In today’s interconnected world, setting corporate tax rates has become a strategic move for countries seeking to attract businesses and increase their tax revenues. This competition has often been termed a “race to the bottom,” where nations lower their tax rates to lure companies to their shores. In some cases, this race has reached rock bottom: a 0% corporate tax rate.

In today’s interconnected world, setting corporate tax rates has become a strategic move for countries seeking to attract businesses and increase their tax revenues. This competition has often been termed a “race to the bottom,” where nations lower their tax rates to lure companies to their shores. In some cases, this race has reached rock bottom: a 0% corporate tax rate.

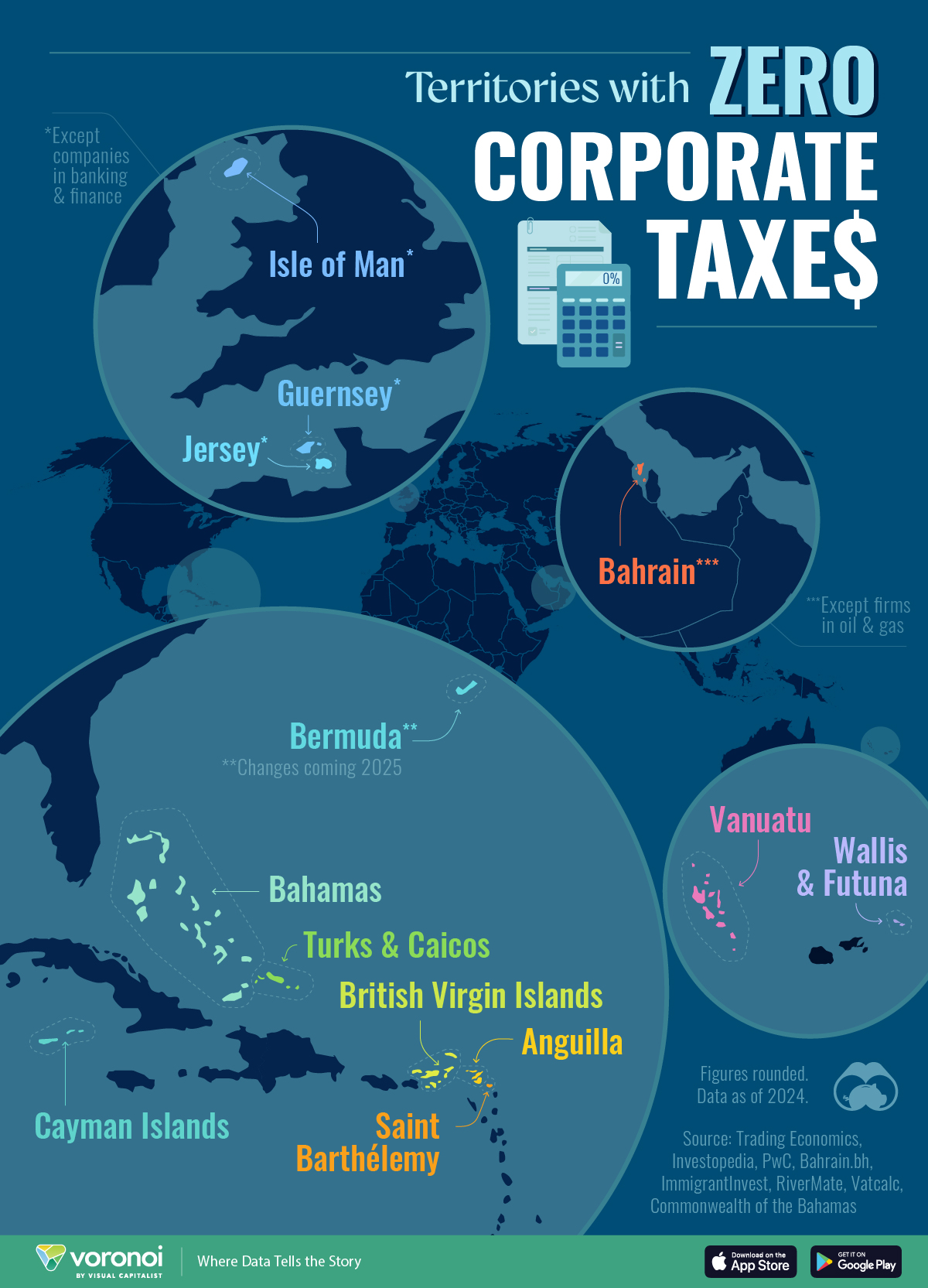

The Map of Zero Corporate Tax Jurisdictions

A small group of nations and territories has embraced the zero corporate tax policy. These locations, often small island nations in the Caribbean, Pacific, and British Isles, have also eliminated income tax and capital gains tax, creating highly attractive environments for business headquarters. According to data from Trading Economics and PwC Tax Summaries accessed in June 2024, these are the notable zero corporate tax jurisdictions:

| Country/Territory | Corporate Tax Rate | Income Tax Rate | Capital Gains Tax Rate |

|---|---|---|---|

| 🇦🇮 Anguilla | 0% | 0% | 0% |

| 🇻🇬 British Virgin Islands | 0% | 0% | 0% |

| 🇻🇺 Vanuatu | 0% | 0% | 0% |

| 🏴 Isle of Man* | 0% | 20% | 0% |

| 🇬🇬 Guernsey* | 0% | 20% | 0% |

| 🇯🇪 Jersey* | 0% | 20% | 0% |

| 🇰🇾 Cayman Islands | 0% | 0% | 0% |

| 🇧🇲 Bermuda** | 0% | 0% | 0% |

| 🇧🇭 Bahrain*** | 0% | 0% | 0% |

| 🇧🇸 Bahamas | 0% | 0% | 0% |

| 🇧🇱 Saint Barthélemy | 0% | 0% | 25% |

| 🇹🇨 Turks and Caicos Islands | 0% | 0% | 0% |

| 🇼🇫 Wallis and Futuna Islands | 0% | 0% | 0% |

**Exceptions to these rates exist for specific industries and revenue thresholds, as detailed in footnotes.

Tax Havens and Their Economic Impact

These zero-tax jurisdictions have become popular locations for the headquarters of numerous international companies, earning the label “tax havens.” The absence of corporate taxes is a significant draw, encouraging businesses to establish a nominal presence in these locations to benefit from the favorable tax conditions.

Unique Cases and Upcoming Changes

While the appeal of zero corporate tax is evident, some jurisdictions impose specific conditions. For instance:

- Bahrain: While it generally offers a 0% corporate tax rate, companies involved in the oil and gas sector face a substantial 46% tax.

- Crown Dependencies (Isle of Man, Guernsey, Jersey): Banking and finance companies are subject to a 10% tax rate. Additionally, companies in the cannabis industry and retail businesses with taxable profits above £500,000 are taxed.

- Bermuda: Starting in 2025, Bermuda will introduce a 15% corporate tax for multinational companies with annual revenues exceeding $800 million. This move aligns with the OECD’s proposal to implement a global minimum corporate tax rate of 15%.

The OECD’s Global Minimum Tax Initiative

The OECD’s initiative to set a global minimum corporate tax rate at 15% marks a significant shift in international tax policy. This landmark agreement, supported by over 130 countries, aims to address the challenges posed by tax havens and aggressive tax planning strategies used by multinational corporations. By establishing a minimum tax floor, the OECD intends to create a more level playing field for all countries, ensuring that corporations pay a fair share of taxes irrespective of where they are headquartered.

Key Aspects of the Initiative

- Top-Up Tax Mechanism: One of the core components of the OECD’s initiative is the implementation of a “top-up” tax. This mechanism allows countries to impose additional taxes on corporations that are domiciled in jurisdictions with lower tax rates. For instance, if a multinational corporation is based in a country with a corporate tax rate below 15%, other countries where the corporation operates can levy a tax to make up the difference. This reduces the benefit of relocating to tax havens with minimal tax obligations.

- Inclusivity and Global Reach: The agreement encompasses a broad coalition of countries, including major economies and traditional tax havens. This widespread adoption is crucial for the initiative’s success, as it minimizes opportunities for tax evasion and profit shifting. The collaborative approach ensures that multinational corporations face consistent tax obligations globally, thereby reducing the appeal of exploiting low-tax jurisdictions.

- Revenue Redistribution: Another critical element of the OECD’s plan is the redistribution of tax revenues. The initiative proposes allocating a portion of tax revenues from multinational corporations to countries where they generate significant sales and revenues, regardless of where the company is headquartered. This approach acknowledges the value generated in market jurisdictions and aims to provide a fairer distribution of tax income.

- Addressing Digital Economy Challenges: The initiative also focuses on the taxation of digital giants and other multinational enterprises that have traditionally been able to shift profits to low-tax jurisdictions. By establishing a minimum tax rate, the OECD seeks to ensure that these companies contribute appropriately to the economies in which they operate, addressing long-standing concerns about the taxation of digital services.

- Implementation and Compliance: The success of the OECD’s initiative hinges on effective implementation and enforcement. Participating countries are expected to incorporate the agreed minimum tax rate into their national legislation. Additionally, robust mechanisms for monitoring and compliance will be essential to prevent loopholes and ensure that corporations adhere to the new rules.

Implications for Global Tax Competition

The OECD’s global minimum tax initiative represents a fundamental change in the dynamics of international tax competition. By setting a floor for corporate tax rates, the initiative aims to reduce the “race to the bottom” phenomenon, where countries continuously lower tax rates to attract businesses. This shift is expected to result in several key outcomes:

- Reduced Appeal of Tax Havens: With the top-up tax mechanism in place, the advantage of establishing headquarters in tax havens diminishes, as corporations will face additional taxes elsewhere to meet the minimum rate.

- Increased Tax Revenues: Countries can anticipate higher tax revenues from multinational corporations, as the minimum rate ensures a baseline level of taxation. This additional revenue can support public services and infrastructure development.

- Enhanced Fairness and Equity: The initiative promotes fairness in the global tax system by ensuring that all corporations, regardless of their location, contribute a reasonable share of taxes. This helps to address inequalities and fosters a more equitable distribution of tax burdens.

Conclusion

In the ongoing global tax competition, zero corporate tax jurisdictions have long stood out as attractive hubs for business headquarters. However, the landscape is shifting with initiatives like the OECD’s global minimum tax rate, aiming to balance the scales and reduce the prevalence of tax havens. As these changes unfold, the strategic decisions of countries and companies alike will continue to evolve, shaping the future of global tax policies.

Contact Information for Dawgen Global

For expert advice and assistance on global tax planning and corporate strategy, contact Dawgen Global:

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements.