IFRS 9 introduced the Expected Credit Loss (ECL) model to replace the incurred loss model for bad debt provisioning. The ECL model is a forward-looking approach that incorporates historical, current, and future economic data to estimate credit losses. While the principles of the ECL model apply universally, there are distinct approaches when calculating bad debt provisions for trade receivables and loans due to their differing nature and risk profiles.

IFRS 9 introduced the Expected Credit Loss (ECL) model to replace the incurred loss model for bad debt provisioning. The ECL model is a forward-looking approach that incorporates historical, current, and future economic data to estimate credit losses. While the principles of the ECL model apply universally, there are distinct approaches when calculating bad debt provisions for trade receivables and loans due to their differing nature and risk profiles.

Key Differences Between Trade Receivables and Loans

| Aspect | Trade Receivables | Loans |

|---|---|---|

| Nature of Asset | Short-term, non-interest-bearing | Long-term, interest-bearing |

| Credit Risk Profile | High volume, low value per transaction | Low volume, high value per transaction |

| Default Indicators | Non-payment or past due amounts | Deterioration in borrower credit rating |

| ECL Model Approach | Simplified Approach | General Approach |

ECL Models Under IFRS 9

1. Trade Receivables: Simplified Approach

The simplified approach is mandatory for trade receivables, lease receivables, and contract assets without significant financing components. This method eliminates the need to track credit risk changes over time and requires lifetime ECL to be calculated from the initial recognition.

Step-by-Step Process:

- Segment the Receivables Portfolio

Divide receivables into groups with similar credit risk characteristics (e.g., by industry, region, or customer type). - Determine Historical Default Rates

Use historical data to establish default rates for each segment. For example:- 1% for receivables < 30 days past due.

- 5% for receivables 30–90 days past due.

- 20% for receivables > 90 days past due.

- Adjust for Current and Forward-Looking Information

Incorporate macroeconomic indicators (e.g., GDP growth, inflation) that may impact default rates. - Calculate Lifetime ECL

Apply the adjusted default rates to the outstanding receivables balance for each segment.

![]()

Example:

A company has $1,000,000 in trade receivables, segmented as follows:

- $600,000 < 30 days past due, default rate = 1%.

- $300,000 30–90 days past due, default rate = 5%.

- $100,000 > 90 days past due, default rate = 20%.

![]()

The total bad debt provision is $41,000.

2. Loans: General Approach

The general approach applies to financial instruments with significant financing components, such as loans and credit facilities. This method involves a more complex, three-stage model based on credit risk changes:

- Stage 1 (12-Month ECL): Assets with no significant increase in credit risk.

- Stage 2 (Lifetime ECL): Assets with a significant increase in credit risk but not credit-impaired.

- Stage 3 (Lifetime ECL): Credit-impaired assets.

Step-by-Step Process:

- Assess Credit Risk at Initial Recognition

Establish the initial credit risk level using the borrower’s credit rating, financial history, and macroeconomic conditions. - Monitor for Significant Credit Risk Increases

Use quantitative criteria (e.g., credit score deterioration) or qualitative factors (e.g., adverse economic conditions) to determine if the asset moves to Stage 2. - Estimate Key ECL Components

- Probability of Default (PD): The likelihood the borrower will default within a given period.

- Loss Given Default (LGD): The percentage of loss if default occurs.

- Exposure at Default (EAD): The outstanding balance expected at the time of default.

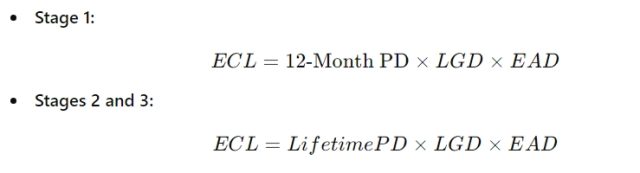

- Calculate ECL Based on the Stage

Example:

A bank has a loan of $500,000 in Stage 1 with:

- 12-Month PD: 3%

- LGD: 45%

- EAD: $500,000

The provision increases as the loan transitions to higher credit risk stages.

Key Considerations for Trade Receivables vs. Loans

Trade Receivables:

- Simplified approach is easier to implement due to the absence of staging.

- Historical and forward-looking data adjustments are essential for reliable provisioning.

- High transaction volumes necessitate automation for efficiency.

Loans:

- Requires robust credit risk monitoring systems to identify staging transitions.

- Forward-looking adjustments demand sophisticated modeling tools.

- Regulatory compliance often involves detailed disclosure of ECL components.

Conclusion

The simplified approach for trade receivables focuses on lifetime ECL, making it straightforward for short-term, high-volume assets. The general approach for loans uses a more nuanced, staged model to reflect varying credit risks over time. By tailoring the calculation method to the asset type, businesses can ensure compliance with IFRS 9 while accurately capturing expected credit losses

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements