Exploring Modern Decision-Making Models: Beyond Rationality

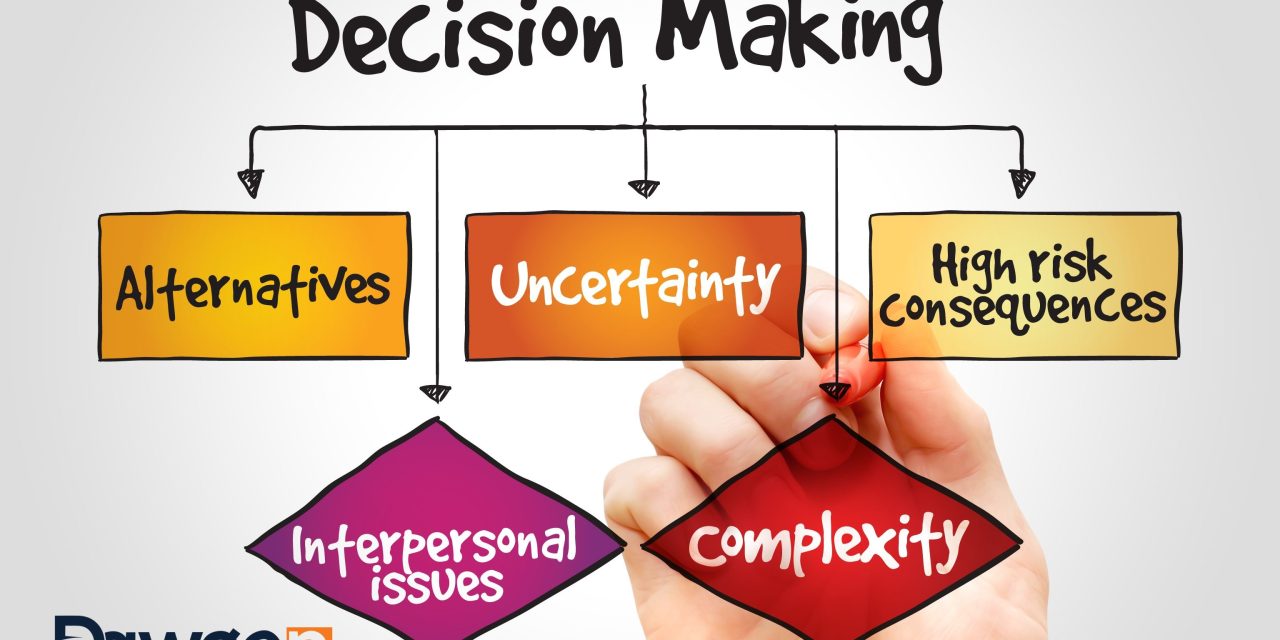

When it comes to decision-making, the traditional Rational Decision-Making Model has long been hailed as the gold standard. This model proposes a structured, linear approach where individuals follow a logical sequence of steps to arrive at a conclusion. However, research and real-world experience suggest that this model does not encompass the full spectrum of how...