In the contemporary battle against climate change, carbon taxes emerge as a crucial weapon. By imposing a cost on greenhouse gas emissions, these taxes aim to mitigate the carbon footprint of businesses and consumers alike. The World Bank’s State and Trends of Carbon Pricing Report, published in April 2023, provides a detailed analysis of the global carbon tax revenues collected in 2022, which we visually present here.

Global Carbon Tax Landscape

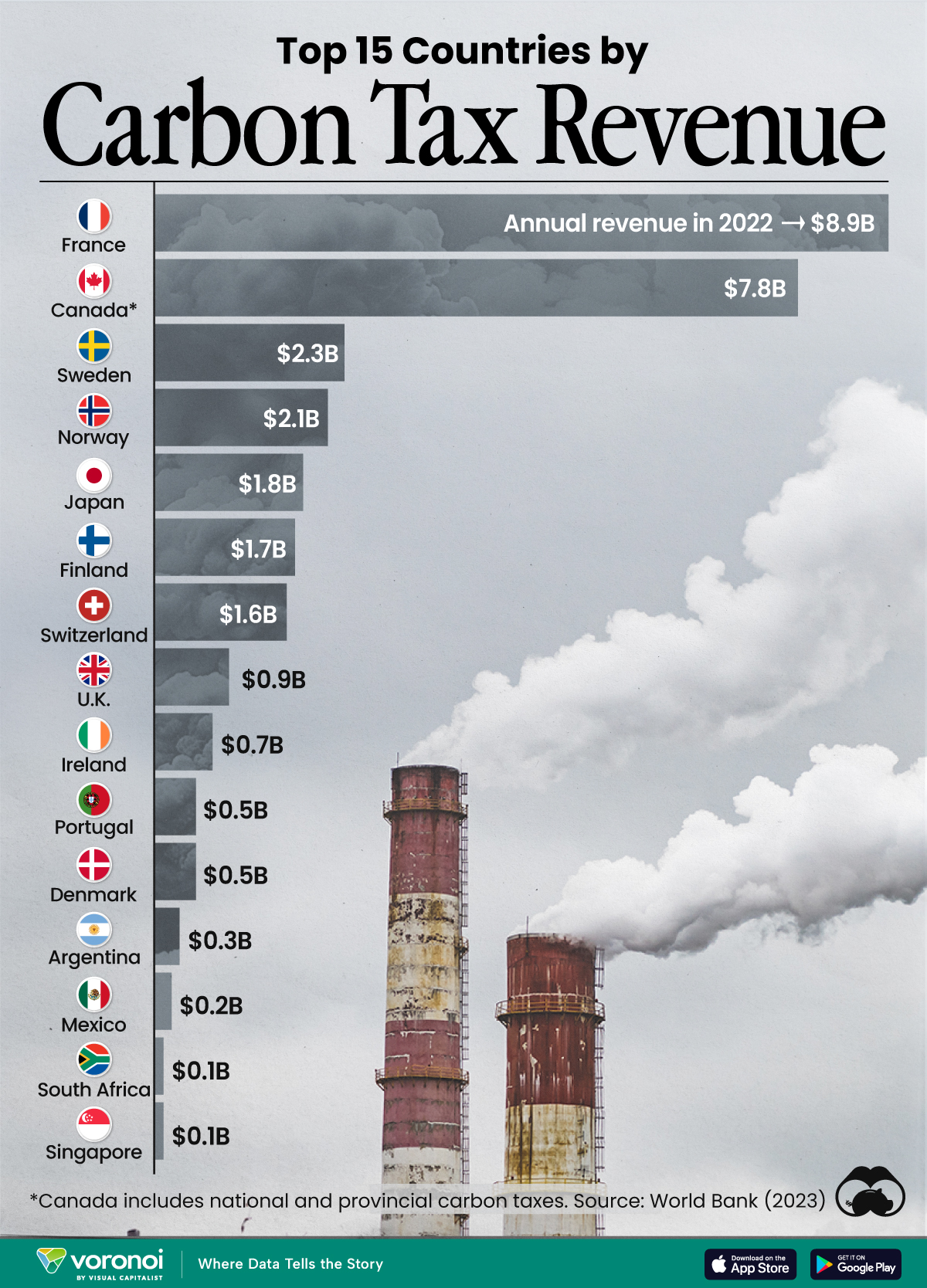

In the global arena, the adoption of carbon taxes is more than a trend—it’s becoming a cornerstone of environmental policy. The staggering $30 billion in revenue collected by the top 15 carbon tax-imposing nations in 2022 exemplifies a significant shift in how economies are addressing the climate crisis. This sum, though impressive, represents not just revenue, but a collective commitment to the health of our planet.

The carbon tax landscape is varied, with each participating country tailoring its approach to align with national priorities and economic structures. Countries are recognizing that the cost of carbon emissions is too great to ignore and that there is substantial economic rationale for taxing carbon-intensive activities. This is evident in the diversification of carbon pricing models, from flat-rate taxes to more dynamic systems that vary by sector, emission type, or fuel usage.

Dynamics of the Carbon Tax Revenue

The revenue generated from carbon taxes is a key indicator of the level of engagement countries have with climate change mitigation. It’s not just about the amount of money raised, but what it reflects—a growing acknowledgment that sustainable practices can coexist with fiscal policy. As nations innovate in developing their carbon pricing strategies, we see an emerging pattern: the more comprehensive the coverage of the tax, the higher the revenue and, potentially, the greater the environmental impact.

For instance, the Scandinavian countries, known for their environmental leadership, are not just taxing emissions for the sake of generating income. Instead, they are using these funds to reinvest in renewable energy projects, enhance public transportation, and support technological innovations that further reduce emissions. This re-investment strategy strengthens the carbon tax’s role as a driver for sustainability.

Global Coverage and Inclusivity

The current carbon tax models span from the European heartland to the diverse economies of Asia and the Americas, illustrating the universal applicability of carbon pricing. It’s a financial tool that can be adapted across different geographic and economic contexts. Each country on the top 15 list has recognized that they can no longer afford the externalities of carbon emissions and have taken a quantifiable step towards internalizing these costs through taxation.

Furthermore, the carbon tax revenues are a testament to the inclusivity of the policies. By placing a price on carbon, the costs of emissions are being democratized, spreading across industries and, ultimately, to consumers. This inclusivity ensures that the responsibility for climate change mitigation does not fall on a single sector but is shared across the entire economy, encouraging collective action.

A Signal for Future Action

The $30 billion in revenue is more than a fiscal accomplishment; it sends a potent message to nations still on the sidelines of carbon pricing. It shows that there is financial viability in taking environmental action, that economic growth need not be sacrificed for the sake of the planet. This realization is pivotal as we steer towards a more sustainable future where economic and environmental interests are not just balanced but are seen as mutually reinforcing.

As the world continues to grapple with the urgent need for climate action, the expanding carbon tax landscape serves as both a blueprint and a rallying cry for nations to redefine their relationship with the environment. The figures speak volumes about what can be achieved when economic tools are effectively leveraged to foster a greener economy.

France and Canada: Pioneers in Carbon Taxation

Within the vanguard of the carbon taxation initiative, France and Canada have established themselves as prominent leaders. Together, they have harnessed the potential of carbon taxes to transform their economies, jointly accounting for more than half of the global revenue collected in 2022.

France’s Trailblazing Carbon Tax Journey

France’s trajectory in carbon pricing began earnestly in 2014, with an initial rate that has since been progressively increased. This escalation reflects the country’s commitment to align economic growth with environmental stewardship. The French carbon tax covers a vast array of emissions, including those from fuel combustion in homes, offices, and factories, effectively encompassing a significant portion of its national emissions profile. The transport sector, which is a major contributor to carbon emissions, is also a significant target of the French carbon tax, encouraging a shift towards cleaner transportation options.

French policymakers have taken a balanced approach, aiming to mitigate the financial impact on consumers and businesses. Revenue from the carbon tax is often reinvested into the economy, funding renewable energy projects and providing subsidies for energy-efficient technologies. This strategy not only reduces emissions but also spurs innovation in the green technology sector, positioning France as a hub for sustainable development.

Canada’s Comprehensive Carbon Pricing System

Canada’s approach to carbon taxation is distinctive due to its federal-provincial dynamic. The Pan-Canadian Framework on Clean Growth and Climate Change, introduced in 2016, laid the groundwork for a nationwide carbon pricing strategy, mandating a minimum carbon tax level that provinces could exceed if they chose. In 2022, this resulted in a layered carbon pricing system where both national and provincial carbon taxes coexist, capturing a wide spectrum of emissions across the country.

The Canadian carbon tax includes a broad range of sectors, from industrial manufacturing to waste management. Its influence extends to the everyday consumer, as the tax is applied to fossil fuels and home heating. Canada’s policy design also incorporates a rebate system, where a portion of the tax revenue is returned directly to households, mitigating the economic burden and maintaining public support for the carbon tax initiative.

A Model for Global Action

France and Canada serve as exemplars of how carbon taxation can be implemented on different scales and under various governance structures. They demonstrate that, with careful design and political commitment, carbon taxes can be a central pillar in a nation’s strategy to address climate change. By successfully generating substantial revenues that can be reinvested in green initiatives, they provide a blueprint for how economic measures can drive environmental progress.

As other nations consider their paths towards sustainability, the pioneering efforts of France and Canada offer valuable lessons. The robustness of their tax rates, the inclusivity of their sectors, and the integration of socio-economic considerations set a global precedent, showing that it is possible to create carbon pricing systems that not only reduce emissions but also foster economic resilience.

Analyzing the Top Earners

Sweden and Norway trail closely behind, with respective revenues of $2.3 billion and $2.1 billion. The Scandinavian commitment to environmental sustainability is reflected in their aggressive carbon taxing policies. In contrast, emerging economies like Argentina, Mexico, and South Africa, while at the bottom of the list, showcase the worldwide reach of carbon taxation efforts.

Carbon Credits as a Strategic Tool for Caribbean Renewable Energy Funding

As small island developing states (SIDS), Caribbean countries face unique challenges in the face of climate change. With their economies often heavily dependent on tourism and agriculture—sectors vulnerable to extreme weather events—adopting sustainable energy solutions is not just beneficial but imperative. However, the transition to renewable energy requires significant investment, a challenge for these nations with limited financial resources. This is where the concept of carbon credits emerges as a potentially transformative strategy.

Understanding Carbon Credits

Carbon credits are part of an international carbon market where countries and companies can purchase certificates representing a reduction of one metric ton of carbon dioxide emissions. These credits can then be used to offset a purchaser’s emissions, essentially funding green initiatives elsewhere as part of their own environmental commitment.

For Caribbean nations, engaging in the carbon credit market presents an opportunity to attract international investment in their renewable energy projects. By developing projects that reduce emissions—such as solar, wind, or geothermal power plants—they can generate carbon credits to be sold on the global market. This mechanism not only supports the local development of renewable energy infrastructure but also brings in additional revenue that can fund further sustainable initiatives.

Potential Advantages for the Caribbean

The appeal of carbon credits in the Caribbean is multifold:

- Financial Incentives: Carbon credit sales provide a financial incentive for developing renewable energy projects, which could otherwise be hindered by upfront costs and economic barriers.

- Market-Based Approach: It is a market-driven approach, allowing Caribbean nations to benefit from global economic systems aimed at reducing emissions.

- Sustainable Development: By linking the reduction of emissions to economic gains, carbon credits can foster a sustainable development model that aligns with the environmental, social, and economic goals of Caribbean societies.

- International Collaboration: Participation in the carbon market facilitates international collaboration, providing a platform for these countries to engage with larger economies in the fight against climate change.

Challenges and Considerations

While the advantages are compelling, there are challenges and considerations for Caribbean countries:

- Market Volatility: The value of carbon credits can be volatile, influenced by international policies and market demand. This uncertainty can pose risks to consistent funding.

- Complex Market Mechanisms: Accessing carbon markets can be complex, requiring technical expertise and robust measurement, reporting, and verification (MRV) systems to ensure project credibility.

- Scalability: The relatively small scale of individual Caribbean renewable energy projects may limit the volume of credits they can generate, affecting profitability and market access.

For Caribbean nations, carbon credits represent an innovative financial mechanism that can propel the region towards a more sustainable energy future. With careful planning, international partnerships, and support from global climate finance structures, carbon credits can offer a viable pathway to not only reduce emissions but also to support economic resilience in the face of environmental challenges. This approach, when integrated with other funding strategies and regional collaboration, can play a significant role in advancing the Caribbean’s renewable energy ambitions and its overall sustainable development agenda.

Assessing the Effectiveness of Carbon Taxing in the Global Climate Strategy

The pursuit of limiting global warming is a complex and pressing challenge. Carbon taxes have been lauded for their direct approach to pricing out carbon emissions, effectively making it more expensive to pollute. However, the pathway to meeting the ambitious 1.5–2°C warming limit set by the Paris Climate Agreement is fraught with debate, particularly around the efficacy of carbon pricing as a singular tool.

The Debate on Carbon Pricing

Experts and policymakers are grappling with determining an optimal global carbon price. Some advocate for a high price to drastically reduce emissions, while others warn of the economic repercussions that could follow such a steep increase. The consensus, however, is shifting toward a recognition that while carbon taxes are essential, they are not a panacea.

The debate intensifies when considering the diverse economic landscapes across the globe. What constitutes an effective carbon price in industrialized nations may not be feasible or effective in developing countries. Moreover, a uniform price may not account for the disparate impacts of climate change or the differing capacities of nations to transition to cleaner energy sources.

A Multi-Faceted Approach

A recent study emphasizes the need for a comprehensive strategy to combat climate change. It warns against an over-reliance on carbon pricing, pointing out that even with a robust carbon tax in place, emissions may not decrease quickly enough to avoid the worst impacts of global warming. This is primarily because carbon taxes, while they do influence market behavior, do not directly control the total volume of emissions.

As a result, additional policy measures are being called into play. These include regulation and standards setting, such as emissions caps for high-polluting industries, mandates for renewable energy adoption, and strict fuel economy standards for vehicles. Investment in technological innovation is equally important, as breakthroughs in carbon capture and storage, battery storage, and renewable technologies are critical in transitioning away from fossil fuels.

The Importance of a Just Transition

An equitable transition is also a crucial component of the broader climate strategy. Carbon taxes can disproportionately affect lower-income groups and developing nations, making it necessary to implement measures that balance the economic burden. Policies like revenue recycling, where the income from carbon taxes is redistributed to mitigate financial impacts, or investing in green jobs and infrastructure, are examples of how to ensure a just and inclusive shift toward a low-carbon economy.

In conclusion, while carbon taxes are a significant step toward curbing global carbon emissions, they must be integrated into a larger framework of climate action. This includes a combination of regulatory measures, investments in technology, and a focus on equity to support those most affected by both climate change and the transition to renewable energy. The effectiveness of carbon taxing, therefore, lies not just in the revenue it generates or the emissions it deters, but in its role within a coordinated suite of solutions tackling the multifaceted challenge of global warming.

The carbon tax revenue data reveals a snapshot of an international effort to value the environment within our economies. Yet, this is only the starting point. Continuous refinement of environmental policies and economic instruments will be indispensable in curbing the trajectory of global warming.

Call to Action

As global citizens, it is imperative to remain informed about our nations’ policies on carbon emissions. Advocating for rigorous and effective environmental policies is not only a civic duty but a necessary step to ensure a sustainable future for all.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements.