The Global Legal Entity Identifier System (GLEIS) is the first global database providing unique identification information of legal entities participating in financial transactions all across the globe.

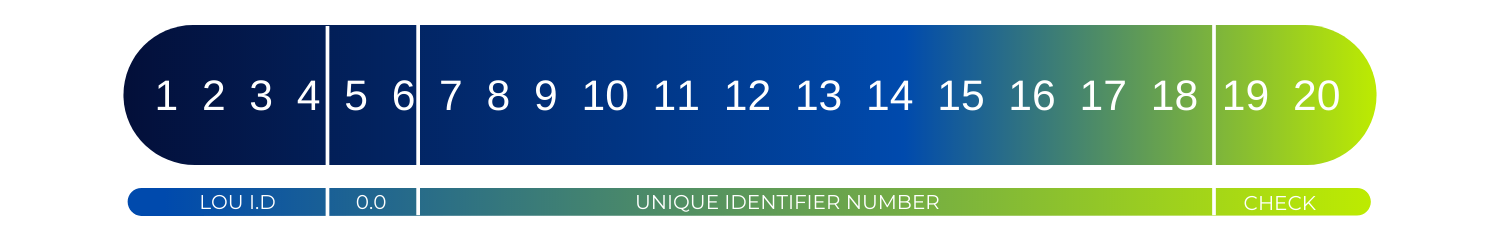

The database forms an index of legal entities which is publicly accessible and completely free of charge to use. Each entity in the LEI database is assigned its own, unique 20 digit code by which it is identified in many business activities and transaction reporting systems.

The LEI is a G20 endorsed, globally verifiable unique identity code. Similar to a global business passport, or an IBAN in banking terms, the LEI code reveals a record with information about a company such as its identity and group structure. Each LEI number is unique and may be obtained by any organisation in the world e.g Limited Company, Fund, Trust etc.

The LEI is based on ISO Standard 17442 and is currently being adopted as the single most important identifier in the global financial ecosystem as it is used by regulators to reduce systemic risk and easily identify parties in any transaction.

The LEI Legal Entity Identifier is an ISO standard that has been adopted to increase transparency in financial markets and transactions between counterparties.

An LEI Code contains reference data on a company such as:

- Entity name

- Entity Registration ID

- Legal Address

- Status of LEI Code

- LEI Issuer

The LEI structure according to image from GLEIF below consists of 20 Alpha-numeric digits each with their own purpose in the system.

The importance of Legal Entity Identifier ?

In 2008, the Global Financial Crisis and collapse of Lehman Brothers precipitated a network effect that accelerated rapidly throughout the global financial system. After the first domino fell, institutional investors throughout capital markets scrambled to assess the extent of their exposure to the bank and its labyrinth of subsidiaries.

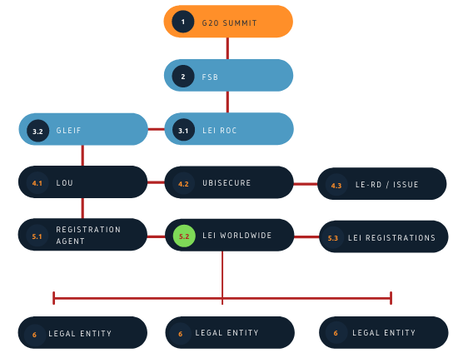

The Financial Stability Board (FSB), appointed by the G20 devised a Global Legal Entity Identifier System (GLEIS), which is maintained by GLEIF (Global LEI Foundation), with governance and oversight provided by the LEIROC (LEI Regulatory Oversight Committee). LEIs are used today to identify market participants in financial transactions, thus allowing for more transparent marketplaces and enabling clear identification of companies participating in financial transactions globally.

The LEI system also has numerous other benefits to Anti-Money Laundering activities (AML), Know Your Customer (KYC) and client onboarding and enhances counterpart identification in financial transactions such as securities trading.

Who need Legal Entity Identifier ?

Since the LEI was introduced, there have been over 115 regulations that require certain organisations to obtain an LEI code across different jurisdictions and industries both municipally and commercially.

Having a Legal Entity Identifier, or LEI code is mandated by EU, US and many other countries regulators in order to engage in financial markets activities e.g securities trading or derivatives.

LEIs are required by Limited Companies, funds & trusts, banks, lenders, OTC Derivatives and securities market participants, pension funds and any regulated industry.

There are a number of mandates currently in existence which state “no LEI, no trade” as the phrase was coined by ESMA (European Securities & Markets Authority). The LEI is heavily relied upon in EU market a number of directives such as EMIR , MiFIR & MIFID II.

However, the US also have similar requirements such as the Dodd Frank Act, the OFR, the Federal Reserve and the Securities & Exchange commission (SEC).

To see a list of laws in your country visit: https://www.gleif.org/en/lei-solutions/regulatory-use-of-the-lei

Types of organisations that require an LEI (not limited to):

- Financial intermediaries (CSDs)

- Banks, investment companies and lenders

- Trade OTC derivatives (except private individuals)

- SMSF (Self Managed Superannuation Funds) traders and trustees

- Investment Vehicles, mutual funds, hedge funds

- Pension schemes

- Commodities trading

- CFDs (Contract for Differences)

- Securities transactions, SFTR reporting

- Entities listed on a stock exchange

- International Branch offices (The Head Office must already have an LEI)**

- Global Private companies

How to get a Legal Entity Identifier (LEI)

Dawgen Global can assist you in getting your Legal Entity Identifier (LEI) .

To get an LEI code you will need to provide basic company information such as:

- Legal company name

- Registered address

- Company ID

- Name of the authorised signatory (e.g Director/CEO)

- Supporting documents (examples of this include Articles of Association, Certificate of Incumbency, Trade Licence, Certificate of Incorporation etc.)

For assistance email us at : [email protected]