In a globalized economy, understanding the relationship between tax revenue and economic output is crucial for evaluating the fiscal health of a nation. The tax-to-GDP ratio serves as a key indicator of this relationship, measuring a country’s tax revenue relative to the size of its economy. This metric is not just a number; it reflects the fiscal policy, government efficiency, and economic structure of a nation.

The Significance of Tax-to-GDP Ratio

A higher tax-to-GDP ratio often suggests that a country has a robust mechanism for tax collection, which in turn provides the government with ample revenue to invest in public services, infrastructure, and social welfare programs. It indicates a greater ability of the government to influence the economy through fiscal policy, which is critical in addressing issues such as inequality and economic development. Conversely, a lower tax-to-GDP ratio might indicate a lighter tax burden on the economy, which could lead to underfunded public services but might also suggest a more market-driven economy with less government intervention.

Europe: A Leader in Tax Collection

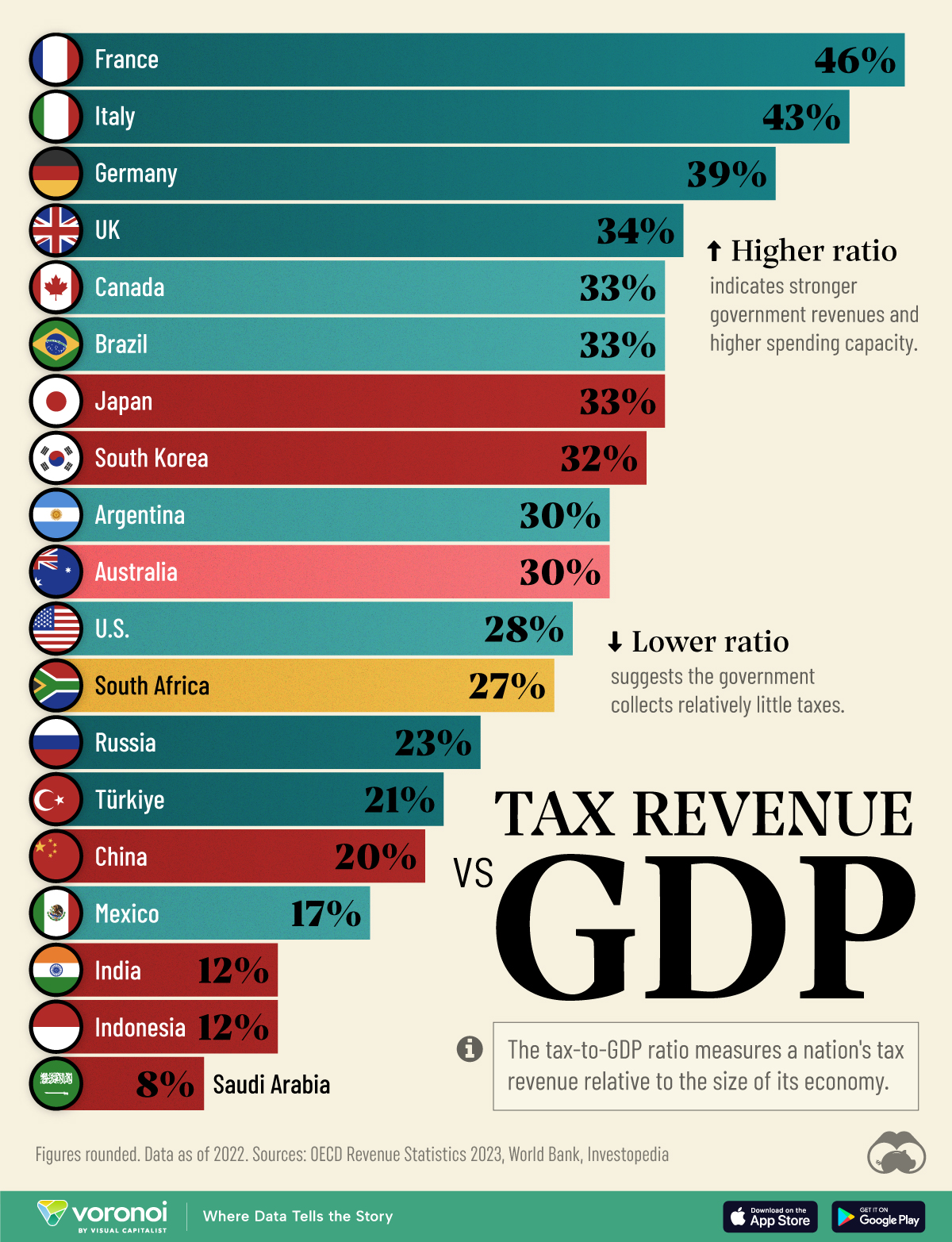

European countries, particularly within the G20, demonstrate some of the highest tax-to-GDP ratios globally. France, Italy, and Germany lead the way with ratios of 46%, 43%, and 39%, respectively. These figures reflect the extensive social welfare systems, healthcare, and infrastructure investments that characterize these economies. The United Kingdom, despite its departure from the European Union, also ranks high with a tax-to-GDP ratio of 34%. These countries exemplify how higher tax revenues can support a comprehensive social safety net and promote economic stability.

Regional and Economic Trends

When examining the tax-to-GDP ratios across the G20, it’s evident that high-income countries dominate the top ranks. For instance, Canada (33%), Japan (33%), and Australia (30%) are all high-income nations with significant tax revenues relative to their GDP. This trend underscores the correlation between a country’s economic status and its tax collection capabilities.

However, this pattern does not hold consistently across all regions. For example, Russia and Türkiye, both of which are upper-middle-income countries, have lower tax-to-GDP ratios of 23% and 21%, respectively. This indicates a disparity in how different countries approach taxation and economic management.

Income and Economic Growth Correlation

The World Bank highlights the importance of a 15% tax-to-GDP ratio as a critical threshold for economic growth and poverty reduction. Countries that achieve and maintain this ratio tend to experience more significant economic growth. A decade-long study suggested that per capita GDP in nations reaching this threshold could be 7.5% larger compared to those that do not. China exemplifies this trend; the country’s substantial tax revenue growth in the 2000s coincided with its rapid economic expansion.

Outliers and Exceptions

Not all nations fit neatly into the high tax-to-GDP ratio equals high economic growth narrative. Saudi Arabia, with a tax-to-GDP ratio of just 8%, is a notable outlier. As a wealthy oil exporter, Saudi Arabia does not rely heavily on taxation to fund government expenditures, a pattern common among other oil-rich nations such as the UAE and Kuwait. These countries can maintain lower tax burdens due to their substantial oil revenues, which fund their government activities without the need for high taxation.

The Broader Implications of Tax-to-GDP Ratios

The tax-to-GDP ratio is more than just a fiscal statistic; it is a window into the underlying economic philosophies and governance models of nations. It reveals how governments balance the need for revenue with the desire to stimulate economic growth, support social services, and maintain fiscal health.

High Ratios and Economic Stability

In countries with high tax-to-GDP ratios, particularly those in Europe like France, Italy, and Germany, the capacity for significant public investment is evident. These nations often utilize their tax revenues to fund comprehensive social welfare programs, robust healthcare systems, and extensive public infrastructure projects. Such investments not only contribute to economic stability and growth but also enhance the quality of life for citizens. A high tax-to-GDP ratio in these contexts is usually indicative of a well-functioning government that can collect taxes efficiently and redistribute wealth in a way that promotes social cohesion and long-term economic sustainability.

These high ratios also allow for more effective fiscal policies, where governments have the flexibility to respond to economic challenges such as recessions, unemployment, and inflation. By having substantial revenue, these countries can implement counter-cyclical measures—spending more during economic downturns to stimulate growth and saving or reducing deficits during periods of economic expansion.

Low Ratios: Different Strategies and Unique Circumstances

Conversely, countries with lower tax-to-GDP ratios often reflect different economic strategies or unique circumstances. For instance, nations like Saudi Arabia or other oil-rich countries can afford lower tax rates because their government revenues are heavily supplemented by natural resource exports. These countries may not need to impose significant taxes on their populations to fund government activities, which can lead to a lighter tax burden and, in some cases, higher disposable incomes for citizens.

However, low tax-to-GDP ratios can also signal potential challenges. In lower-middle-income countries or emerging markets like India and Indonesia, a lower ratio might reflect the difficulties in expanding the tax base due to a large informal economy, weak administrative capacity, or political resistance to taxation. This can limit the government’s ability to invest in critical areas such as infrastructure, education, and healthcare, which are essential for long-term economic growth and development.

