The recent clarification by the Solicitor General of India (SGI), Tushar Mehta, has reaffirmed the boundaries of authority between the National Financial Reporting Authority (NFRA) and the Institute of Chartered Accountants of India (ICAI). This pivotal decision highlights a defining moment in the governance of auditing and quality management standards in India. The implications of this decision ripple through the auditing profession, impacting regulatory practices and stakeholders’ trust in the system.

The recent clarification by the Solicitor General of India (SGI), Tushar Mehta, has reaffirmed the boundaries of authority between the National Financial Reporting Authority (NFRA) and the Institute of Chartered Accountants of India (ICAI). This pivotal decision highlights a defining moment in the governance of auditing and quality management standards in India. The implications of this decision ripple through the auditing profession, impacting regulatory practices and stakeholders’ trust in the system.

Background: The NFRA-ICAI Stand-Off

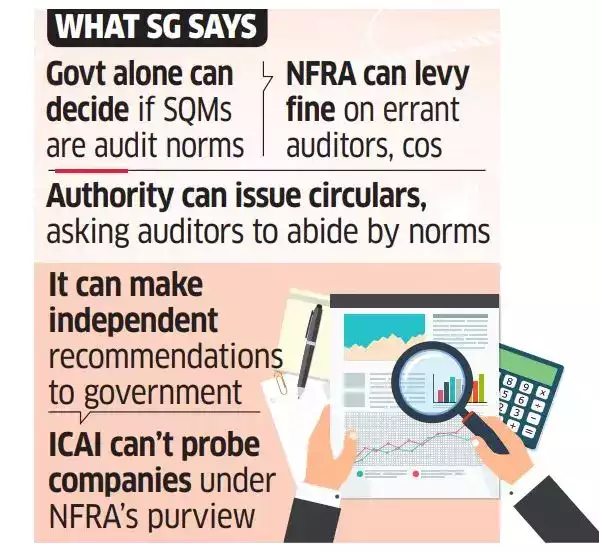

The dispute arose following the ICAI’s introduction of new Standards on Quality Management (SQMs) in October 2024, which sought to amend existing auditing norms. This move by ICAI prompted the NFRA to seek a legal opinion from the Solicitor General. In his detailed 24-page communication, SGI Tushar Mehta clarified that the ICAI’s powers under Section 143(10) of the Companies Act, 2013, are transitional and do not encompass the independent authority to create, notify, or amend SQMs or Standards of Auditing (SAs).

This legal opinion not only aligns with NFRA’s position but also delineates the limits of ICAI’s jurisdiction, ensuring that the regulatory oversight of auditing standards remains firmly under NFRA’s purview.

Key Takeaways from SGI’s Clarification

- Regulatory Authority Defined: The SGI’s opinion underscores that the ICAI’s role in standard-setting is transitional and secondary to the NFRA, reinforcing the latter’s position as the apex body in overseeing auditing and financial reporting standards.

- Legal and Institutional Integrity: By confirming NFRA’s exclusive authority, the SGI has provided legal clarity and upheld the integrity of the regulatory framework governing corporate auditing in India.

- Implications for ICAI: The ICAI must recalibrate its approach to align with its advisory role, working in tandem with NFRA rather than assuming unilateral authority over SQMs and SAs.

Broader Implications for Auditing and Quality Management

- Strengthening Governance: The decision reinforces the NFRA’s central role, ensuring that auditing standards are developed and implemented with uniformity and legal backing. This governance model aims to enhance stakeholder confidence in the regulatory ecosystem.

- Global Best Practices: With NFRA’s exclusive control over standard-setting, India can align more effectively with international auditing norms, contributing to its credibility in the global financial landscape.

- Collaborative Opportunities: The ICAI can pivot its focus towards collaboration with NFRA, contributing its technical expertise while respecting the boundaries of its regulatory powers.

Challenges and Opportunities Ahead

While the clarification resolves immediate jurisdictional conflicts, it also sets the stage for new dynamics between NFRA and ICAI. For the auditing profession to thrive:

- Clear Communication Channels: Both bodies must establish transparent mechanisms for consultation and collaboration to prevent future conflicts.

- Capacity Building: ICAI can invest in capacity-building initiatives to support auditors in adapting to NFRA-regulated standards.

- Focus on Quality Assurance: A unified regulatory framework under NFRA can streamline the adoption of high-quality auditing practices, fostering trust and reliability.

Conclusion

The Solicitor General’s clarification marks a pivotal milestone in India’s corporate auditing landscape. By reaffirming the National Financial Reporting Authority’s (NFRA) regulatory authority, it provides much-needed clarity on the Institute of Chartered Accountants of India’s (ICAI) transitional role. This legal pronouncement strengthens the foundations of India’s financial reporting and auditing ecosystem, ensuring it remains robust, transparent, and better aligned with international standards.

However, this situation also serves as a cautionary tale for other accounting institutes globally. Misinterpretations of regulatory powers and mandates are not unique to India. The evolving nature of global financial reporting frameworks, combined with the complex interplay of national and international regulations, often creates ambiguities. Accounting institutes in other jurisdictions might similarly overstep their roles or misinterpret their authority to amend or enforce standards, especially in the absence of explicit legal frameworks or oversight.

Potential for Similar Misinterpretations Globally

- Jurisdictional Ambiguities: Like the ICAI, other professional bodies may perceive their historical roles in standard-setting as extending beyond their actual jurisdiction. This is particularly likely in regions where accounting bodies have traditionally played a dual role as regulators and educators.

- Regulatory Evolution: The growing influence of international standard-setting organizations such as the International Auditing and Assurance Standards Board (IAASB) and the Financial Reporting Council (FRC) demands that national bodies adapt to a more collaborative and secondary role, which might not always be clearly defined.

- Lack of Oversight: In countries where financial reporting oversight bodies are weak or nonexistent, accounting institutes may assume authority that exceeds their remit, creating potential conflicts with emerging regulatory frameworks.

- Risk of Fragmentation: If different bodies within a single jurisdiction issue overlapping or conflicting standards, it can lead to a fragmented regulatory environment, undermining consistency and stakeholder confidence.

Lessons Learned and Recommendations

The Indian experience highlights several lessons that can guide global accounting and auditing communities:

- Clear Legal Mandates: Regulators and accounting institutes worldwide must establish and adhere to clear legal frameworks that delineate responsibilities and authorities to avoid conflicts and ensure consistency.

- Collaborative Relationships: Regulatory authorities and professional bodies should foster collaboration, leveraging the technical expertise of accounting institutes while maintaining oversight to align with national and international standards.

- Proactive Governance: Regular reviews of regulatory frameworks and proactive communication between stakeholders can prevent similar jurisdictional conflicts.

- Global Alignment: National accounting bodies should prioritize aligning their practices with international standards to promote global trust in financial reporting and auditing.

Dawgen Global’s Perspective

Dawgen Global recognizes the importance of regulatory clarity and its impact on the integrity of financial reporting systems. As an integrated multidisciplinary professional services firm, we emphasize the need for strong governance structures that prevent overreach by any single entity while fostering collaboration for the greater good.

The Solicitor General’s clarification in India underscores the global necessity of upholding transparency, accountability, and trust in auditing and financial reporting. At Dawgen Global, we remain committed to supporting organizations worldwide in navigating these complexities, ensuring compliance with both national and international frameworks. Together, we can build a unified and resilient ecosystem that enhances the credibility of the auditing profession and instills confidence in financial markets.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📞 USA Office: 855-354-2447 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements