The quintessential American Dream has long been characterized by a white picket fence surrounding the comfort of one’s own home. This dream, however, is slipping further away from reality for many Americans as median house prices now soar to nearly six times the median income in the country. Utilizing comprehensive datasets from the Federal Reserve, this article delves into the historical and current state of the U.S. housing market and its implications for American households.

The Historical Perspective

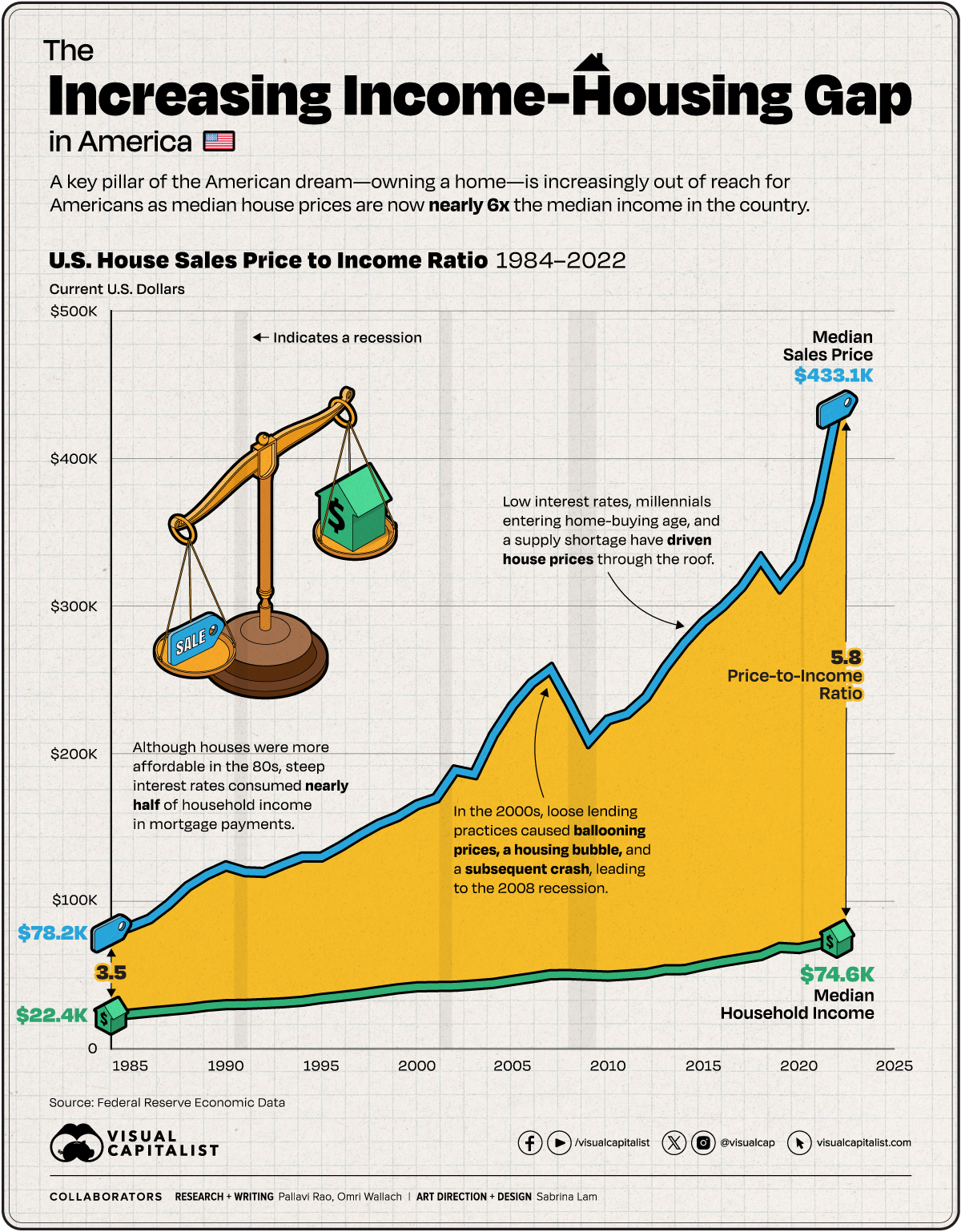

In 1984, a snapshot of the American economy depicted a hopeful scene for aspiring homeowners. The median annual income stood at a modest $22,420, with the median house sales price beginning at $78,200—a ratio of 3.49 when compared to income. This period marked the most affordable point for U.S. housing since the Federal Reserve began tracking such data. However, beneath the surface lay the challenges of an economy grappling with the aftermath of rampant inflation and interest rates that hovered near 14%. The dream of homeownership, while statistically more attainable, was mitigated by these substantial interest payments.

The Surge and Tumble: Mid-2000s to the 2008 Recession

The housing narrative took a dramatic turn in the mid-2000s. House prices surged, fueled by lenient lending practices and an influx of subprime mortgages. These risky loans were extended to buyers with questionable credit, and then repackaged into attractive securities. The facade of prosperity crumbled as these loans began to default, leading to a housing market collapse and triggering the 2008 recession.

Post-Recession Trends

In the aftermath of the economic downturn, the Federal Reserve slashed interest rates to reignite economic demand. While this move was designed to ease the path to homeownership, it had the unintended consequence of pushing housing prices upward. Simultaneously, the entry of millennials into the housing market, coupled with a stagnation in new construction and the conversion of homes into rental properties by investors, exacerbated the supply-demand imbalance.

The Current Landscape: A Deepening Crisis of Affordability

As we step into 2023, the dream of homeownership is not just drifting out of reach for the average American family—it’s accelerating away at a pace that policy and wages can scarcely keep up with. The stark figures speak volumes: a median household income that hovers around $74,600 pales in comparison to the median home price tag of $433,100. This vast divide is encapsulated in the price-to-income ratio that has swelled to a staggering 5.8, a number that not only reflects a market out of balance but also portends a worrisome trend in housing accessibility.

The sheer magnitude of this ratio is more than a statistic; it’s a nationwide alert that the income growth for most families has not kept pace with the explosive rise in home prices. The reasons behind this growing gap are manifold and complex. A critical shortage of affordable housing stock, an ever-intensifying competition for available homes, and the rise of investment-driven purchases all contribute to this challenging landscape.

In many metropolitan areas, the situation grows even more grim. Some cities exhibit median home prices that require an income level three to four times the national median to simply gain a foothold in the market. These are not just the traditionally expensive coastal cities but also include those in the heartland, where once-affordable markets are now feeling the pinch.

This disconnect between wages and home prices isn’t merely a hurdle for homebuyers; it’s reshaping the socioeconomic fabric of communities. Families who might have once aspired to own a home are now redirecting their focus towards the rental market, which is no less competitive and, in many cases, offers little relief from high housing costs.

The ramifications extend beyond the personal stresses and strains on individual families. There’s a broader economic impact that cannot be ignored. When a substantial portion of income is devoted to housing, it leaves less disposable income for goods and services, reducing overall consumer spending and potentially stifling economic growth.

But perhaps the most telling aspect of the current landscape is the shift in what homeownership now represents. No longer is it a milestone of personal achievement or a solid foundation for family stability. Instead, for too many, it has become a distant line item on a wish list, an aspiration that, without significant economic change, may remain unfulfilled.

This growing crisis of affordability calls for a decisive response. It is a clarion call for innovation in housing construction, for flexibility in zoning laws to allow for more affordable dwellings, and for a reexamination of the lending practices that can either gatekeep or grant the path to homeownership. It’s clear that if the dream of homeownership is to remain a central tenet of the American experience, there must be a concerted effort to realign the market’s trajectory with the economic realities of its citizens.

The Economic Implications of Unaffordable Housing: A Closer Look

The escalating cost of housing in America does more than strain household budgets; it sends ripples across the broader economic landscape, distorting markets and dampening growth prospects. The tentacles of this crisis reach into various sectors, reshaping the economy in fundamental ways.

Consumer Spending and Economic Growth

Historically, a flourishing housing market has been a precursor to robust economic health. Homeownership typically prompts a cascade of additional spending, dubbed the ‘multiplier effect’. New homeowners furnish, decorate, and renovate, channeling funds into a wide array of industries. But as housing becomes unattainable, this cascade is reduced to a trickle. Households contending with disproportionate housing costs inevitably trim budgets. Leisure travel, vehicle upgrades, even educational investments become deferred dreams, leading to a contraction in multiple sectors that rely on discretionary consumer spending.

Labor Market Dynamics and Mobility

The ability to relocate for work has been a cornerstone of the fluid American labor market. However, when workers are priced out of housing markets, this mobility stalls. A worker’s ability to move for a better opportunity is a critical component of economic dynamism; it’s how skills are optimally allocated across the economy. Yet, when potential moves are curtailed by prohibitive housing costs, both workers and employers suffer. This is most acute in thriving urban centers where high living costs mean that essential service workers—teachers, nurses, police officers—can’t afford to live near their jobs, leading to longer commutes, increased traffic congestion, and lower quality of life.

The Challenge for Local Economies and Workforce Development

Local economies are feeling the squeeze as well. In areas with inflated housing markets, businesses face higher wage demands from employees who need more to cover their living expenses. This can lead to a slow erosion of a city’s economic base, as businesses relocate to areas with more affordable housing to minimize operating costs. Concurrently, regions with more affordable housing may not have the same job opportunities, perpetuating a mismatch between where people live and where they work.

The Social Impact and Inequality

The housing affordability crisis also deepens social stratification. Those with means continue to invest in real estate, often converting potential owner-occupied homes into rental properties. This exacerbates the divide between the ‘property rich’ and ‘property poor’, reinforcing systemic inequalities. For the younger generations, particularly Millennials and Gen Z, the dream of homeownership is increasingly delayed or denied, affecting not only their financial stability but also their psychological well-being and future planning.

Public Policy and Infrastructure

Public policy, too, faces profound challenges. Urban planners and policymakers must grapple with the consequences of unaffordable housing, from increased demands on public transportation systems to the need for expanded social services. Infrastructure that was built on assumptions of steady local population growth may no longer be sustainable as households disperse to more affordable locales. This redistribution can lead to underutilized services in some areas and overburdened systems in others.

In conclusion, the implications of unaffordable housing extend well beyond the immediate concerns of individual households. The current state of housing affordability has profound and pervasive impacts on consumer behavior, labor markets, local economies, social inequality, and public policy. The American economy, famed for its resilience and dynamism, now faces a critical test: can it adapt to the reality of a changing housing landscape, or will it be hindered by an enduring crisis of affordability? The answer to this question will shape the economic prospects of generations to come.

The data paints a clear picture: the American dream of homeownership is under threat, pushed out of reach by a widening income-housing gap. As we consider the implications of this trend, it’s evident that a multifaceted approach involving policymakers, the housing industry, and financial institutions is essential to forge pathways back to affordability.

Call to Action

We invite our readers to further explore the nuances of the housing market and to engage with other compelling visualizations that reveal the state of the economy.

Read another related article here

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with DawgenGlobal. Together, let’s venture into a future brimming with opportunities and achievements.