Since 1991, global equity markets have been defined by alternating cycles of expansion, volatility, and recovery—each shaped by macroeconomic disruptions and transformative global events. From the dot-com boom of the late ’90s to the 2008 global financial crisis and the far-reaching impact of the COVID-19 pandemic, equity performance across regions has varied significantly. At Dawgen Global, we help clients make smarter and more effective investment decisions by decoding these global equity cycles and aligning strategies with long-term value creation.

Since 1991, global equity markets have been defined by alternating cycles of expansion, volatility, and recovery—each shaped by macroeconomic disruptions and transformative global events. From the dot-com boom of the late ’90s to the 2008 global financial crisis and the far-reaching impact of the COVID-19 pandemic, equity performance across regions has varied significantly. At Dawgen Global, we help clients make smarter and more effective investment decisions by decoding these global equity cycles and aligning strategies with long-term value creation.

U.S. Dominance in the Last Decade

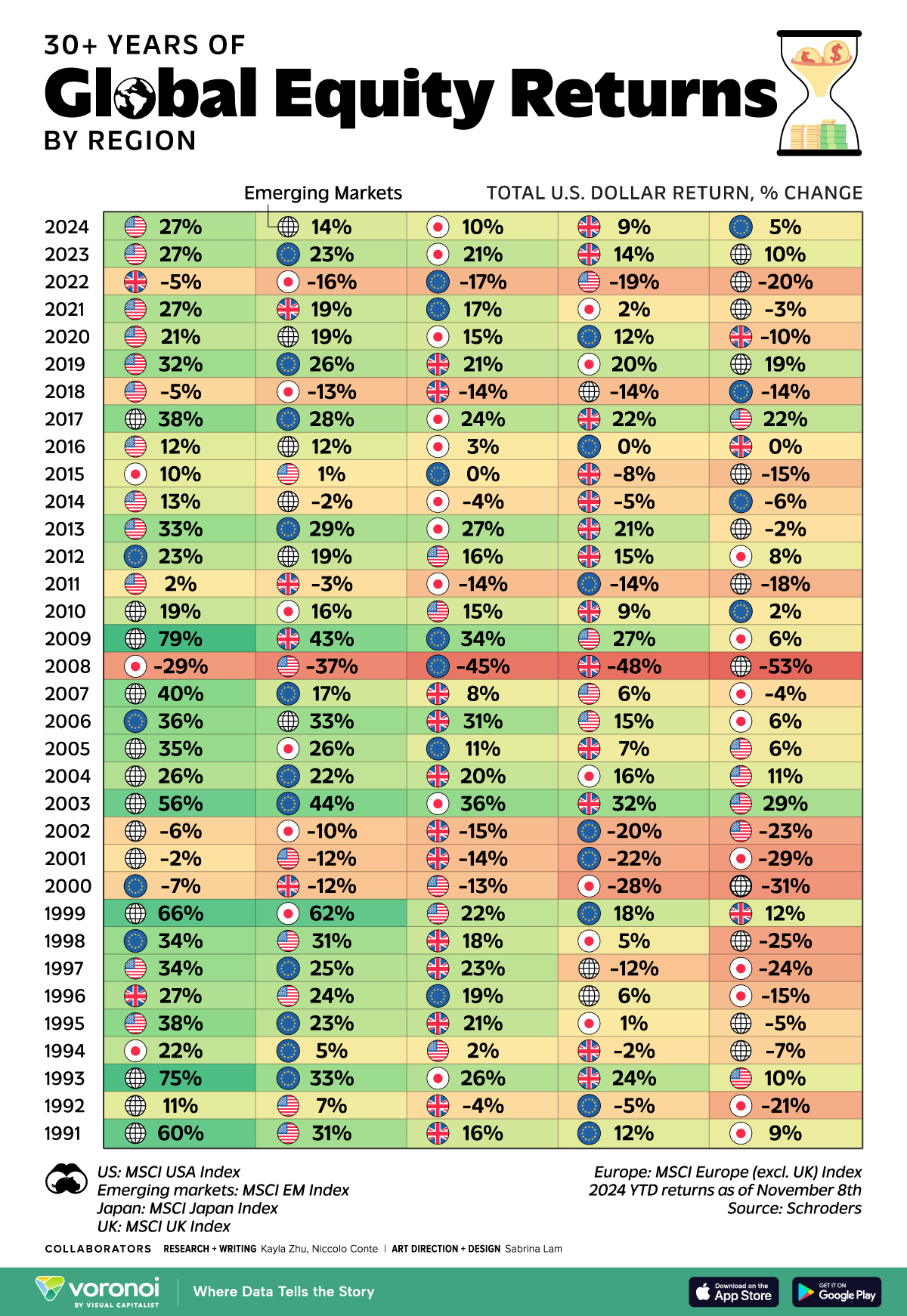

Recent equity performance has clearly favored the United States. From 2009 to 2024 YTD, U.S. equities have emerged as the top-performing region in 10 out of 15 years, supported by a resilient corporate sector, innovation leadership in technology, and accommodative monetary policy. In both 2023 and 2024 YTD, U.S. equities posted impressive returns of 27%—outperforming all other regions.

However, this dominance hasn’t been without interruptions. During 2002 to 2005, in the aftermath of the dot-com crash, the U.S. was the worst-performing region. In 2002 alone, U.S. equities suffered a -23% return. Dawgen Global’s advisory services help clients not only capitalize on U.S. market strengths but also understand when to pivot to alternative opportunities.

Emerging Markets: Cycles of Boom and Correction

From 1991 to 2010, emerging markets (EM) were a powerhouse, topping the performance charts 12 times. The MSCI Emerging Markets Index delivered annualized returns of 15.9% during the 2001–2010 period, outperforming developed markets.

However, the narrative shifted dramatically in the last decade. Since 2011, emerging market returns have stagnated, averaging just 0.9% annually. Market dynamics in regions such as China, India, Brazil, and South Korea have evolved, requiring more nuanced, risk-adjusted strategies. Dawgen Global provides region-specific advisory, helping clients assess geopolitical risks, currency volatility, and long-term growth potential in emerging markets.

Europe and the UK: Steady Yet Subdued Performance

European equities, excluding the UK, have generally displayed lower volatility compared to EMs, but also lower growth. The UK market had moments of resilience, such as in 2022 when it was the best performer at -5% (in a year when all regions saw negative returns). Meanwhile, Europe is experiencing a rebound in 2024 with a 5% gain year-to-date, driven by recovering energy stability and strong consumer spending.

Dawgen Global offers clients strategic allocation guidance to European assets, identifying sectors likely to benefit from cyclical recoveries and sustainable economic policies.

Japan: A Mixed Bag of Returns

Japanese equities have experienced sporadic performance, peaking in select years like 1999 (62%) and 2005 (26%), but largely underperforming in comparison to the U.S. or EMs. Japan’s demographic challenges and structural economic stagnation have limited growth, although recent corporate governance reforms are renewing investor interest.

Our team at Dawgen Global analyzes these macro trends to guide institutional and individual investors on Japan’s evolving role within a diversified portfolio.

The Dawgen Global Edge: Strategic Advisory Rooted in Data

As an integrated advisory firm, Dawgen Global empowers clients with data-driven strategies. By studying historical equity trends and correlating them with economic indicators, geopolitical developments, and monetary policies, we provide clients with:

-

Tailored Portfolio Structuring aligned with global macroeconomic conditions

-

Dynamic Regional Allocation to capture growth while managing risk

-

Market Entry and Exit Timing strategies backed by analytics

-

Long-term Wealth Planning incorporating volatility buffers and asset diversification

Final Thoughts

The global equity landscape is in constant motion—shaped by waves of innovation, shifts in regulatory policy, economic cycles, and geopolitical disruptions. From the meteoric rise of technology stocks to the turbulence caused by pandemics and inflationary pressures, markets continue to reflect the complex realities of our interconnected world.

For investors, this dynamism presents both opportunities and risks. The ability to thrive in this environment requires more than simply tracking market trends. It demands a deep understanding of the forces driving performance across regions and sectors, as well as the discipline to adjust strategies as new realities emerge.

At Dawgen Global, we believe that navigating market cycles effectively is not just about reacting to events—it’s about anticipating change, interpreting the data with context, and acting decisively. Our advisory services are designed to help clients move beyond surface-level analysis and uncover the strategic insights needed to build resilient, forward-thinking portfolios.

Whether it’s identifying underpriced assets in emerging markets, rebalancing exposure to U.S. equities amid policy shifts, or capitalizing on sector rotation in Europe and Japan—Dawgen Global brings the expertise, tools, and global perspective needed to support long-term financial growth.

In a world where change is the only constant, Dawgen Global remains a steadfast partner in helping clients make smarter and more effective investment decisions.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670/876-9265210 📲 WhatsApp Global: +1 876 5544445

📞 USA Office: 855-354-2447

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements