In 2023, the Organisation for Economic Co-operation and Development (OECD) reported a stable average tax-to-GDP ratio of 33.9% among its member countries. This level represents a slight decrease of 0.1 percentage points compared to 2021 and 2022 but remains above the pre-pandemic average of 33.4% observed in 2019. The data reveals a delicate balance as governments strive to manage the dual pressures of rising public spending demands and the need to support economic recovery amid global challenges.

In 2023, the Organisation for Economic Co-operation and Development (OECD) reported a stable average tax-to-GDP ratio of 33.9% among its member countries. This level represents a slight decrease of 0.1 percentage points compared to 2021 and 2022 but remains above the pre-pandemic average of 33.4% observed in 2019. The data reveals a delicate balance as governments strive to manage the dual pressures of rising public spending demands and the need to support economic recovery amid global challenges.

Variations in Tax-to-GDP Ratios Across Countries

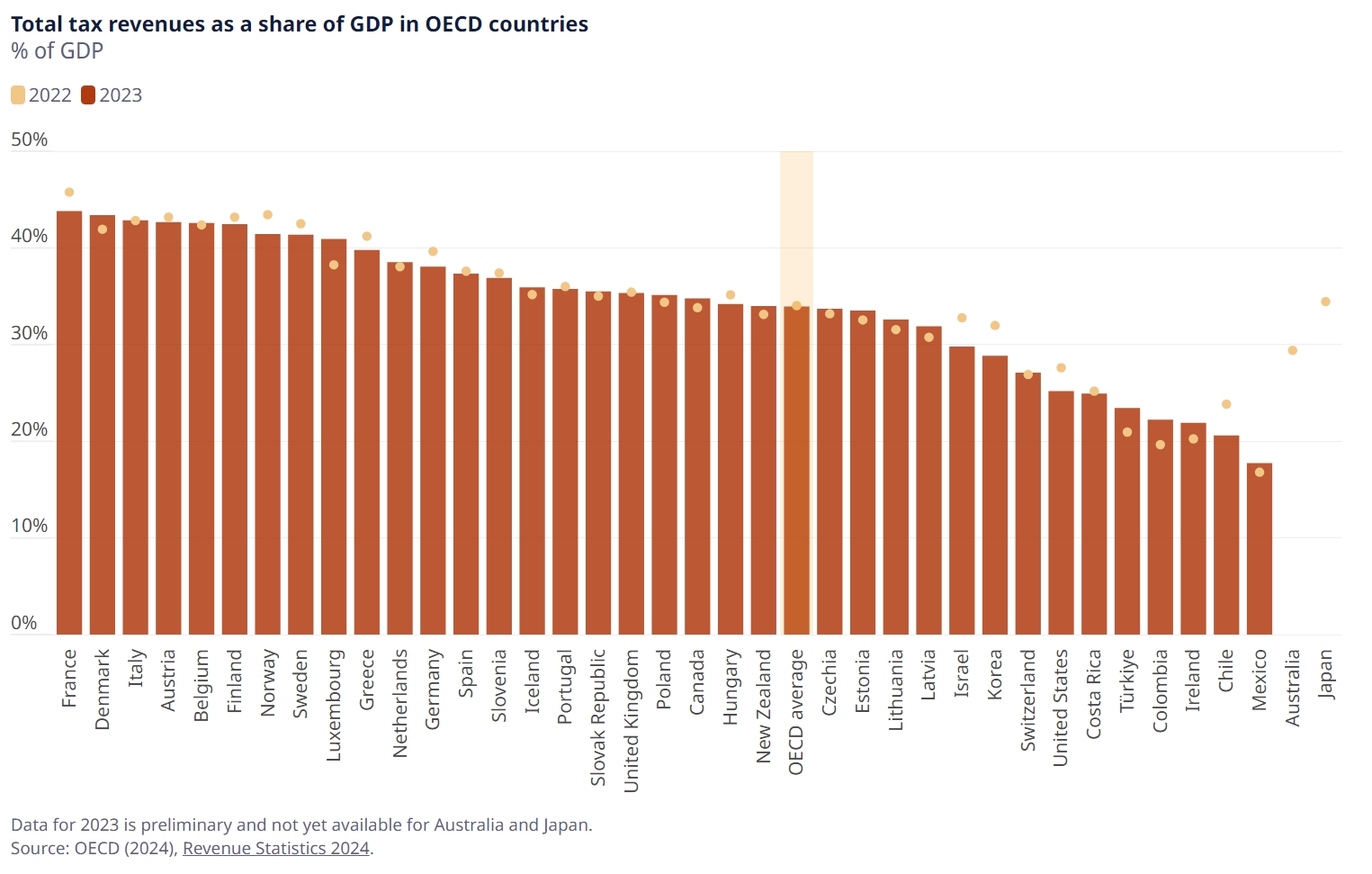

Preliminary findings for 2023 highlight significant disparities in the tax-to-GDP ratios across the OECD’s 36 member nations:

- Increases: Eighteen countries experienced growth in their tax-to-GDP ratios. Luxembourg, Colombia, and Türkiye led this trend with increases exceeding 2.5 percentage points.

- Decreases: Seventeen countries saw declines, with Israel, Korea, and Chile reporting reductions of at least 3.0 percentage points.

- Range: Tax-to-GDP ratios ranged from 17.7% in Mexico, representing the lowest among OECD countries, to 43.8% in France, the highest. Notably, this year’s range marks the smallest disparity since at least 2000, reflecting a degree of convergence in tax policy outcomes.

Health-Related Taxes: A Growing Trend

One of the emerging trends identified in the “Revenue Statistics 2024” report is the increasing use of health-related taxes. These taxes, levied on products like alcohol, tobacco, and sugar-sweetened beverages, serve a dual purpose: generating revenue and encouraging healthier consumption habits. In 2022, these taxes accounted for:

- 0.7% of GDP on average.

- 2.2% of total tax revenues across OECD countries.

Despite their rising adoption, a long-term decline in revenue from certain health-related taxes, particularly excise duties on alcohol, has been noted since 2000.

The Evolution of Value Added Tax (VAT) Systems

The “Consumption Tax Trends 2024” report focuses on advancements in VAT systems, a critical source of government revenue. In 2022, VAT accounted for 20.8% of total tax revenue, up slightly from the previous year. Efforts to modernize VAT systems and enhance compliance have been driven by two key objectives:

- Addressing Fraud: OECD countries are implementing digital solutions to reduce VAT evasion.

- Taxing E-Commerce: Recognizing the growing importance of online transactions, 27 OECD nations have established mechanisms to collect VAT on e-commerce sales of imported goods and digital services, such as apps and streaming platforms.

Digital Reporting: A New Compliance Standard

To improve VAT compliance, nearly all OECD countries with VAT systems have introduced digital reporting requirements. These frameworks often mandate the electronic submission of detailed transactional data, either in real-time or periodically. While these requirements vary across jurisdictions, they are becoming a cornerstone of modern tax administration.

Challenges and Future Directions

Governments face mounting fiscal pressures stemming from:

- Aging Populations: Rising healthcare and pension costs.

- Climate Change: Investments in sustainability and disaster mitigation.

- Economic Recovery: Addressing cost-of-living concerns while ensuring long-term economic growth.

Tax policy reforms are essential to address these challenges. By modernizing tax systems, particularly through digital transformation and targeted measures like health-related taxes, OECD countries are working to ensure fiscal sustainability and equitable revenue collection.

Conclusion: Charting the Future of Tax Systems Amid Global Uncertainty

The OECD’s latest findings highlight not only the resilience of tax systems but also their capacity to adapt to a rapidly evolving global landscape. As the world faces unprecedented challenges—from economic instability and demographic shifts to climate crises and digital transformation—governments are increasingly relying on innovative tax reforms to sustain public finances and foster equitable economic growth.

Stability Amidst Change

The steadiness of average tax revenues within OECD countries underscores the critical role of well-structured tax policies in maintaining fiscal stability. Despite pressures from volatile global markets, inflationary trends, and shifting consumption patterns, governments have managed to sustain a relatively consistent tax-to-GDP ratio. This stability provides a foundation for addressing urgent spending needs, particularly in areas such as healthcare, infrastructure, and environmental sustainability.

Embracing Innovation and Modernization

Innovation in tax policy and administration is central to addressing current and future challenges. Member countries are adopting forward-looking measures such as:

- Digital Taxation: Leveraging technology to close compliance gaps, especially in e-commerce and digital services.

- Health-Related Taxes: Promoting societal well-being while generating targeted revenues through excise taxes on products like tobacco and sugary beverages.

- Real-Time Reporting: Enhancing transparency and reducing fraud with digital reporting mechanisms, which improve the efficiency and reliability of VAT systems.

These advancements demonstrate a collective effort to modernize tax frameworks, ensuring they remain effective in an increasingly digitalized and globalized economy.

Responding to Spending Pressures

Tax systems are also adapting to mounting spending pressures driven by aging populations, escalating healthcare costs, and the urgent need for climate action. Governments are increasingly looking beyond traditional revenue streams to fund these priorities. Strategies such as expanding the tax base, introducing environmental levies, and revising property taxes are being explored to align fiscal policies with long-term economic and social goals.

Enhancing Equity and Fairness

A notable focus among OECD countries is the pursuit of fairness in tax systems. Addressing income inequality, wealth disparities, and corporate tax avoidance has become a priority. Measures to ensure that digital and multinational corporations pay their fair share, particularly through the implementation of global minimum tax standards, reflect this commitment to equitable taxation.

A Blueprint for Resilience

As countries navigate these complexities, the OECD’s insights serve as a valuable blueprint for resilience. By fostering international collaboration and sharing best practices, member nations can build tax systems that are not only robust and efficient but also equitable and forward-looking. These efforts are crucial for maintaining public trust and ensuring that fiscal policies effectively support sustainable economic development.

The Path Forward

Looking ahead, the ability of tax systems to adapt and innovate will remain pivotal. Governments must balance the immediate demands of economic recovery and inflation management with the long-term goals of sustainability, equity, and growth. As the OECD’s findings reveal, the tools to achieve this balance—technological advancements, collaborative frameworks, and adaptive policies—are already within reach. The challenge lies in their implementation, ensuring tax systems remain a cornerstone of stability in an ever-changing world.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📞 USA Office: 855-354-2447 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements