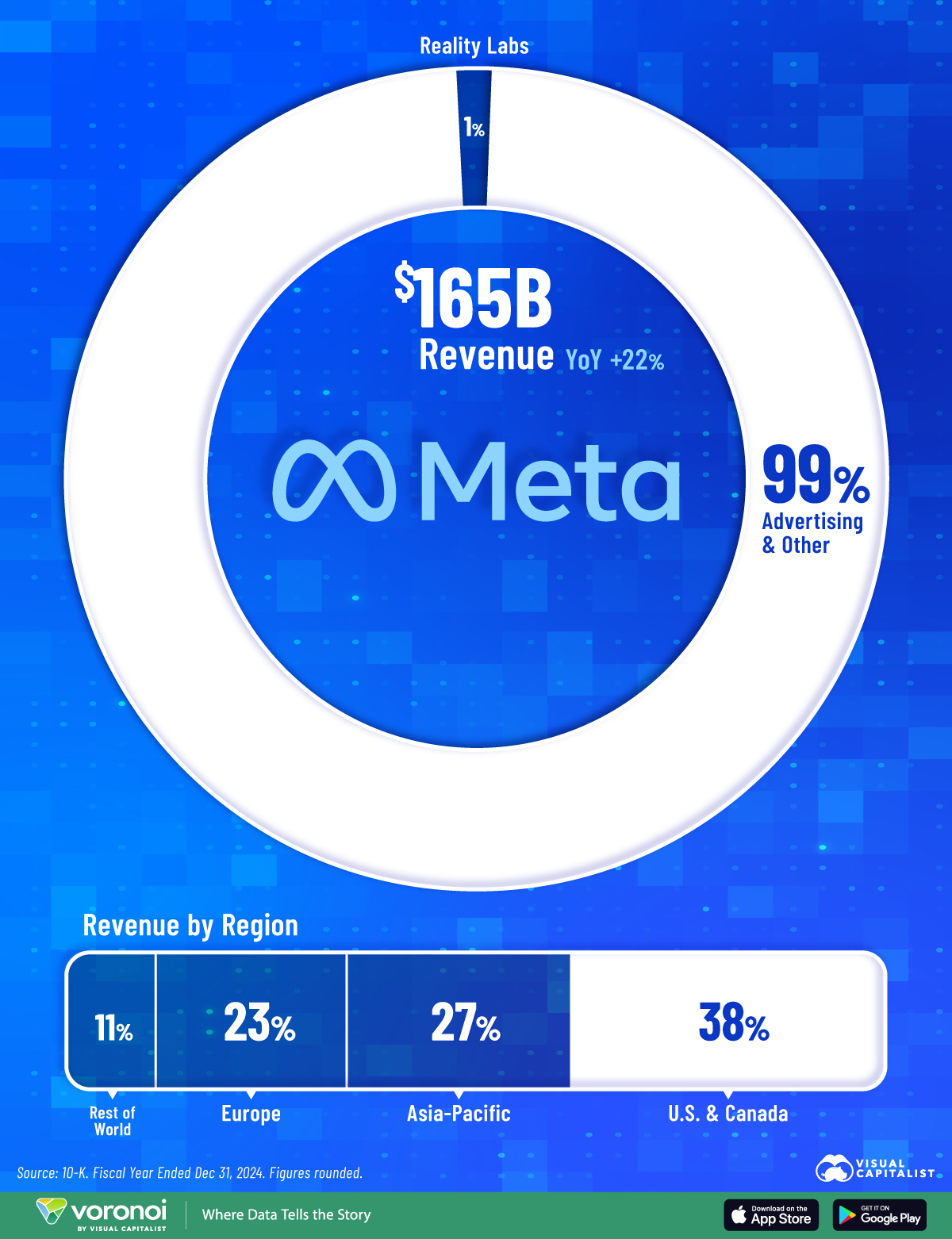

In 2024, Meta celebrated a landmark achievement—$165 billion in revenue, with a staggering 22% year-over-year growth. This growth was powered largely by Meta’s advertising business, bolstered by strategic investments in artificial intelligence and data infrastructure. But beneath the surface of this financial success lies a cautionary tale—a $17.7 billion annual loss from Meta’s Reality Labs, the company’s augmented and virtual reality division.

This wasn’t a one-time stumble. Since 2020, Reality Labs has lost over $60 billion, drawing attention to the crucial importance of strategic risk management, even for companies with deep pockets and global dominance.

At Dawgen Global, we understand that ambition without risk discipline can destabilize a business. That’s why we help companies—whether startups or multinationals—develop robust risk management frameworks to protect their growth trajectory and long-term goals.

Understanding Reality Labs: A Risky Bet on the Future

Reality Labs is Meta’s bold investment in the future of immersive technology, including AR/VR devices, the metaverse, and spatial computing. Its mission is to redefine how people connect in digital environments.

However, while the vision is futuristic, the business fundamentals are currently shaky:

-

Revenue in 2024 was only $2.1 billion

-

Operating losses reached $17.7 billion

-

Since inception, Reality Labs has not turned a profit

For entrepreneurs and executives, this raises a critical question: When does innovation become speculation?

Strategic Risk Management: A Necessary Counterbalance to Innovation

At its core, risk management isn’t about stifling innovation—it’s about supporting it with clarity and structure. When companies like Meta pursue transformative technologies, the stakes are high. Massive capital is deployed, timelines stretch, and consumer adoption is uncertain.

Meta’s situation underscores several risk blind spots:

-

❌ Unclear market demand for the metaverse concept

-

❌ Lack of a short- or medium-term revenue model

-

❌ High burn rate with uncertain payoff

-

❌ Technology still in early stages of adoption

Dawgen Global advises clients to approach innovation with discipline, ensuring the business is equipped to navigate uncertain waters.

Dawgen Global’s Risk Management Framework

At Dawgen Global, our Risk Advisory Services are designed to align visionary ambition with grounded strategy. We support our clients in:

1. Risk Identification and Classification

We work with management teams to identify strategic, operational, financial, and market risks. For ventures like Reality Labs, this could include:

-

Market readiness risk

-

Consumer adoption risk

-

Competitive landscape uncertainty

-

Regulatory concerns

2. Investment Evaluation and ROI Modeling

Before capital is deployed, we help model potential outcomes and conduct break-even analysis, net present value (NPV) assessments, and sensitivity analysis to test assumptions.

3. Scenario Planning and Stress Testing

We create hypothetical best-case, worst-case, and base-case scenarios to evaluate how the venture may perform under varying conditions.

4. Real-Time Risk Monitoring

Once projects are launched, Dawgen Global provides frameworks for monitoring KPIs, budget adherence, and operational performance against risk thresholds.

5. Exit Strategies and Contingency Planning

Every high-risk investment needs an exit strategy. Whether it’s pivoting, pausing, or winding down a division, we ensure clients have a clear, data-driven path forward.

What Entrepreneurs Can Learn from Meta’s Metaverse Misstep

Meta’s experience isn’t just a big tech story—it’s a universal lesson for all entrepreneurs and growing businesses:

-

Innovation must be anchored in a strong business case.

-

Capital allocation should follow structured risk assessments.

-

Bold ideas require realistic timelines and adaptive strategies.

At Dawgen Global, we help entrepreneurs pursue innovation without betting the business. Our advisory services are designed to bring rigor, foresight, and accountability to every decision—so visionary ideas can thrive without unchecked risk.

Final Thoughts: Risk Is Inevitable, Mismanagement Isn’t

Reality Labs is a reminder that no company is immune to miscalculations—not even one with billions in cash reserves. For smaller businesses, the margin for error is even slimmer.

That’s why risk management is not optional. It’s essential.

Dawgen Global is here to be your trusted advisor—guiding your growth, sharpening your strategy, and safeguarding your future. Whether you’re launching a new product, entering new markets, or scaling operations, our team ensures that your decisions are built on data, analysis, and resilience.

Let’s Talk Strategy. Let’s Talk Risk. Let’s Talk Growth.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670/876-9265210 📲 WhatsApp Global: +1 876 5544445

📞 USA Office: 855-354-2447

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements