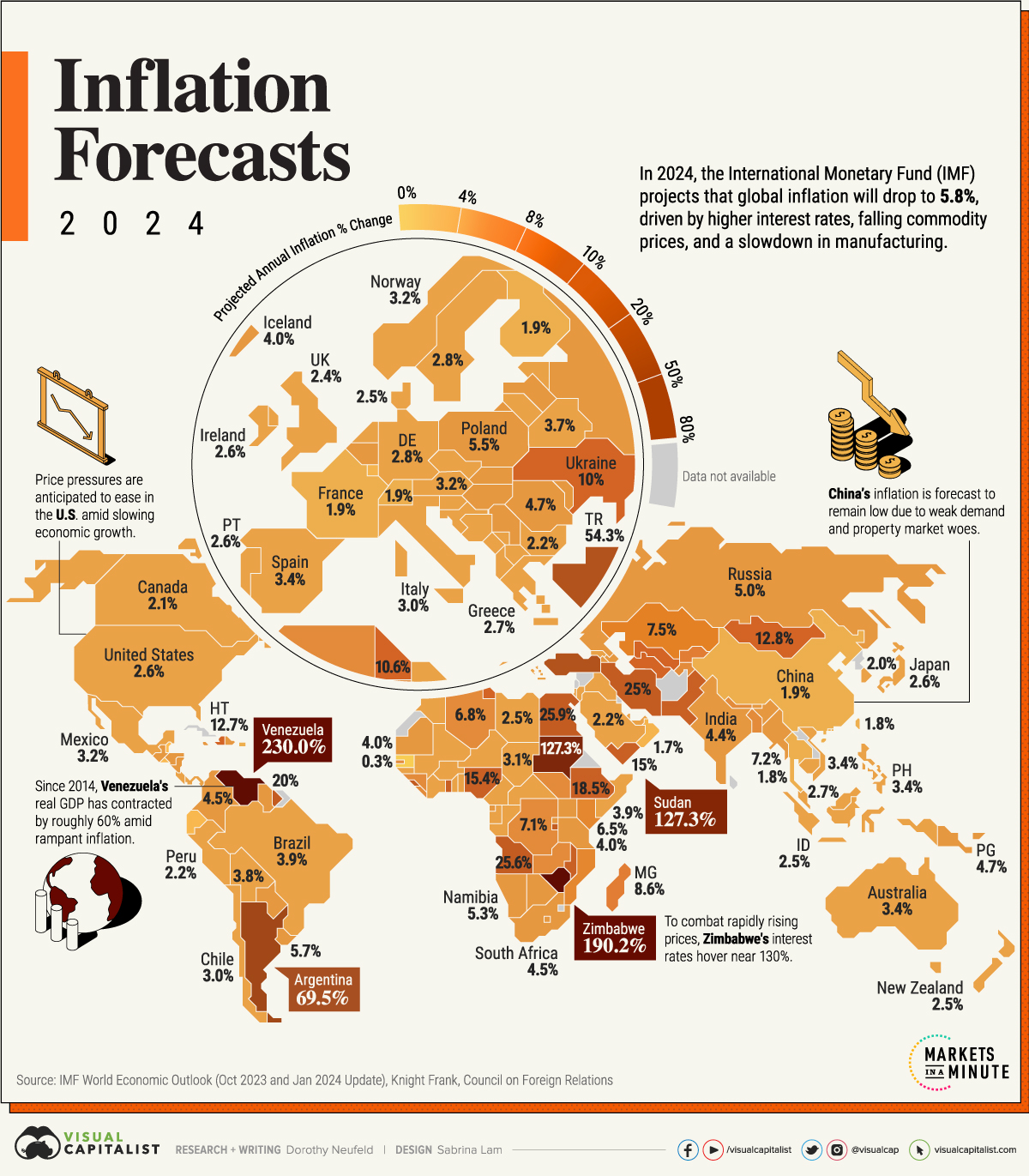

In the intricate tapestry of global economics, inflation acts as both a weaver and a colorist, altering patterns and shades in the standard of living canvas. The latest projections by the International Monetary Fund (IMF) suggest that the inflationary spiral is loosening its grip, predicting a global average decrease to 5.8% in 2024 from the previous year’s 6.8%. But even as the pressures appear to ease, the figure hovers above the desired 2% benchmark, indicating that the journey towards economic equilibrium is fraught with complexity.

Dr. Dawkins Brown, the esteemed executive chairman of Dawgen Global, insightfully remarks, “Inflation is much like a chameleon, adapting and changing colors in response to its environment. As such, economies must be vigilant and adaptable, ready to respond to the shifting hues of inflationary trends to safeguard the living standards of their citizens.”

Global Trend:

The expected moderation in inflation is largely due to an orchestrated symphony of tighter monetary policies, declining energy costs, and a subsiding labor market fervor. These factors, akin to a cooling breeze, are forecast to temper the previously sweltering price escalations.

Regional Highlights:

Each region paints a different picture of the inflation narrative:

- Venezuela: Once amidst an inflationary maelstrom, the country is now projected to face a 230% rate, a dramatic fall signaling economic stabilization efforts taking root. However, the impact on the cost of living remains acute, painting a sobering picture of the nation’s fiscal health.

- Zimbabwe: The economic canvas here is streaked with the deep scars of hyperinflation, projected at 190.2%, which relentlessly erodes the purchasing power of its citizens.

- United States: With an anticipated inflation rate of 2.6%, the U.S. economy displays a palette closer to stability, resonating with the Federal Reserve’s target.

- China: At 1.9%, China’s inflation rate reflects a subdued demand, a result of the cooling embers in its property market and manufacturing sector.

- European Advanced Economies: With an average projection of 3.3%, the inflation rates in these countries apply a modest brush of pressure on the overall economic canvas.

Assessing the Caribbean Outlook: The 2024 Inflation Forecasts and Implications for Island Economies

As we navigate the broader implications of the IMF’s 2024 inflation projections, it is imperative to cast a lens over the Caribbean islands, a region often overshadowed in global economic discourse yet vitally important to understand in its unique economic and financial dynamics.

Caribbean Economies in Focus: The Caribbean region presents a tapestry of economies that are as diverse as they are interconnected. Tourism, remittances, and foreign direct investment remain the lifeblood of many island nations, making them particularly sensitive to global economic shifts.

- Jamaica: Projected at a 5.0% inflation rate, Jamaica’s economy shows signs of resilience, balancing on the tightrope of economic reforms and the volatile nature of international trade.

- Trinidad and Tobago: With a 2.3% projection, this twin-island republic stands to benefit from a tempered inflation environment, bolstering its energy-centric economy.

- The Bahamas: At 2.6%, The Bahamas may see a stable cost of living, contingent on the tourism sector’s recovery and international financial market conditions.

Impact on Island Life: The projected inflation rates for the Caribbean suggest a relative stabilization, yet the ripple effects on the cost of living are nuanced. For many islanders, even slight inflationary upticks can translate to immediate price changes in markets due to high import dependence.

The interplay between inflation and standard of living is particularly pronounced in the Caribbean, where the cost of imported goods and energy can swing dramatically, directly impacting household budgets. Moreover, the region’s susceptibility to natural disasters adds another layer of economic unpredictability that can aggravate inflationary pressures.

While the Caribbean’s projected inflation rates are generally moderate, risks loom. A significant portion of these economies’ revenues comes from tourism—a sector highly sensitive to global economic health and consumer sentiment. Disruptions from climatic events or global economic downturns can quickly translate into fiscal deficits and rising prices.

Dr. Dawkins Brown of Dawgen Global offers a cautionary perspective: “The Caribbean economies, with their unique vulnerabilities, must navigate inflation projections with a strategy that is as reactive as it is preemptive. Ensuring economic resilience in the face of global headwinds will be key to maintaining the islands’ standard of living.”

For the Caribbean, the 2024 inflation forecasts offer a beacon of cautious optimism. However, the true test will lie in these economies’ ability to adapt to external shocks and maintain the delicate balance between growth, price stability, and the well-being of their populations. As they steer through these economic waters, the Caribbean islands will need to remain agile, drawing on the strength of their communities and the wisdom of their leaders to chart a course toward sustainable prosperity.

Impact on Standard of Living:

The interplay between inflation and the standard of living is a nuanced one:

- In High Inflation Economies: The relentless tide of inflation washes away the purchasing power of households, leading to a stark deterioration in the quality of life.

- In Moderate to Low Inflation Economies: Stability or improvement in living standards is contingent upon wage trends keeping pace with or overtaking inflationary increases.

Risks and Considerations:

However, the landscape is fraught with potential upheavals:

- Geopolitical Conflicts: Like storm clouds on the horizon, conflicts in the Middle East and Red Sea threaten to precipitate a resurgence in inflationary pressures through escalated shipping and energy costs.

- Strong Consumer Demand: The reservoirs of excess savings could unleash a deluge of consumer spending, potentially swelling the currents of inflation.

- Housing Market: As a cornerstone of the CPI, an uptick in housing costs looms as an inflationary specter, particularly in mature economies like the United States.

As we parse through the IMF’s projections, it is evident that while the global inflation trajectory leans towards stabilization, the repercussions on living standards will be unevenly felt. Developed economies may inch closer to stability and prosperity, while those grappling with higher inflation rates might continue to face economic duress. Dr. Dawkins Brown concludes, “The interplay between wage growth and inflation, coupled with geopolitical stability and housing market dynamics, will ultimately dictate the quality of life for millions. It is a delicate balance, one that demands our vigilance and proactive strategy.”

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with DawgenGlobal. Together, let’s venture into a future brimming with opportunities and achievements.