Moreover, a low tax-to-GDP ratio might constrain a government’s ability to engage in effective fiscal policy. Without sufficient tax revenue, these countries might struggle to respond adequately to economic crises or to invest in long-term growth initiatives, potentially leading to greater economic volatility and slower development.

Evolving Global Dynamics and the Future

As global economies continue to evolve, the tax-to-GDP ratio will remain a crucial metric for understanding shifts in economic power and stability. For instance, as emerging markets grow and develop more sophisticated tax systems, we may see an increase in their tax-to-GDP ratios, enabling them to make greater public investments and exert more influence on the global stage.

Conversely, high-income countries may face pressures to reduce their tax burdens in response to global competition, technological advancements, and demographic changes, potentially leading to shifts in their economic strategies. Additionally, the global push towards sustainability and the transition to green economies may require rethinking traditional taxation models, such as carbon taxes or other environmental levies, which could alter tax-to-GDP ratios in unpredictable ways.

Monitoring these ratios across different regions and income levels will provide valuable insights into how nations adapt to global challenges, from economic inequality and climate change to technological disruption and geopolitical tensions. By understanding the nuances behind the tax-to-GDP ratio, policymakers, economists, and global investors can better anticipate and navigate the complex landscape of global economic power and stability.

In conclusion, while the tax-to-GDP ratio offers a snapshot of a nation’s fiscal health, its broader implications extend to how countries position themselves in the global economy. It reflects not only the current state of economic affairs but also the potential for future growth, stability, and global influence.

Dawgen Global: Assisting Clients with Expert Tax Advisory Services

Understanding and optimizing the tax-to-GDP ratio is not only crucial for governments but also for businesses operating within these economies. As tax policies evolve and become increasingly complex, navigating the intricacies of taxation requires specialized expertise. This is where Dawgen Global steps in, offering comprehensive tax advisory services tailored to meet the unique needs of clients across various industries and regions.

Tailored Tax Advisory Solutions

At Dawgen Global, we recognize that every business is different, with its own set of challenges and opportunities. Our tax advisory services are designed to provide customized solutions that align with each client’s strategic goals while ensuring compliance with local and international tax regulations. Whether you are a multinational corporation, a small business, or an individual investor, our team of seasoned tax professionals is equipped to guide you through the complexities of the tax landscape.

Strategic Tax Planning

Effective tax planning is at the core of our advisory services. We help our clients develop tax strategies that minimize liabilities and maximize opportunities for growth. This includes advising on corporate tax structures, international tax planning, transfer pricing, and mergers and acquisitions (M&A). By staying ahead of regulatory changes and anticipating future trends, we enable our clients to make informed decisions that enhance their financial outcomes.

Navigating Global Taxation Challenges

In today’s globalized economy, businesses must contend with varying tax regimes, cross-border regulations, and the risks of tax disputes. Dawgen Global’s expertise in global tax issues allows us to assist clients in navigating these challenges. We provide guidance on international tax treaties, compliance with OECD guidelines, and strategies for managing tax risks in multiple jurisdictions. Our goal is to help our clients achieve tax efficiency while remaining fully compliant with all relevant regulations.

Supporting Businesses Through Tax Audits

Facing a tax audit can be daunting, but with Dawgen Global by your side, you can navigate the process with confidence. We support our clients through every stage of the audit process, from preparation and documentation to negotiation and resolution. Our team works diligently to protect your interests and ensure that your business emerges from the audit with minimal disruption.

Continuous Support and Updates

Tax laws and regulations are constantly changing, and businesses need to stay informed to remain compliant and competitive. Dawgen Global provides continuous support to our clients, keeping them updated on the latest developments in tax policy and advising them on how these changes may impact their operations. This proactive approach ensures that our clients are always prepared for the future, no matter how the tax landscape evolves.

Commitment to Excellence

At Dawgen Global, our commitment to excellence in tax advisory services is unwavering. We pride ourselves on our ability to deliver results that meet and exceed our clients’ expectations. By combining deep technical knowledge with practical experience, we empower our clients to achieve their business objectives while optimizing their tax positions.

In conclusion, understanding the tax-to-GDP ratio and its implications is essential for businesses seeking to thrive in today’s complex economic environment. With Dawgen Global’s expert tax advisory services, clients can confidently navigate the challenges of taxation, seize opportunities for growth, and ensure long-term financial success. Whether you are looking to optimize your tax strategy, manage global tax risks, or respond to changes in tax policy, Dawgen Global is your trusted partner in achieving smarter and more effective tax solutions.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements.