In 2025, the U.S. state tax landscape looks vastly different from what it did two decades ago. A shift toward lower income tax rates, the rise of flat-tax structures, and new taxes on capital gains in select states reflect a changing fiscal environment that directly impacts business owners, entrepreneurs, and SMEs.

In 2025, the U.S. state tax landscape looks vastly different from what it did two decades ago. A shift toward lower income tax rates, the rise of flat-tax structures, and new taxes on capital gains in select states reflect a changing fiscal environment that directly impacts business owners, entrepreneurs, and SMEs.

For organizations operating in or expanding to the United States—or even doing business with U.S. entities—these changes affect more than tax bills. They influence location decisions, employee compensation models, capital investments, and long-term planning.

At Dawgen Global, we believe that tax is more than a compliance issue—it’s a strategic lever. Understanding these evolving trends is essential to optimizing your business structure and driving sustainable growth.

Key Tax Trends Business Owners Should Watch

1. 📉 23 States Have Reduced Top Marginal Income Tax Rates

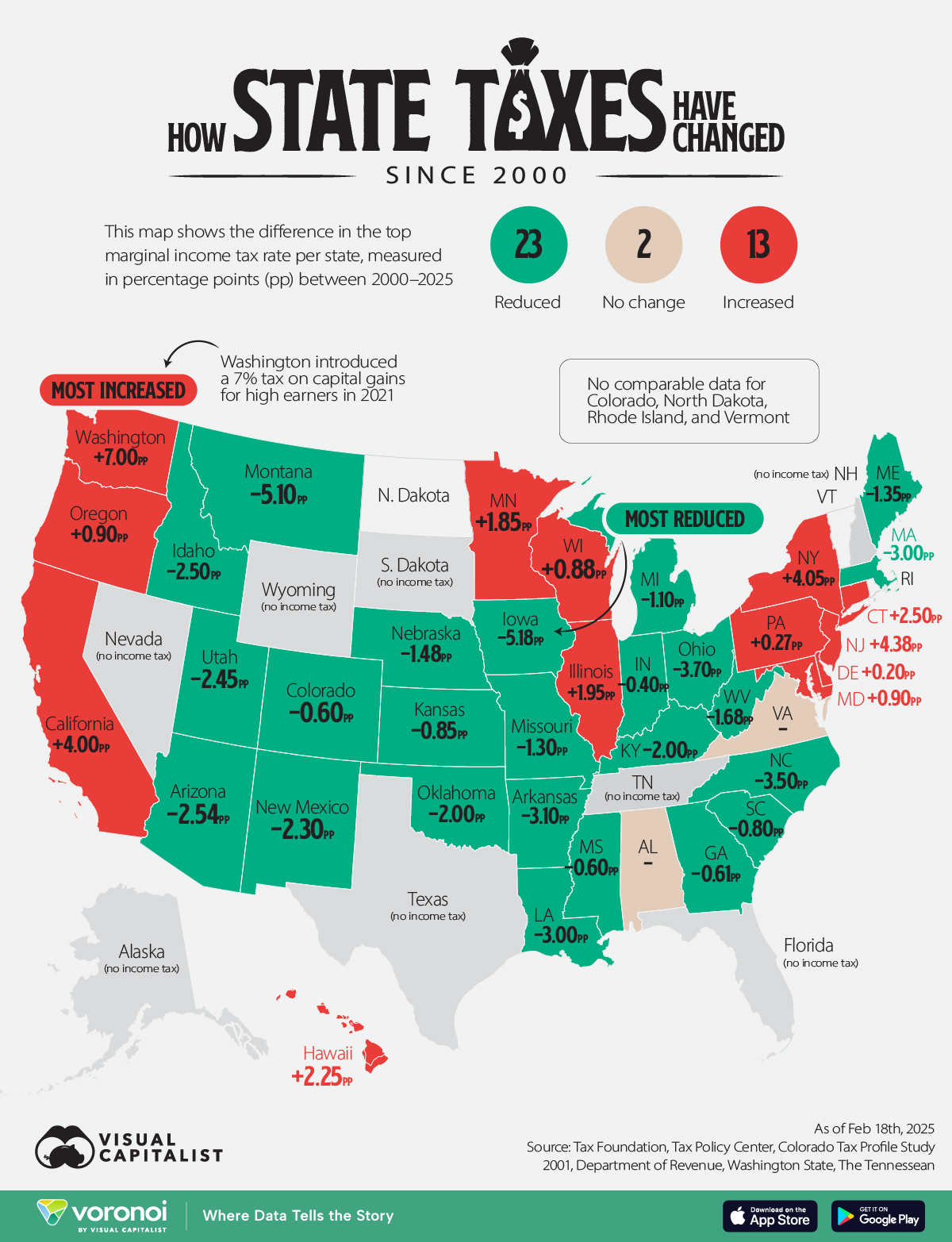

Between 2000 and 2025, 23 states lowered their top personal income tax rates. This means lower taxes on business income passed through to owners of partnerships, LLCs, and S Corporations—commonly used by SMEs.

States such as:

-

Iowa (-5.18pp)

-

Arkansas (-3.10pp)

-

Louisiana (-3.00pp)

These reductions are not just numbers—they translate to real cost savings and improved after-tax income for entrepreneurs and key personnel.

Dawgen Insight: Lower tax states may offer better post-tax returns for pass-through income. Our advisors help clients choose the right structure to capitalize on these benefits.

2. 🏛️ Rise of Flat Tax Systems

A growing number of states, including Arizona, Georgia, and Utah, have transitioned from progressive tax brackets to flat tax systems. While flat taxes simplify compliance, they may impact how employee salaries are structured and how incentives are offered to top earners.

For business owners, this shift requires:

-

Reassessing net compensation for executives and employees

-

Revisiting benefits strategies to remain competitive

-

Understanding how flat taxes affect owners drawing income from the business

Dawgen Insight: We provide modeling services to help businesses forecast tax outcomes and re-engineer compensation packages under flat-tax regimes.

3. 🚨 States Increasing Tax Rates on High Earners and Capital Gains

Not all states are cutting taxes. 13 states and D.C. have increased their top rates since 2000.

Notable examples:

-

Washington State (+7.00pp): Imposed a 7% capital gains tax on stock/bond profits over $250,000

-

New Jersey (+4.38pp) and California (+4.00pp) have significantly raised top brackets

-

Massachusetts added a 9% rate for income above $1.8M, transitioning away from a flat tax

This trend toward taxing wealthier earners and investment returns has implications for:

-

Business owners planning to exit or sell equity

-

Those with investment income from passive sources

-

Executives or founders based in high-tax states

Dawgen Insight: We help you proactively plan for liquidity events and explore state-level structuring options to minimize exposure to rising taxes.

4. 🌎 Location Strategy Becomes a Tax Strategy

Where your business is based—or where your executives reside—can significantly impact your overall tax burden.

For example:

-

Florida, Texas, and Nevada have no income tax, ideal for entity domiciling and personal residency.

-

States like California and New York combine high personal income tax with additional business regulations, potentially reducing net profitability.

Whether you’re opening a new office, launching a U.S. subsidiary, or relocating staff, location is a strategic decision.

Dawgen Insight: We help clients assess tax implications of relocation and advise on tax-advantaged jurisdictions for business formation.

5. 💼 SMEs Must Align Financial Planning with Tax Trends

Business owners often focus on top-line growth and operational efficiency—but ignoring tax changes can erode profitability.

With evolving tax rules, entrepreneurs must:

-

Re-evaluate ownership structures (e.g., sole proprietor vs. S Corp)

-

Consider multi-state tax exposures

-

Monitor legislative changes that affect industry-specific tax credits and deductions

-

Plan for employee taxation across state lines, especially with remote work policies

Dawgen Insight: Our financial advisory team integrates tax and business strategy, providing a holistic view of profitability and risk exposure.

How Dawgen Global Can Help

Dawgen Global is a multidisciplinary professional services firm serving clients across the Caribbean and internationally. We help SMEs, family-owned businesses, and growing enterprises make smarter and more effective decisions through integrated advisory solutions.

Our services include:

-

U.S. tax planning and compliance for business owners

-

Cross-border business structuring and expansion support

-

Compensation and benefits optimization

-

Exit and succession planning

-

State tax comparison and forecasting models

Our advisors understand the challenges faced by entrepreneurs operating across jurisdictions—and we bring clarity, structure, and strategy to the complex world of taxes.

Turning Tax Change Into Strategic Advantage

The evolving U.S. state income tax environment in 2025 marks more than just a fiscal shift—it signals a new era in how businesses must think, plan, and operate. For business owners, particularly those operating across multiple jurisdictions or contemplating U.S. market entry, these changes are not merely technical adjustments. They are powerful drivers that can reshape where you grow, how you structure, and what you earn.

📌 A Strategic Lens is Now Essential

It’s no longer sufficient to view taxes as an annual exercise in compliance. Taxation—especially at the state level—has become a strategic consideration that affects:

-

Profit margins

-

Talent acquisition and compensation planning

-

Capital allocation and financing decisions

-

Exit strategies and succession planning

-

Business valuation and investor attractiveness

With tax policies diverging sharply from state to state, your business decisions—whether launching a new venture, acquiring assets, forming partnerships, or relocating operations—must be informed by both financial implications and long-term tax positioning.

🌍 Global Vision, Local Intelligence

For Caribbean entrepreneurs and SMEs eyeing U.S. markets, the tax landscape can feel like a maze. From capital gains levies in Washington State to aggressive rate cuts in Iowa and Arkansas, each state offers a different equation for risk and reward.

At Dawgen Global, we bring a dual lens to every advisory engagement:

-

A global perspective rooted in international tax knowledge

-

A local understanding of U.S. state-specific policies, regulations, and incentives

We don’t just help you react to tax changes—we position you to capitalize on them.

🧭 Your Strategic Tax Partner

Whether you’re:

-

Planning a multi-state expansion or relocating to a more favorable jurisdiction

-

Re-evaluating your compensation strategy to attract top talent

-

Structuring a business for long-term tax efficiency

-

Preparing for an equity sale or succession event

-

Navigating compliance across multiple borders

Dawgen Global provides the forward-thinking advice and comprehensive support to guide your business at every stage.

We help turn tax uncertainty into a competitive advantage, empowering you to grow with confidence and clarity.

✅ Take Action Now

The businesses that thrive in the future are those that make informed, agile decisions today. Don’t wait until tax changes catch up with you—get ahead of them with a trusted advisor by your side.

🔍 Let Dawgen Global be your partner in navigating the shifting tax landscape—because smarter decisions begin with better insights.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670/876-9265210 📲 WhatsApp Global: +1 876 5544445

📞 USA Office: 855-354-2447

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements