The banking sector, an industry where traditional practices have long been the norm, now stands at the crossroads of digital transformation. This evolution is markedly bifurcating banks into two distinct categories – leaders and laggards. Leaders in digital adoption not only stay ahead of the curve but create substantial value by implementing strategies that are difficult for their competitors to replicate. In contrast, laggards remain in a reactive stance, often emulating but seldom innovating.

The Digital Chasm

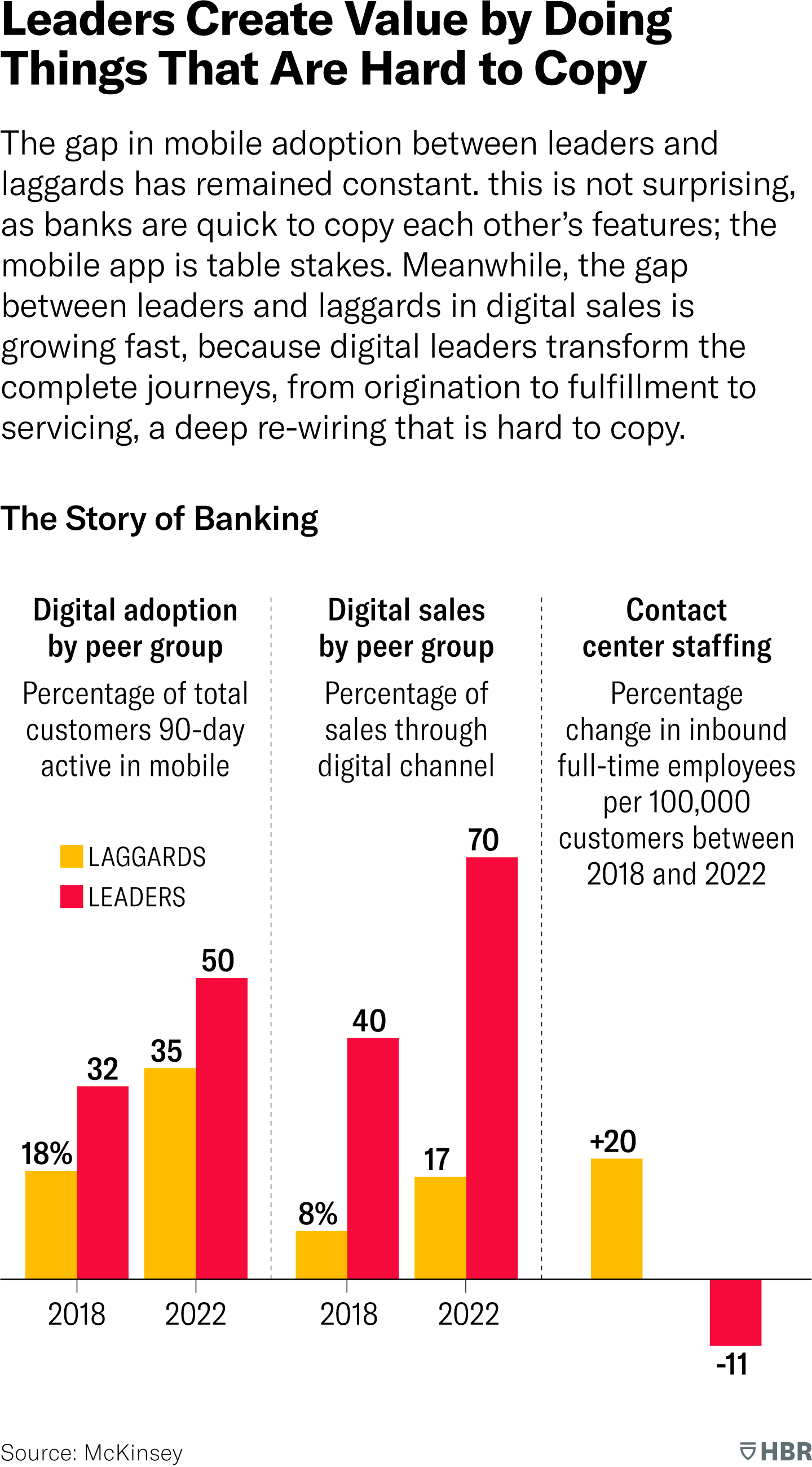

A compelling visual representation from McKinsey outlines the stark contrast between these two groups. In 2018, only 18% of customers from the laggard group were actively using mobile banking, compared to 32% of customers from the leader group. By 2022, while leaders saw an increase to 35%, laggards also showed growth, achieving 50% active mobile users. Notably, the gap in mobile adoption has remained constant, echoing the agility of leaders to continuously innovate and the tendency of laggards to follow the path forged by others. Mobile banking, once a novel feature, has become a basic expectation – table stakes, as it were.

Sales Through Digital Channels: A Divergent Tale

The narrative diverges significantly when assessing digital sales. In 2018, leaders had already achieved 40% of sales through digital channels, dwarfing the laggards’ mere 8%. Fast forward to 2022, and the divide deepens; leaders skyrocket to 70%, whereas laggards progress to just 17%. This indicates a profound difference in strategy and execution. Digital leaders don’t just offer digital options; they transform the entire customer journey, from origination to fulfillment to servicing, integrating a deep digital re-wiring that laggards struggle to emulate.

Operational Shifts Reflect Digital Priorities

The operational adjustments in response to digital transformation further illustrate the dichotomy. From 2018 to 2022, leaders have reduced contact center staffing by 11% per 100,000 customers, signaling a successful shift towards digital self-service capabilities that reduce the need for traditional customer service interactions. In contrast, laggards have increased staffing by 20%, suggesting not only a delay in digital adoption but also a potential misalignment of resources that could hinder future competitiveness.

The Path Forward

Visionary Leadership in Banking

In the fast-paced arena of financial services, visionary leaders are redefining the customer experience through the astute use of digital technologies. By doing so, they are not only streamlining operational processes but also enhancing customer engagement, creating a personalized and seamless experience that resonates with the modern consumer. This involves leveraging data analytics to understand customer needs, preferences, and behaviors, and then applying those insights to develop targeted products and services.

Moreover, these leaders are pioneering the use of artificial intelligence to facilitate predictive banking, where algorithms can anticipate customer needs and offer solutions proactively. This level of personalization is redefining the value proposition of banks, setting a new benchmark in customer service that is challenging for others to match.

Integrative Digital Transformations

The transformation to a digital-first approach often requires an overhaul of legacy systems, an endeavor fraught with challenges yet rich with rewards. Leaders are therefore committing to significant investments in technology to build agile, scalable platforms that can adapt to evolving market demands. They recognize that true transformation is more than digitizing existing services; it involves reimagining the entire banking ecosystem.

From internal processes to customer interfaces, every touchpoint is being optimized for digital interaction. Crucially, this digital integration extends to ensuring cybersecurity and data protection – essential elements in building customer trust in the digital age.

Breaking the Imitation Cycle

For laggards in the banking sector, the path forward demands a fundamental shift in approach. These institutions must break free from the comfort of traditional methods and the imitation of competitors’ strategies. Instead, they must boldly redefine their approach to embrace digital innovation.

This necessitates investing not only in new technologies but also in the people and culture that can drive transformation. Upskilling employees to excel in a digital environment, fostering a culture of innovation, and adopting a customer-centric approach are all pivotal. Additionally, forging partnerships with fintech companies can provide a significant leap forward, allowing traditional banks to quickly integrate advanced technologies and modernize their service offerings.

Prioritizing Digital Footprint Transformation

As laggards begin to prioritize their digital footprint, they must look towards long-term, sustainable growth through technology. This means developing an omnichannel strategy that aligns with the way customers want to interact with their banks, be it via mobile apps, online portals, or even through emerging interfaces such as voice recognition or augmented reality.

Investment in digital infrastructure must be viewed as a foundational step towards innovation, with a focus on platforms that allow for rapid deployment of new services. Moreover, data-driven decision-making should be at the core of the strategy, enabling a responsive and flexible approach to market changes.

Embracing a Start-up Mentality

To truly transform, laggards should consider adopting a start-up mentality, characterized by agility, a willingness to take calculated risks, and an ethos of continuous improvement. This means being open to experimentation, learning quickly from successes and failures, and scaling effective innovations rapidly.

The path forward for the banking industry is clear: it requires a bold embrace of digital transformation. Leaders have demonstrated the advantages of a robust digital strategy, and laggards must now follow suit or redefine the approach to make their own mark. The industry is at a tipping point, and the decisions made now will shape the financial landscape for years to come. The opportunity is not just to catch up, but to leapfrog into a future where digital is the foundation of all banking activities.

The tale of leaders and laggards within the banking industry is not just about technological adoption; it’s about a fundamental shift in philosophy. Leaders view digital transformation as an ongoing journey that reshapes their entire business model. In contrast, laggards must now recognize that to remain viable, they must go beyond adopting what already exists. They need to pioneer new ways to serve their customers, or they risk being left irreversibly behind in the digital dust.

For banks looking to the future, the message is clear: innovate and transform or follow and falter. The digital age waits for no one, and in the financial world, being a leader or a laggard is not merely a title – it’s a determinant of survival.

Dawgen Global: Catalyzing Digital Transformation for Organizations

Facilitating a Seamless Digital Transition

In the journey towards digital transformation, Dawgen Global stands as a pivotal ally for organizations looking to navigate the complexities of modernization. With a comprehensive understanding of the digital landscape and a keen insight into the banking industry’s evolving needs, Dawgen Global offers strategic guidance to help companies transition from traditional operations to cutting-edge digital environments.

Strategy Development and Implementation

Dawgen Global’s approach to digital transformation is holistic, beginning with an in-depth analysis of an organization’s current state and a strategic vision for its digital future. Their team of experts collaborates with clients to develop bespoke strategies that address the unique challenges and opportunities of their business. By focusing on long-term goals while managing short-term milestones, Dawgen Global ensures a smooth and progressive implementation of digital technologies.

Leveraging Data and Analytics

Data is the lifeblood of digital transformation. Dawgen Global assists organizations in harnessing the power of their data through advanced analytics. By translating data into actionable insights, they empower banks to make informed decisions that drive customer satisfaction and operational efficiency. Their analytics services can help identify new market opportunities, optimize customer journeys, and streamline processes.

Fostering Innovation and Cultural Change

Understanding that technology alone does not equate to transformation, Dawgen Global places a strong emphasis on cultivating a culture of innovation within organizations. They provide training and change management programs designed to elevate the digital literacy of staff and align leadership and employees with the new direction. Dawgen Global knows that when people thrive, transformation succeeds.

Integrating Technology Solutions

With a finger on the pulse of the latest technological advancements, Dawgen Global assists clients in selecting and integrating the most appropriate technologies for their specific needs. From mobile banking solutions to cloud computing and cybersecurity, they ensure that the technological infrastructure not only meets current requirements but is also scalable for future growth.

Collaborative Partnerships

Recognizing the power of collaboration in the digital age, Dawgen Global helps banks form strategic partnerships with fintech firms and other innovators. These partnerships can accelerate the adoption of advanced digital tools and practices, opening up a broader range of services and capabilities for traditional banks.

Risk Management and Regulatory Compliance

As banks undertake digital initiatives, they encounter various risks and regulatory hurdles. Dawgen Global provides expertise in managing these risks, ensuring that digital adoption is compliant with the latest financial regulations and standards. Their risk management framework is designed to protect both the organization and its customers throughout the digital transformation journey.

Tailored Transformation Roadmaps

Every bank’s path to digital maturity is unique. Dawgen Global excels in crafting tailored roadmaps that guide organizations step by step through the transformation process. They balance quick wins with long-term strategic initiatives, enabling banks to progress at a pace that supports their business objectives while maintaining operational stability.

In the dynamic and competitive landscape of the banking industry, Dawgen Global emerges as a vital partner for institutions seeking to claim their position as digital leaders. With their comprehensive services, from strategic planning to technological integration and cultural change, Dawgen Global is equipped to escort organizations through the intricacies of digital transformation, paving the way for innovation, growth, and lasting success in the digital era.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with DawgenGlobal. Together, let’s venture into a future brimming with opportunities and achievements.