In today’s fast-paced and ever-evolving business environment, the pressures of rapid technological advancements and increasingly complex regulatory demands are pushing organizations to rethink traditional practices. Specifically, the audit sector, critical for maintaining financial integrity and ensuring compliance, finds itself at a crucial juncture. The landscape of auditing is undergoing a significant transformation, driven by the need to adapt to these changes and the potential that digital innovations offer.

In today’s fast-paced and ever-evolving business environment, the pressures of rapid technological advancements and increasingly complex regulatory demands are pushing organizations to rethink traditional practices. Specifically, the audit sector, critical for maintaining financial integrity and ensuring compliance, finds itself at a crucial juncture. The landscape of auditing is undergoing a significant transformation, driven by the need to adapt to these changes and the potential that digital innovations offer.

The integration of digital tools into auditing is not merely a trend—it is a strategic imperative. As businesses expand in scale and complexity, maintaining robust audit systems that can effectively handle this growth becomes more challenging. Traditional audit methodologies, often cumbersome and time-consuming, are proving inadequate in addressing the speed and intricacy of today’s business transactions and the detailed regulatory scrutiny they attract.

Adapting to Technological Change

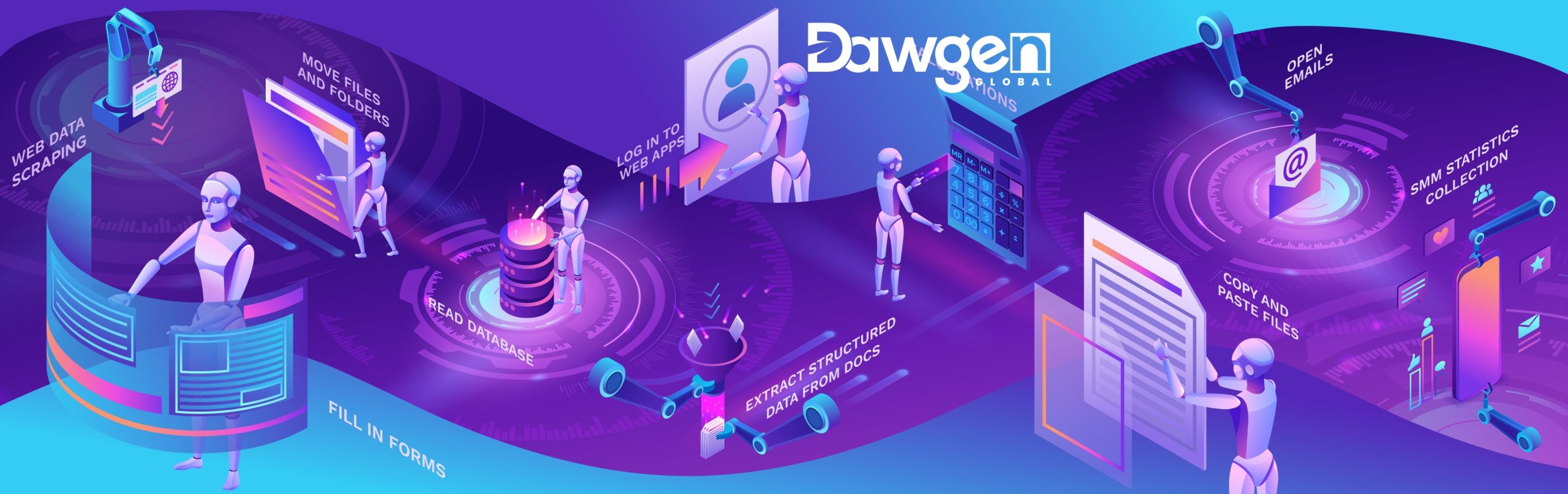

The digital revolution in the audit industry is marked by the adoption of a range of technologies such as Artificial Intelligence (AI), Machine Learning (ML), Robotic Process Automation (RPA), and blockchain technology. These tools offer unprecedented capabilities in processing data, enhancing analytical depth, and increasing operational efficiency. By automating routine tasks, providing deeper insights into vast data sets, and ensuring greater accuracy and security, digital tools are setting new standards in auditing.

Meeting Regulatory Demands

As regulatory frameworks become more stringent, the importance of compliance cannot be overstated. Digital tools help ensure that organizations meet these requirements more effectively by automating compliance checks and maintaining detailed, immutable records. This not only helps in avoiding costly legal or financial penalties but also in fostering a culture of transparency and trust.

Staying Ahead in a Competitive Market

In the context of global competition, staying current with technological advances is crucial, but true leadership comes from staying ahead. By harnessing digital tools, audit firms and internal audit departments can offer more than just compliance assurance—they can provide strategic insights that can significantly influence decision-making at the highest levels of management. This shift in capability transforms the role of auditors from gatekeepers to strategic advisors, a change that adds immense value to businesses.

Exploring the Impact

This article aims to delve deeper into how these digital tools are reshaping the audit process. We will explore specific technologies that are at the forefront of this revolution, examine their impacts on efficiency, effectiveness, and economic operations, and consider the broader implications for the auditing profession and the business community at large. The goal is to provide a comprehensive overview of the digital transformation in auditing and to illustrate why this evolution is critical for the future of business oversight and financial governance.

Enhancing Efficiency with Automation

The push towards automation in auditing, spearheaded by technologies such as Robotic Process Automation (RPA), is a cornerstone in the modernization of audit processes. RPA specifically has had a transformative impact on the efficiency with which audits are conducted. By automating routine and labor-intensive tasks, RPA not only speeds up the audit process but also enhances the accuracy and reliability of audit results. Here’s a deeper dive into how automation is enhancing efficiency in auditing:

Streamlining Routine Tasks

RPA excels in handling tasks that are highly structured and rule-based. In the context of auditing, this includes:

- Data Entry and Extraction: Automating the entry of data into audit systems and the extraction of data from various digital sources ensures that information is processed quickly and without the errors that often come with manual handling.

- Transaction Matching: RPA systems can rapidly match transactions across different ledgers and journals, a process that is not only time-consuming but also prone to errors when performed manually. By automating this process, auditors can ensure greater accuracy and focus their efforts on discrepancies that require human judgment.

- Compliance Checks: Automated systems can continuously monitor compliance with regulatory requirements, alerting auditors to any deviations in real-time. This proactive approach to compliance helps prevent violations and reduces the risk of fines or penalties for non-compliance.

Enhancing Audit Speed

The automation of these tasks leads to a significant reduction in the time required to complete audit processes. For example:

- Reduced Cycle Times: Automating data-intensive tasks decreases the overall time from the start of an audit to its completion. This efficiency gain is crucial during peak audit periods or when handling high volumes of transactions.

- Faster Response to Findings: Automation allows for quicker identification and reporting of issues, which means that auditors can address potential problems more swiftly and recommend corrective actions sooner.

Reducing Human Error

One of the primary advantages of RPA is its ability to operate without the fatigue or distraction that humans can experience, which significantly reduces the risk of errors.

- Consistency: Automated processes perform the same way every time, ensuring that audits are carried out consistently across different departments or geographic locations.

- Accuracy: By removing the human element from tasks such as data entry and calculations, RPA minimizes the chances of mistakes that can lead to inaccurate audit results and potentially costly rectifications.

Cost Efficiency

Automating audit processes can lead to substantial cost savings for auditing firms and their clients:

- Lower Labor Costs: Automation reduces the need for additional staff during peak times and decreases reliance on external consultants for routine tasks.

- Optimized Resource Allocation: With routine tasks automated, more experienced auditors can focus on high-value areas such as strategic planning, risk analysis, and advisory services, thereby enhancing the overall value of the audit service.

Conclusion

As RPA and other automation technologies continue to evolve, their role in auditing is expected to grow, further enhancing efficiency and accuracy in the audit process. This shift not only benefits auditors by freeing up their time for more complex and strategic work but also provides clients with faster, more reliable audit outcomes. In an increasingly data-driven world, the ability to conduct thorough, efficient audits is crucial, and automation is key to achieving this goal.

Boosting Effectiveness with AI and Analytics

AI and advanced analytics are revolutionizing the effectiveness of audits by enabling deeper insights and more precise risk assessments. AI algorithms can process and analyze data in ways that human auditors cannot, identifying subtle patterns and anomalies that might indicate potential issues or opportunities for improvement. Furthermore, these tools can adapt and learn from each data interaction, continuously improving their analytical capabilities over time.

Economic Gains Through Digital Integration

The economic benefits of integrating digital solutions into auditing are manifold. First, the reduction in time and resources required to complete an audit directly translates into cost savings for both auditing firms and their clients. Additionally, the increased accuracy and reliability of digital audits reduce the risk of financial penalties resulting from compliance failures or financial misstatements. Lastly, the strategic insights provided by advanced analytics can guide businesses in optimizing their operations and financial strategies, leading to better financial health and growth opportunities.

Challenges and Considerations

Despite the clear benefits, the transition to digital auditing is not without its challenges. Concerns about data security, the initial cost of technology adoption, and the need for skill upgrades among audit professionals are significant hurdles. Addressing these concerns requires a well-thought-out strategy involving robust cybersecurity measures, investment in technology training, and a phased approach to the adoption of digital tools.

The future of auditing is undoubtedly digital. As the industry continues to evolve, embracing digital solutions will be essential for audit firms that wish to remain competitive and relevant. The benefits of such a transformation—increased efficiency, enhanced effectiveness, and economic gains—are too compelling to ignore. With careful planning and execution, the auditing profession can look forward to a future where digital solutions not only streamline and enhance audit processes but also contribute to a more transparent and financially stable corporate environment.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements.