Over the past 25 years, the landscape of U.S. state income taxes has undergone significant transformation. As the global economy grows increasingly interconnected, these shifts hold notable implications not just for domestic U.S. stakeholders—but also for Caribbean investors, entrepreneurs, and businesses with cross-border interests.

Over the past 25 years, the landscape of U.S. state income taxes has undergone significant transformation. As the global economy grows increasingly interconnected, these shifts hold notable implications not just for domestic U.S. stakeholders—but also for Caribbean investors, entrepreneurs, and businesses with cross-border interests.

At Dawgen Global, we recognize the importance of understanding how tax trends in the United States can affect decision-making in the Caribbean. In this article, we explore how state-level income tax changes may influence investment strategies, expansion decisions, and overall business structuring for Caribbean stakeholders.

A Changing Tax Map: Key Trends from 2000 to 2025

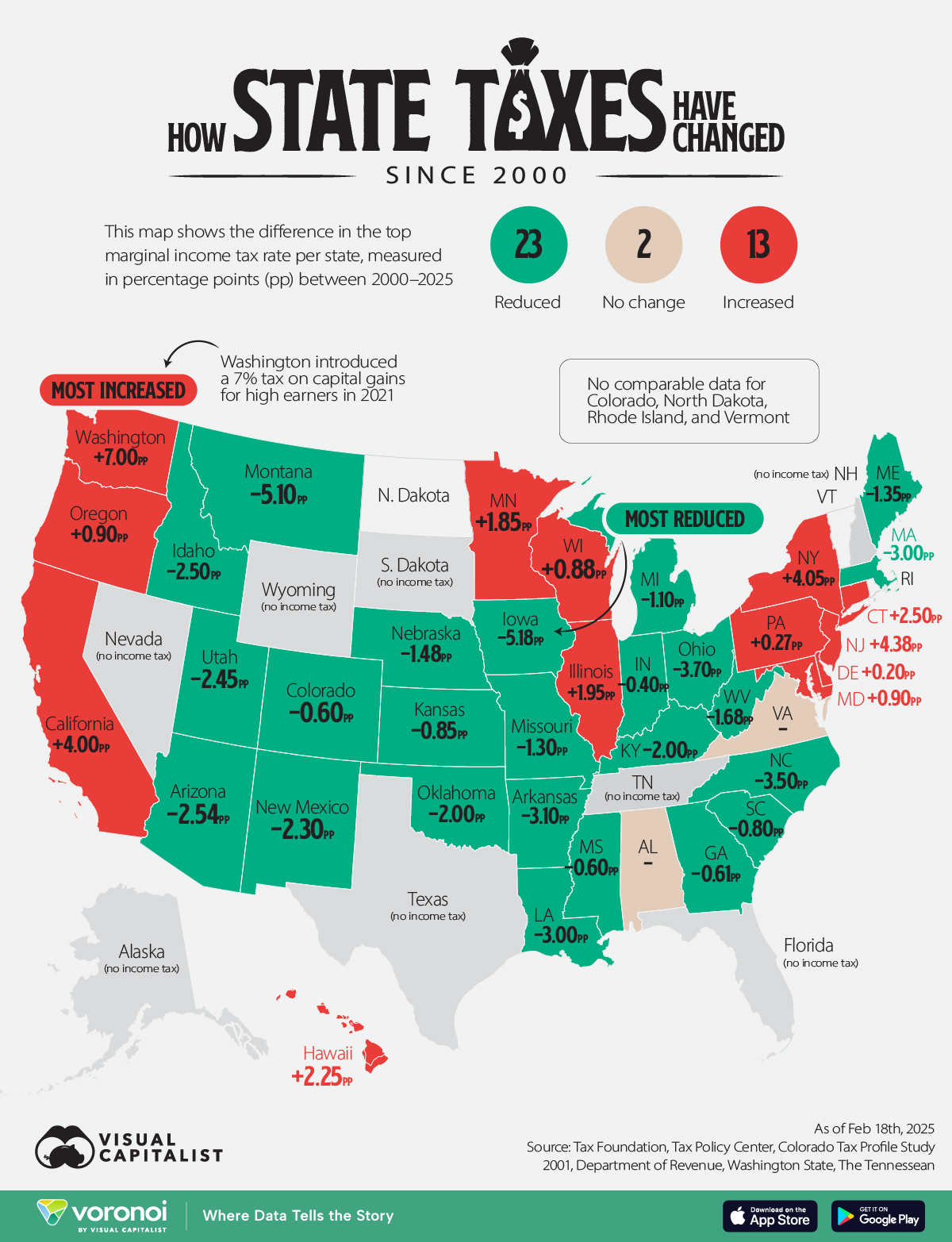

A recent analysis by the Tax Foundation and the Tax Policy Center shows that:

-

23 U.S. states have reduced their top marginal income tax rates since 2000.

-

13 states have increased their top rates.

-

Two states (Tennessee and New Hampshire) eliminated income tax entirely, joining six others with no state income tax.

-

A number of states transitioned from marginal to flat-rate tax systems, simplifying their tax codes.

Notably, Washington State introduced a 7% capital gains tax in 2021, and New Jersey saw the highest increase in standard income tax at +4.38 percentage points.

Implications for Caribbean Investors and Entrepreneurs

1. Tax Efficiency in Investment Planning

For Caribbean investors with assets or income streams in the U.S., understanding state income tax rates is vital. States like Florida, Texas, and Nevada still offer no income tax, making them attractive for real estate acquisitions, portfolio management, or business incorporations.

Conversely, states like California (+4.00pp) and New York (+0.88pp) have become more expensive in terms of tax burden, potentially reducing net returns on investment.

