Understanding the true value of your business is crucial for making informed strategic decisions, whether you’re planning to sell, seeking investment, or simply aiming to understand your market position. One of the key metrics used in business valuation is the EBITDA multiple. This article delves into how the EBITDA multiple is determined and its significant impact on the final valuation of your company.

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a measure of a company’s overall financial performance and is used as an alternative to net income in some circumstances. EBITDA provides a clear view of a company’s operational profitability by stripping out the effects of financial and accounting decisions.

Understanding EBITDA Multiples

An EBITDA multiple is a valuation ratio that compares a company’s Enterprise Value (EV) to its EBITDA. The multiple indicates how many times the EBITDA a company is worth. This metric is particularly useful because it normalizes differences in capital structure, taxation, and fixed assets across companies, providing a clearer comparison.

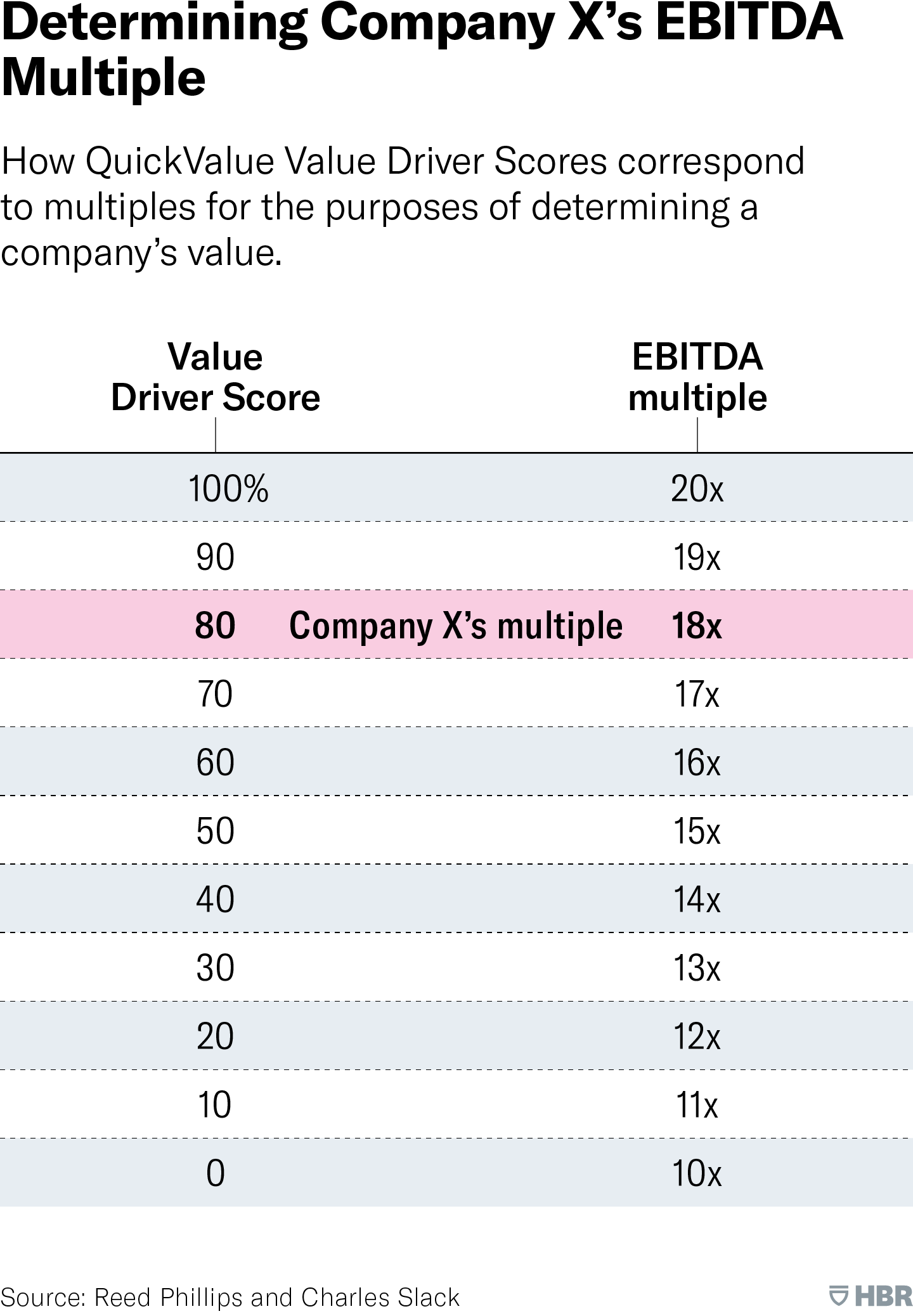

The image below demonstrates how QuickValue Value Driver Scores correspond to multiples for the purpose of determining a company’s value. Let’s explore this further.

Determining the Multiple

The QuickValue Value Driver Score is a comprehensive tool designed to evaluate a company’s performance across multiple dimensions. This score is critical in determining the appropriate EBITDA multiple for valuing a company. Here’s a closer look at what the Value Driver Score entails:

- Market Position: This dimension assesses the company’s standing in its industry, including market share, competitive advantage, and brand strength.

- Revenue Growth: This measures the rate at which the company’s revenue is increasing, indicating its growth potential and scalability.

- Profitability: This looks at the company’s profit margins and overall financial health, providing insights into its ability to generate profit.

- Operational Efficiency: This evaluates how effectively the company utilizes its resources to produce goods or services, impacting its cost structure and profitability.

Each of these dimensions contributes to the overall Value Driver Score, which is expressed as a percentage. The higher the score, the better the company’s performance in these critical areas.

Based on the Value Driver Score, companies are assigned an EBITDA multiple. For example, if Company X has a Value Driver Score of 80%, the corresponding EBITDA multiple is 18x. This means that the company’s Enterprise Value is 18 times its EBITDA. The process of determining the multiple can be summarized as follows:

- Assessment: Conduct a thorough analysis of the company’s performance across the dimensions of market position, revenue growth, profitability, and operational efficiency.

- Scoring: Assign a Value Driver Score based on the assessment results, reflecting the company’s overall performance as a percentage.

- Multiplication: Apply the Value Driver Score to the predefined table of EBITDA multiples to determine the appropriate multiple for the company.

For instance, using the provided table, an 80% Value Driver Score equates to an 18x EBITDA multiple. If Company X’s EBITDA is $5 million, its Enterprise Value would be:

Enterprise Value (EV)=EBITDA×EBITDA Multiple!

EV=5 million×18=90 million !

This enterprise value reflects what the market believes the company is worth based on its earning potential and performance indicators.

Understanding the Value Driver Score to EBITDA Multiple Relationship

Predefined Multiples Table

The key to translating the Value Driver Score into an EBITDA multiple lies in a predefined table that correlates specific scores with specific multiples. The table provided in the image is an example of such a correlation:

| Value Driver Score | EBITDA Multiple |

|---|---|

| 100% | 20x |

| 90% | 19x |

| 80% | 18x |

| 70% | 17x |

| 60% | 16x |

| 50% | 15x |

| 40% | 14x |

| 30% | 13x |

| 20% | 12x |

| 10% | 11x |

| 0% | 10x |

Each value driver score percentage corresponds to an EBITDA multiple. This predefined table is developed based on industry standards, historical data, and financial analysis practices.

Example Calculation

To understand how to assign an EBITDA multiple based on the Value Driver Score, let’s go through an example:

- Assessment: Assume we have conducted a comprehensive evaluation of Company X, assessing its market position, revenue growth, profitability, and operational efficiency.

- Scoring: After the evaluation, Company X is given a Value Driver Score of 80%. This means the company performs at 80% efficiency when compared to an ideal or top-performing company in its industry.

- Multiplication: Refer to the predefined table. A score of 80% corresponds to an EBITDA multiple of 18x.

Thus, if Company X’s Value Driver Score is 80%, according to the table, the corresponding EBITDA multiple is 18x. This means the market value of Company X is considered to be 18 times its EBITDA.

Why Use a Predefined Table?

Using a predefined table offers several advantages:

- Standardization: Ensures that the valuation process is consistent and objective.

- Comparison: Makes it easier to compare different companies within the same industry.

- Reliability: Based on historical data and market analysis, making it a reliable method for valuation.

Impact on Valuation

The EBITDA multiple has a profound impact on the overall valuation of the company. To understand this, let’s break down the valuation formula:

Enterprise Value (EV)=EBITDA×EBITDA Multiple ! !

Using the earlier example, if Company X has an EBITDA of $5 million and an EBITDA multiple of 18x, the enterprise value would be:

EV=5 million×18=90 million !!

This enterprise value reflects what the market believes the company is worth based on its earning potential and performance indicators.

Factors Influencing the EBITDA Multiple

Several factors can influence the EBITDA multiple assigned to a company:

- Industry Sector: Different industries have different average EBITDA multiples based on growth prospects, risk, and market conditions.

- Company Size: Larger companies often have higher multiples due to perceived lower risk and better access to capital.

- Growth Rate: Companies with higher growth rates are typically valued higher, leading to higher EBITDA multiples.

- Profitability: More profitable companies often command higher multiples.

- Market Conditions: Economic cycles and investor sentiment can affect multiples across the board.

Knowing your business’s EBITDA multiple and understanding how it impacts your valuation is essential for strategic decision-making. It provides a standardized way to compare your company against peers and can be a critical factor in negotiations during mergers, acquisitions, or funding rounds. By focusing on improving the key drivers that influence your EBITDA multiple, you can enhance your company’s value and ensure you are well-positioned in the market.

Call to Action

If you’re looking to understand the true value of your business, consider a detailed evaluation of your EBITDA multiple. At Dawgen Global, we specialize in providing comprehensive valuation services to help you make informed business decisions. Contact us today to learn more.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements.