In today’s increasingly integrated global economy, tax policy continues to play a pivotal role in shaping investment decisions and driving cross-border growth strategies. For businesses evaluating expansion or partnership across Europe, a deep understanding of the region’s corporate income tax (CIT) regimes is crucial. As of 2025, Europe presents a dynamic fiscal map—one marked by variation, reform, and opportunity.

In today’s increasingly integrated global economy, tax policy continues to play a pivotal role in shaping investment decisions and driving cross-border growth strategies. For businesses evaluating expansion or partnership across Europe, a deep understanding of the region’s corporate income tax (CIT) regimes is crucial. As of 2025, Europe presents a dynamic fiscal map—one marked by variation, reform, and opportunity.

At Dawgen Global, we help clients make smarter and more effective decisions. This article provides a comprehensive analysis of the current corporate tax rates across Europe, recent changes, and strategic implications for multinational operations.

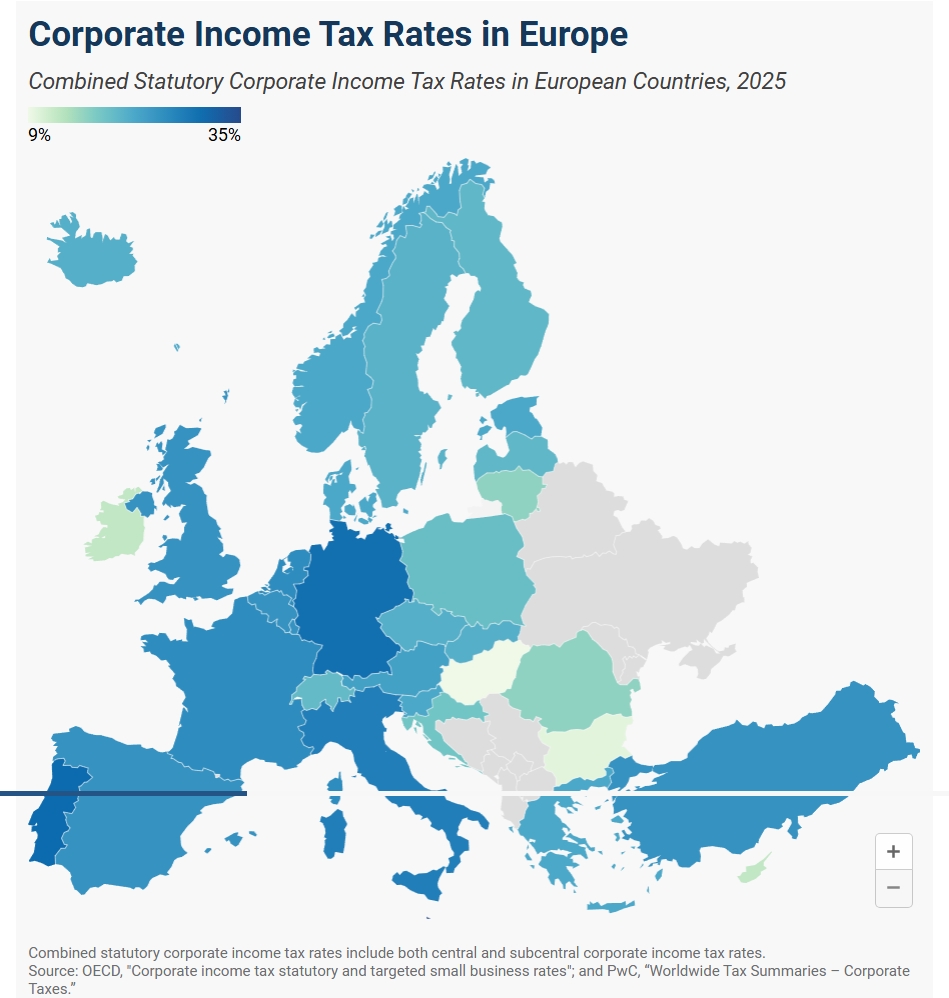

The European Corporate Tax Spectrum in 2025

According to the latest research published by the Tax Foundation, the average statutory corporate income tax rate across Europe in 2025 is 21.5%, slightly below the global average of 23.5%. This average includes both central government taxes and local-level surtaxes, offering a holistic view of the corporate tax burden.

🏁 High-Tax Jurisdictions: Stability Meets Fiscal Pressure

Some European countries maintain relatively high CIT rates, reflecting both their fiscal policy objectives and welfare commitments:

-

Malta: 35.0% (the highest in the region)

-

Portugal: 30.5%

-

Germany: 29.9%

-

Italy: 27.8%

-

France: 25.8%

These rates often signal strong regulatory systems and developed infrastructures but may require careful tax planning to manage overall business profitability.

🏁 Low-Tax Jurisdictions: Strategic Lures for Investment

In contrast, several countries continue to offer low CIT rates, often to bolster their competitiveness and attract foreign direct investment (FDI):

-

Hungary: 9.0% (lowest in Europe)

-

Bulgaria: 10.0%

-

Ireland: 12.5%

-

Cyprus: 12.5%

-

Lithuania: 16.0%

These jurisdictions are frequently considered for international headquarters, holding companies, or innovation hubs due to their cost-effective tax environments.

Recent Shifts: A Changing Landscape

Several European countries enacted notable tax rate adjustments in 2025, signaling changing economic strategies and responses to global pressures.

Countries that increased their corporate tax rates:

-

Czechia: From 19% to 21%

-

Estonia: From 20% to 22%

-

Iceland: From 20% to 21%

-

Lithuania: From 15% to 16%

-

Slovenia: From 19% to 22%

These increases may reflect post-pandemic fiscal consolidation or broader economic reforms aimed at funding public services or reducing deficits.

Countries that reduced their corporate tax rates:

-

Portugal: From 31.5% to 30.5%

Even modest reductions can send powerful signals to investors, especially when combined with other business-friendly reforms.

🔍 Strategic Implications for Businesses: Beyond the Tax Rate

While the statutory corporate income tax rate is often the first figure decision-makers examine, it represents only the tip of the iceberg. Successful international expansion—particularly into diverse jurisdictions like Europe—requires a multifaceted tax and regulatory analysis. Businesses must approach market entry with a comprehensive understanding of both the quantitative and qualitative components of a country’s tax environment.

Here are the key considerations that go beyond nominal rates:

1. ✅ Effective Tax Rates vs. Statutory Rates

A country may advertise a high statutory rate, but the effective tax rate (ETR)—what companies actually pay—can be substantially lower due to a wide range of available incentives:

-

R&D tax credits: Many countries, such as the UK and France, provide generous deductions for qualifying research activities.

-

Innovation box regimes: Ireland, the Netherlands, and Luxembourg offer reduced tax rates on income derived from intellectual property.

-

Investment allowances and depreciation schemes: These mechanisms accelerate deductions for capital investments, lowering taxable profits.

-

Tax holidays for new investors: Certain regions within Europe grant temporary exemptions for new or strategic investments, particularly in underdeveloped areas.

Strategic takeaway: Don’t judge a tax system by its headline rate. A detailed modeling of actual liabilities, considering available incentives, can reveal a very different financial picture.

2. 🏛️ Regulatory Complexity and Compliance Burden

A lower tax rate may be rendered less attractive if the jurisdiction is plagued by bureaucratic inefficiencies, frequent legislative changes, or unclear compliance procedures. Key aspects to consider include:

-

Simplicity of the tax code

-

Transparency of tax rulings and assessments

-

Strength of taxpayer rights and appeal processes

-

Availability of digital filing and tax automation

For instance, Estonia’s tax system, despite its rate increase in 2025, remains one of the most business-friendly due to its cash-flow based corporate tax regime and streamlined compliance processes.

Strategic takeaway: A predictable, transparent, and user-friendly tax system may outweigh a lower but administratively burdensome alternative.

3. 🌍 Alignment with Global Minimum Tax Initiatives

The implementation of the OECD’s Pillar Two initiative—aiming to set a global minimum corporate tax rate of 15%—will have major implications for multinational enterprises. This shift aims to:

-

Deter artificial profit shifting to low-tax jurisdictions

-

Ensure a fair distribution of taxing rights

-

Increase compliance requirements for large groups (particularly those with consolidated revenue above €750 million)

Even countries with low statutory rates, such as Hungary (9%) or Ireland (12.5%), may see their advantages diluted as “top-up taxes” are applied at the parent company level.

Strategic takeaway: Businesses must review their global tax structures, not just from a tax-saving perspective, but in light of international cooperation and reputational risk.

4. 📊 Local Economic Conditions and Cost Structures

A tax rate should not be analyzed in isolation. Several economic variables influence the total cost of doing business, including:

-

Wage levels and social security contributions

-

Cost and reliability of utilities and infrastructure

-

Access to skilled labor and innovation ecosystems

-

Macroeconomic stability and currency fluctuations

-

Regulatory risk and ease of doing business rankings

For example, while Germany’s tax rate is nearly 30%, its world-class infrastructure, skilled labor pool, and innovation-driven economy make it an attractive hub for advanced manufacturing and engineering.

Strategic takeaway: Holistic cost-benefit analysis ensures businesses avoid the trap of tax arbitrage at the expense of operational efficiency and long-term viability.

5. 🤝 Double Taxation Treaty Networks

An often-underestimated component of tax strategy is a jurisdiction’s network of bilateral tax treaties. These agreements are essential for:

-

Avoiding double taxation on cross-border income

-

Reducing withholding taxes on dividends, interest, and royalties

-

Providing permanent establishment (PE) protections

-

Offering mutual agreement procedures (MAP) for dispute resolution

Countries like Netherlands, Luxembourg, and the UK boast extensive and favorable treaty networks, making them ideal locations for regional headquarters or IP holding entities.

Strategic takeaway: Tax treaties should be front and center in any global structuring decision, especially for businesses engaged in licensing, franchising, or financing operations across borders.

🚀 Dawgen Global’s Advisory Approach

At Dawgen Global, we guide our clients to look beyond the numbers. We believe that strategic tax planning is not just about minimizing liability—it’s about aligning your tax position with your business model, values, and growth trajectory.

We offer bespoke support in:

-

Tax Due Diligence and Risk Reviews

-

International Corporate Structuring

-

OECD Pillar Two Compliance Advisory

-

Incentive Optimization and R&D Claim Support

-

Double Tax Treaty Analysis and Structuring

Whether you’re entering the European market or reassessing your current footprint, we help ensure your tax strategy is resilient, efficient, and future-ready.

Dawgen Global’s Perspective: A Holistic Approach to Tax Strategy

At Dawgen Global, we understand that effective tax strategy is not about finding the lowest rate—but about aligning tax planning with business goals, regulatory expectations, and long-term value creation. Our multidisciplinary team of advisors across the Caribbean and international markets offers tailored solutions in:

-

International Tax Planning

-

Transfer Pricing Advisory

-

Corporate Structuring

-

M&A Tax Due Diligence

-

Tax Risk Management and Compliance

We help clients navigate the complex terrain of global taxation with confidence—empowering them to make decisions that drive sustainable growth.

Conclusion: Europe in 2025—Opportunity Awaits the Prepared

With its vast economic diversity and fiscal evolution, Europe remains a critical destination for global business. But thriving in this environment demands more than ambition—it requires insight, foresight, and the right partners.

Dawgen Global is here to support your journey. Whether you’re entering new markets, optimizing existing operations, or preparing for regulatory change, we deliver the expertise and clarity you need to succeed.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670/876-9265210 📲 WhatsApp Global: +1 876 5544445

📞 USA Office: 855-354-2447

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements