In an era where change is the only constant, disruption has become a buzzword synonymous with both opportunity and peril in the business landscape. Disruption can stem from technological advances, shifts in consumer behavior, or groundbreaking business models. In light of these shifts, Dawgen Global presents an exploration of strategic responses that can help businesses not only survive but thrive amid such waves of change.

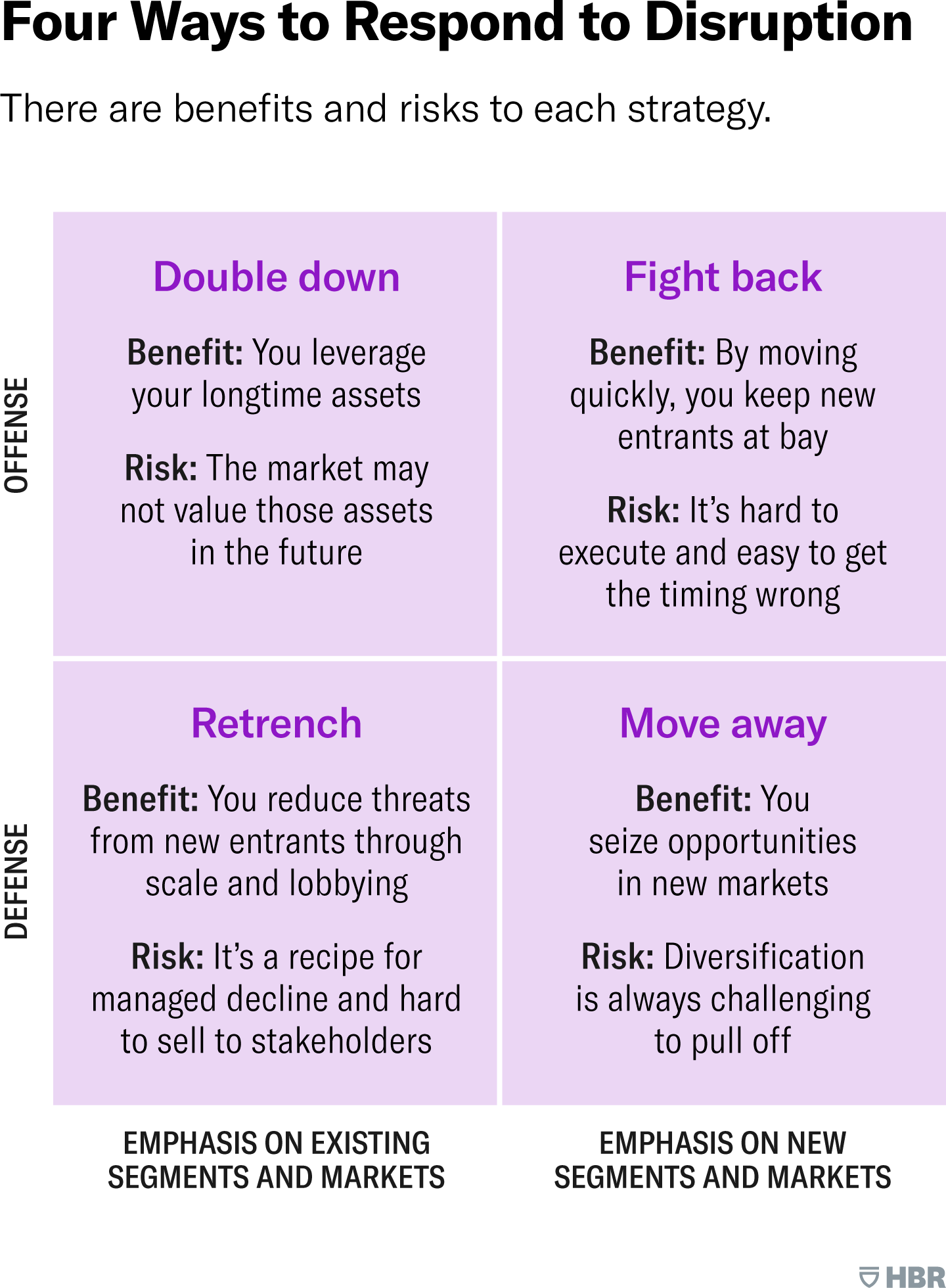

The Four Strategic Responses to Disruption

Businesses facing disruption have a spectrum of strategies at their disposal. These can be categorized into offensive and defensive moves, focusing on either existing or new market segments. Below we dissect these four tactical responses, as conceptualized in the framework provided by the Harvard Business Review.

1. Double Down (Offense, Existing Markets):

In the business game of high stakes, to “double down” is to commit further to an existing course of action, intensifying efforts and investment in the hopes of a greater payoff. This strategic response leverages the full weight of a company’s longstanding assets — be it a trusted brand, a loyal customer base, proprietary technologies, or exclusive supplier relationships.

Imagine a century-old financial institution facing fintech disruption. Doubling down might mean investing heavily in their existing brick-and-mortar branches, enhancing the customer service experience, or offering premium rates to existing clients. The strength here is familiarity and a historical track record — qualities that can instill a sense of trust and security in customers wary of new, untested market entrants.

But doubling down is not just about bolstering what already exists. It can also involve innovating within the confines of current markets. A beverage company, for instance, might double down by creating new flavors or limited-edition products that cater to their established market’s tastes while drawing on their well-known brand appeal.

This strategy often requires enhancing operational efficiencies to deliver more value from these assets. A manufacturing company might invest in advanced production technologies to increase output or improve quality of the products that their market already loves and trusts.

However, there are risks associated with this approach. The market landscape is a shifting one, with consumer preferences, technology, and competitive dynamics perpetually in flux. Doubling down on current assets presupposes that these assets will retain, or even increase, their value over time — an assumption that can be dramatically disproven.

Take, for example, the cautionary tale of Kodak. Despite having invented the digital camera, they continued to focus on their film products, unable to envision a future where these assets would no longer be valued. By the time the company acknowledged the digital wave, it was too late; the market had moved on, and their delayed response was insufficient to recover their leading position.

In assessing whether to double down, companies must critically evaluate the future relevance of their assets. This is no easy feat; it requires forecasting market trends and assessing the potential for current assets to adapt. It also demands a thorough understanding of the evolving landscape: Are new technologies on the horizon that could render your assets obsolete? Is there a shift in consumer behavior that indicates a different direction?

In summary, the double down strategy is a powerful tool when applied with precision and foresight. It calls for a balance between leveraging the strength of current assets and remaining agile enough to pivot as market conditions change. Businesses that choose to double down must do so with their eyes wide open to the potential for both unprecedented success and unforeseen obsolescence.

2. Fight Back (Offense, New Markets):

The “Fight Back” strategy is the corporate equivalent of an audacious counterattack in the face of an advancing enemy. When disruption looms, some companies choose not just to defend their ground but to expand into new territories, be they new geographical markets, customer segments, or product categories. This is a proactive, rather than reactive, stance that requires a company to channel its resources and creativity into innovation and strategic expansion.

Consider the traditional retailer that once dominated town centers and shopping malls. As e-commerce revolutionizes how consumers shop, these retailers are not just improving their in-store experience but also launching comprehensive online storefronts, embracing the omnichannel approach, and venturing into the digital realm to reclaim their market share. This could involve developing a user-friendly website, adopting e-commerce logistics, and employing digital marketing strategies that compete with, or even outperform, online-native competitors.

The benefits of this approach can be significant. By entering new markets, companies can access new revenue streams and customer bases, reducing their reliance on their traditional segments. It also sends a strong message to the market: the company is innovative, adaptable, and competitive. This can boost investor confidence and stave off competitive threats.

But the fight back strategy is fraught with risk. New markets often have different dynamics and consumer behaviors, which established companies might not fully understand. The journey is replete with pitfalls — from misjudging consumer preferences to underestimating the complexity of new supply chains or digital ecosystems. It requires substantial investment, not only in terms of capital but also time and strategic focus.

Xerox provides a cautionary tale in this regard. Known for its photocopiers and printers, the company made several attempts to diversify its offerings. However, ventures into new markets, such as its investment in the early stages of personal computing, did not always align with its core strengths or market dynamics, leading to significant losses. The lesson from Xerox’s experiences is clear: diversification must be undertaken with careful planning, a deep understanding of new market conditions, and the agility to adapt quickly if circumstances change.

A successful fight back strategy also hinges on timing. Enter the market too early, and you risk investing in a segment that’s not ready — a move that can lead to costly efforts to educate the market. Enter too late, and you’ll find the market saturated with competitors, making it difficult to gain a foothold.

In sum, the fight back strategy requires a bold vision backed by meticulous research, innovative thinking, and impeccable execution. It demands that a company understands not only where the market is today but where it will be tomorrow. It’s not a path for the faint-hearted or the ill-prepared but for companies with the foresight, resources, and resilience to turn the challenge of disruption into an opportunity for expansion and reinvention.

3. Retrench (Defense, Existing Markets):

The retrenchment strategy is akin to fortifying one’s castle in anticipation of a siege. When disruptive forces encroach upon a company’s market share, retrenching offers a way to shore up defenses by streamlining operations, sharpening the focus on core competencies, and optimizing the use of resources to protect the company’s position in its current markets.

In practice, this can mean a variety of things. A business may choose to divest non-core assets to concentrate on areas where it has a competitive advantage. This could involve selling off underperforming divisions or product lines to free up capital and managerial attention for more profitable endeavors. Cost-cutting measures are also a common aspect of this strategy, such as reducing the workforce, tightening budgets, and improving operational efficiency to reduce overheads without compromising product or service quality.

Additionally, retrenching can involve intensifying customer retention efforts. A company might increase customer service training to improve satisfaction or offer loyalty rewards to maintain a steady revenue base. By reinforcing the value proposition to existing customers, companies can resist the lure of competitors and reduce churn.

Another facet of retrenchment may be regulatory engagement. Companies often lobby for industry regulations that favor established players or create barriers to entry for upstarts. This can be a controversial tactic, as it may be perceived as stifling innovation, but it can also level the playing field, especially in industries that are capital-intensive or have significant safety concerns.

The airline industry exemplifies this approach. Legacy carriers, faced with competition from low-cost airlines, have consolidated routes, formed alliances, and utilized their slots at congested airports more strategically. They’ve also focused on lucrative business traveler segments, optimizing their frequent flyer programs to keep these high-value customers loyal.

However, retrenchment is not without its drawbacks. There’s the risk of entering a state of managed decline. By focusing too narrowly on existing markets and current operations, companies may miss out on opportunities for growth. This can create a negative perception among stakeholders, who may view the company as lacking innovation and growth potential. Furthermore, if the market continues to evolve away from the company’s offerings, no amount of cost-cutting or efficiency gains will compensate for the loss of relevance.

Moreover, excessive cost-cutting can damage a company’s internal culture and erode the quality of its products or services, leading to a loss of customers and a decline in market position. This delicate balance requires a strategic vision that ensures the company remains efficient and competitive without losing sight of potential future opportunities for growth and renewal.

In essence, retrenchment is about doing less to earn more: pruning the organizational tree so that it can weather the storm of disruption. It’s a defensive tactic that can be effective in the short term but must be complemented with a vision for future growth to ensure long-term viability and success.

The move away strategy represents a strategic pivot, an evolutionary leap to new grounds when the home territory comes under threat. It’s about the diversification of the business portfolio and a fundamental shift in the corporate narrative. Companies that adopt this approach are not just looking to survive; they are seeking to transform, to metamorphose into entities that can thrive in entirely different ecosystems.

Diversification is at the heart of this strategy, which involves venturing into markets or product lines that may not have been part of the company’s original purview. It’s a move that requires bold decision-making and a venture into the unknown, reminiscent of a tech company branching into healthcare with wearables that monitor vital signs, or an automotive giant investing in mobility solutions and autonomous vehicles.

The move away strategy is predicated on the idea that there’s a limit to growth within existing markets. Perhaps the market is saturated, or technological disruption has created an irreversible decline in demand for certain products or services. In such cases, the potential losses in existing markets can be offset by capturing value in new arenas.

Nokia’s pivot from its roots in paper and rubber to telecommunications is a storied example of moving away with great success. The move was prescient, anticipating the decline in demand for their original products and capitalizing on the nascent mobile communications wave. Similarly, companies like Amazon have successfully moved away from their original market by expanding from an online bookstore into cloud computing with Amazon Web Services, now a significant profit driver for the company.

However, the challenges of this strategy are substantial. Understanding a new market—its competitors, regulatory environment, consumer behaviors, and risks—is no small feat. Companies must do their due diligence, often investing significant time and resources into market research before making the first move. They also need to build new competencies, acquire or develop new technologies, and possibly reshape their brand to resonate with a new audience.

Execution is critical. Diversification into unrelated markets can dilute a company’s brand and confuse consumers as well as investors. Moreover, it can strain a company’s resources, as developing expertise and infrastructure in new areas can be capital-intensive. Missteps can be costly, as was the case with some of Google’s more peripheral projects that failed to gain traction and were eventually shelved.

Yet, when done with careful planning and strategic insight, moving away can breathe new life into a stagnating company. It can open up new horizons for revenue and growth, as it allows companies to tap into emerging markets and trends before they become mainstream.

In conclusion, the move away strategy is a journey into new beginnings. It requires a delicate balance of risk-taking and strategic planning. It’s about innovation, adaptation, and sometimes, transformation. For companies willing to take the plunge, it can be a pathway not just to survival but to a whole new level of success.

Case Studies and Examples:

Netflix: Embracing the ‘Fight Back’ Strategy

Netflix’s journey serves as a paragon of the ‘Fight Back’ strategy. Originally a mail-order DVD rental service, the company anticipated the shift towards digital consumption early on. In the mid-2000s, facing a saturated DVD market and the looming threat of digital piracy and online competitors, Netflix chose to pivot aggressively into streaming services. This strategic move was not without risk; it required significant investment in digital infrastructure and content licensing, not to mention the development of a new business model away from physical rentals.

However, the bold move paid off. Netflix quickly established itself as a leader in the new market for online streaming, outpacing traditional media companies and tech giants alike. The company invested heavily in original content, further differentiating its service and solidifying its market position. Today, Netflix is synonymous with streaming entertainment, having successfully transitioned from its original DVD rental model to becoming a global content powerhouse.

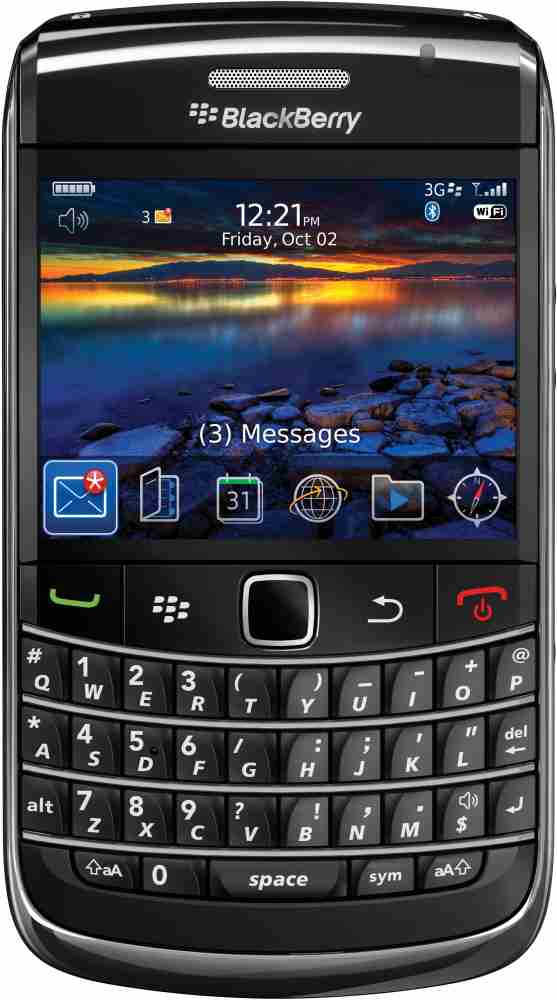

BlackBerry: The Pitfalls of ‘Double Down’

BlackBerry (formerly Research In Motion) offers a sobering example of the risks inherent in the ‘Double Down’ strategy. Once a titan in the mobile device industry, BlackBerry built its reputation on secure, reliable communication devices with physical keyboards. As smartphones started to become more mainstream, BlackBerry doubled down on its strengths — security and enterprise email services.

However, the rise of Apple’s iPhone and a slew of Android devices changed consumer expectations. The market shifted towards touchscreens, apps, and multimedia capabilities, areas where BlackBerry was slow to innovate. By the time the company attempted to catch up, it had already lost significant market share. BlackBerry’s insistence on its original market strengths ultimately led to its decline as a hardware manufacturer.

BlackBerry’s experience underscores the peril of doubling down in a rapidly changing market. While the company had significant assets in enterprise mobility, it failed to recognize and adapt to the shifting landscape in consumer preferences and technology.

Conclusions from Case Studies

These cases illustrate the critical importance of understanding market trends and being willing to adapt business models accordingly. Netflix’s successful ‘Fight Back’ strategy hinged on its foresight and agility, while BlackBerry’s ill-fated ‘Double Down’ approach serves as a cautionary tale about resistance to change. For businesses today, the key takeaway is to be observant, adaptable, and ready to pivot when the market dictates. Both success and failure in the face of disruption provide valuable lessons for companies crafting their strategic responses.

Analysis:

Choosing the optimal path in response to market disruption is an intricate process that demands a nuanced understanding of a company’s situation. It’s not merely about picking a strategy; it’s about diagnosing the business environment, comprehending the nature of the disruption, and evaluating the firm’s capacity to respond.

A thorough SWOT analysis provides a framework for this assessment. By examining strengths, a company can identify the core competencies that offer a competitive edge and consider whether doubling down on these assets makes sense. Meanwhile, an honest appraisal of weaknesses may highlight areas where a fight back strategy could introduce necessary innovation and growth. Opportunities in the market are crucial for identifying areas for potential expansion or diversification, guiding the move away strategy. Lastly, understanding the threats can underscore the need for a retrenchment approach to protect the existing market position.

A SWOT analysis must be coupled with market analysis to understand the external forces at play. This includes evaluating consumer trends, regulatory changes, and technological advancements that could either offer new opportunities or pose significant risks.

The disruptive nature of the market can be unpredictable, and the correct strategy may change over time. Thus, flexibility and ongoing re-evaluation are essential. Organizations should be prepared to adapt their strategies as market dynamics evolve and new information comes to light.

Conclusion:

In the tumultuous seas of today’s business environment, disruption has become a constant undercurrent. Navigating these waters requires strategic foresight and the courage to take decisive action. Whether a company chooses to double down, fight back, retrench, or move away, the decision must be rooted in a deep understanding of both the external market and internal capabilities.

Leaders must eschew a one-size-fits-all approach and instead tailor their strategies to their unique circumstances. They must embrace the possibility that the best response today may not be the best response tomorrow, and stay vigilant for signs that a change in strategy is warranted.

Ultimately, it’s not just about weathering the storm of disruption — it’s about setting a course for sustained growth and innovation. The right strategic response can transform disruption from a threat into a powerful catalyst for a company’s evolution and success. As businesses plot their course, they must remain steadfast in their resolve, adaptable in their approach, and always mindful of the shifting winds of market change.

Businesses seeking to understand their best course of action in the face of disruption are encouraged to engage with strategic experts. Dawgen Global is positioned to assist in this endeavor, offering insights and guidance to chart a course through the choppy seas of change. Contact us to fortify your strategic compass and set sail toward a prosperous horizon.

To ensure a comprehensive and nuanced article, each section should be elaborated with further details, research, and case studies that are specific to the industry and target audience of the publication.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements.