

By focusing on capital efficiency, companies can ensure that every dollar invested is working as hard as possible to generate returns, thus improving overall ROIC.

Innovation and Expansion

Investing in innovation and expansion is vital for long-term growth but can affect short-term ROIC due to the initial costs involved. However, with strategic planning, these investments can lead to significant improvements in ROIC:

- Investing in Innovative Processes: Whether it’s adopting new technologies, improving product designs, or streamlining services, innovation can lead to more efficient operations and open up new revenue opportunities. For instance, investing in digital transformation can automate tasks, reduce errors, and provide data insights that lead to better decision-making.

- Market Expansion: Expanding into new markets or segments can incur substantial upfront costs, but it increases the potential customer base and diversifies revenue sources. Strategies could include international expansion, targeting new demographic groups, or developing new product lines tailored to specific market needs.

While these investments might temporarily lower ROIC, if executed based on a clear understanding of market demands and competitive dynamics, they can dramatically enhance the company’s market position and profitability in the long term.

Optimizing ROIC is a multifaceted endeavor that requires a balanced approach to operational efficiency, capital management, and strategic investment in innovation and growth. By continually refining these areas, companies can ensure sustainable growth and create substantial value for shareholders, thereby achieving superior ROIC. This strategic focus not only strengthens the business’s financial position but also enhances its competitive edge in the marketplace.

Case Studies

Successful Implementation: Apple Inc.

Apple Inc. is a standout example of how a strategic focus on ROIC can drive phenomenal success. The company has demonstrated an exceptional ability to maintain high ROIC through several key strategies:

- Innovation and Product Development: Apple’s commitment to continuous innovation has kept its product offerings at the forefront of technology, appealing to a high-end consumer market. This includes the development of iconic products like the iPhone, iPad, and MacBook, as well as newer offerings such as wearables (Apple Watch) and services (Apple Music, iCloud). Each product not only complements others in the ecosystem but also encourages brand loyalty and enhances customer lifetime value.

- Brand Management: Apple’s brand is one of its most significant assets. By consistently maintaining a brand associated with quality, innovation, and exclusivity, Apple commands premium pricing for its products. This strategy not only boosts profit margins but also reinforces customer loyalty, which is crucial for long-term revenue generation.

- Efficient Supply Chain Management: Apple’s supply chain is finely tuned to maximize efficiency and cost-effectiveness. The company uses a meticulous approach to procurement, manufacturing, and logistics, which minimizes production costs while ensuring high-quality standards. Strategic partnerships with suppliers ensure timely delivery of components, minimizing inventory costs and enabling quick turnaround times for new and updated products.

- Expansion into Digital Services: Recognizing the maturation of its main hardware markets, Apple has vigorously expanded into digital services. This sector offers high-margin, recurring revenue streams that enhance the overall profitability of the business. Services like Apple Music, the App Store, and Apple Pay provide steady cash flows that complement the more cyclical nature of product sales.

Lessons Learned: The Importance of Strategic Focus

Long-Term Value Creation Over Short-Term Profits: The key takeaway from Apple’s strategy is the focus on creating long-term value rather than merely maximizing short-term profits. This approach is evident in Apple’s substantial investments in R&D, brand management, and infrastructure, ensuring sustainable growth and profitability.

Integrated Product Ecosystem: Apple’s strategy of creating an integrated ecosystem of products and services encourages customer retention and increases ROIC. Each product or service is designed to work seamlessly within the ecosystem, enhancing user experience and increasing customer dependence on Apple products, which drives repeat sales and increases the lifetime value of customers.

Diversification and Adaptation: Apple’s move into digital services illustrates the importance of adapting business strategies in response to market changes. As the hardware market becomes increasingly saturated, Apple has successfully diversified its revenue streams, which stabilizes its financial performance and enhances its ROIC.

Cultivating Brand Loyalty: Apple’s focus on maintaining a strong brand and customer loyalty through quality and innovation is crucial. This not only supports premium pricing but also reduces the cost of sales and increases the efficiency of marketing expenditures, contributing to higher ROIC.

Apple Inc.’s approach to maintaining a high ROIC underscores the effectiveness of integrating innovative product development, strong brand management, efficient operations, and strategic market expansion. The lessons drawn from Apple’s success story can serve as valuable insights for other companies aiming to optimize their ROIC and achieve sustainable shareholder value.

Conclusion

Understanding and optimizing ROIC is essential for any business aiming to thrive in a competitive environment. By focusing on strategies that enhance both NOPAT and the efficiency of capital use, companies can significantly improve their financial health and shareholder value. Leaders are encouraged to regularly analyze their ROIC to identify improvement opportunities and make informed decisions that align with long-term value creation.

Contact Information:

For further inquiries or detailed analysis on optimizing ROIC within your organization, please reach out:

📧 Email: [email protected]

📞 Caribbean Office: 1 876 929 3670

📞 USA Office: +1 786 673 3120

📱 WhatsApp Global: +1 876 5544445

Leveraging ROIC as a metric not only enhances financial performance but also positions a company for sustainable growth and success in the global marketplace.