Dawgen Insight: We assist clients with tailored cross-border tax planning strategies that maximize returns while ensuring full compliance.

2. Location Strategy for Business Expansion

Entrepreneurs seeking to expand their Caribbean-based operations to the U.S. must now factor in state-specific tax burdens when choosing where to establish subsidiaries, sales offices, or fulfillment centers.

For example:

-

Iowa and Arkansas significantly reduced their top rates, potentially improving margins for businesses operating there.

-

States like Massachusetts and Connecticut introduced higher marginal rates for top earners, which may affect executive compensation planning and pass-through entity taxes.

Dawgen Insight: Our advisory services support entity structuring, location strategy, and tax optimization for cross-border expansions.

3. Navigating Flat Tax Systems

Nine states, including Arizona, Georgia, and North Carolina, shifted from marginal brackets to flat tax systems. While these systems offer simplicity, they may also present challenges for Caribbean entrepreneurs relying on progressive tax planning.

Flat taxes can disproportionately affect middle-income earners, especially when operating across borders with differing income levels.

Dawgen Insight: We provide tax modeling services to evaluate how different U.S. state tax structures impact Caribbean entrepreneurs and professionals working abroad.

4. Capital Gains Tax and High-Net-Worth Individuals

Washington’s newly introduced 7% capital gains tax on stock and bond profits (over $250,000) reflects a trend of targeting wealth accumulation. This development raises questions about how capital gains are categorized—and taxed—state by state.

For Caribbean high-net-worth individuals with investment portfolios in the U.S., such changes may require portfolio restructuring or income deferral strategies.

Dawgen Insight: Our wealth planning experts help you navigate complex tax treatments on investments and structure portfolios for optimal tax efficiency.

Cross-Border Compliance: A Dawgen Global Priority

Navigating both U.S. federal and state tax requirements, especially when managing dual residency, foreign bank accounts, or offshore entities, can be overwhelming. Dawgen Global provides comprehensive tax advisory services including:

-

U.S.-Caribbean tax treaty analysis

-

Double taxation avoidance planning

-

IRS and state-level reporting compliance

-

Cross-border corporate structuring

-

Estate and trust planning with U.S. asset implications

Moreover, states like Arizona, Georgia, Kentucky, and Mississippi have adopted flat tax structures, simplifying tax obligations but raising concerns about equity. On the other hand, states such as Massachusetts have introduced new brackets, moving away from flat taxes to a more progressive system.

A Strategic Approach to U.S. State Tax Trends for Caribbean Stakeholders

As U.S. state income tax systems continue to evolve in complexity and divergence, Caribbean investors and entrepreneurs face a pivotal moment. What once may have been a uniform consideration—“how much federal tax will I pay?”—has now expanded into a nuanced, state-by-state analysis of where, when, and how to invest or operate. These changes are not cosmetic—they affect profitability, compliance burdens, and long-term wealth preservation.

For example, a Caribbean business owner looking to establish operations in the U.S. now must account for:

-

The difference between states with zero income tax (like Florida or Texas) versus those with high or rising top marginal rates (such as California or New Jersey).

-

The implications of flat tax regimes, which may offer simplicity but lack the flexibility of progressive brackets for tax planning.

-

Newly introduced taxes on capital gains or high-income brackets, which could significantly reduce net returns on investment, especially for real estate, equity holdings, and private businesses.

These policy changes are not just technical shifts—they represent broader shifts in fiscal philosophy and political climate within individual U.S. states. Some are actively reducing taxes to attract businesses and high-income earners, while others are increasing rates to fund social programs or balance budgets.

Why This Matters for Caribbean Entrepreneurs

Caribbean investors and entrepreneurs are increasingly global. Whether you’re expanding your e-commerce platform into the U.S., acquiring rental property in Miami, launching a fintech startup with U.S. partners, or simply managing a diversified investment portfolio—you are affected by these tax changes.

Without a strategic approach, you may unknowingly:

-

Incur double taxation on income or gains

-

Pay higher than necessary tax due to poor entity structuring

-

Face penalties from non-compliance with shifting state rules

-

Miss out on tax-saving opportunities available through legal structuring or tax treaties

These risks highlight the need for proactive advisory, continuous monitoring, and cross-border expertise.

Dawgen Global: Your Cross-Border Tax and Investment Partner

At Dawgen Global, we are more than an accounting firm—we are your strategic advisors in a rapidly changing world. With a presence across the Caribbean and a deep understanding of international tax frameworks, we guide our clients through the complexities of U.S. state and federal tax planning with precision and foresight.

Our team assists in:

-

Selecting optimal states for incorporation or expansion based on tax policy, industry support, and regulatory climate.

-

Structuring tax-efficient investments and business models that reduce liabilities and protect assets.

-

Ensuring compliance with U.S. state and federal filing requirements, while leveraging treaty-based planning to avoid unnecessary taxation.

-

Offering insights into ongoing legislative trends and how they may impact your future growth.

We serve individuals, family offices, and businesses throughout the Caribbean who are engaged in or exploring opportunities in the United States. With tailored services that include international tax structuring, business advisory, financial modeling, and compliance support, Dawgen Global is your trusted partner in building resilient, profitable, and compliant cross-border ventures.

Looking Ahead

As the U.S. continues to recalibrate its tax code in response to economic shifts, population migration, and political priorities, Caribbean investors and entrepreneurs must stay informed—and act with clarity and purpose.

Success in this environment requires more than ambition. It requires intelligence, agility, and the right advisory support.

At Dawgen Global, we help you make Smarter and More Effective Decisions in a globalized marketplace—so that your vision today translates into prosperity tomorrow.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670/876-9265210 📲 WhatsApp Global: +1 876 5544445

📞 USA Office: 855-354-2447

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements