The global trading landscape is undergoing a seismic shift as new tariff policies challenge the foundation of long-standing international trade agreements. On April 2, 2025, former U.S. President Donald Trump announced a sweeping new tariff plan, signaling a significant change in America’s trade stance. These include a baseline 10% tariff on all imports starting April 9, with steeper duties such as 24% on Japanese goods, 26% on Indian imports, and a striking 49% tariff on products from Cambodia.

The global trading landscape is undergoing a seismic shift as new tariff policies challenge the foundation of long-standing international trade agreements. On April 2, 2025, former U.S. President Donald Trump announced a sweeping new tariff plan, signaling a significant change in America’s trade stance. These include a baseline 10% tariff on all imports starting April 9, with steeper duties such as 24% on Japanese goods, 26% on Indian imports, and a striking 49% tariff on products from Cambodia.

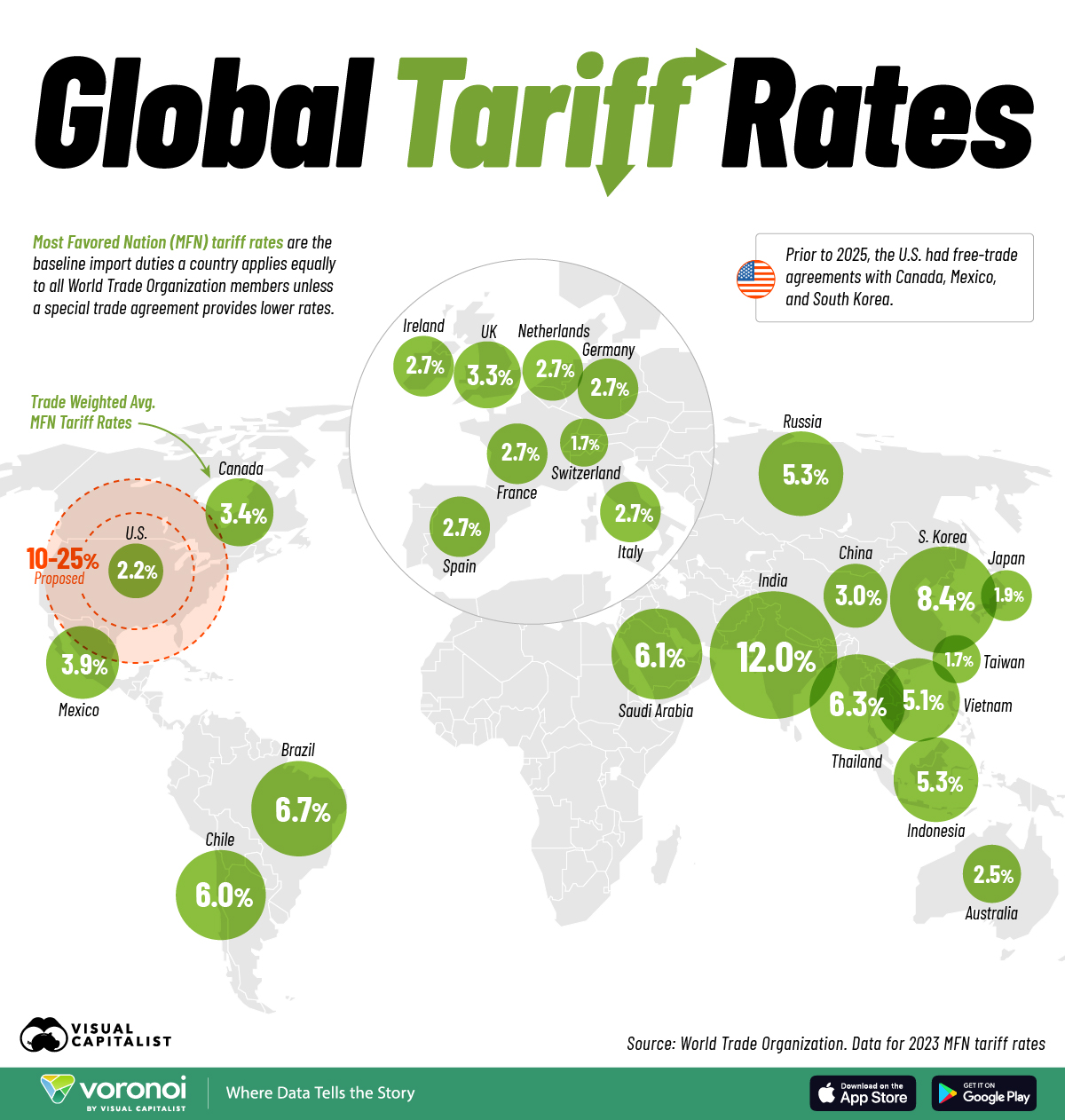

This policy pivot comes despite the fact that many of the world’s largest economies maintain relatively low average tariffs. According to data from the World Trade Organization (WTO), countries like Switzerland (1.7%), Japan (1.9%), and Taiwan (1.7%) have some of the lowest trade-weighted average Most Favored Nation (MFN) tariff rates. These low rates are designed to encourage trade, investment, and economic cooperation.

What Are MFN Tariff Rates?

Most Favored Nation (MFN) tariffs represent the standard import duty a country applies equally to all WTO members, unless a preferential agreement (such as a Free Trade Agreement) offers lower rates. These rates are considered the baseline for international trade policy.

How Do Global Tariff Rates Compare?

As of 2023, many economies have average MFN tariffs below 5%, highlighting a global trend toward open trade. For instance:

-

European Union countries, such as France, Germany, and Italy, maintain a uniform rate of 2.7%

-

Canada stands at 3.4%

-

China at 3.0%

-

United Kingdom at 3.3%

-

Australia at 2.5%

-

South Korea, one of the few with higher rates, posts an average of 8.4%

India remains an outlier with a trade-weighted MFN rate of 12.0%, the highest among major economies. Some specific Indian tariffs—such as those on imported automobiles—can reach up to 100%, signaling a highly protectionist approach.

A Closer Look at the U.S. Shift

Prior to 2025, the United States maintained robust Free Trade Agreements (FTAs) with key partners such as Canada, Mexico, and South Korea, enabling duty-free or significantly reduced tariff trade. These agreements were instrumental in supporting integrated supply chains, particularly under frameworks like the United States-Mexico-Canada Agreement (USMCA). The strategic goal was to foster economic collaboration, drive exports, and ensure competitive pricing for U.S. consumers.

However, with the April 2025 policy shift, the U.S. has introduced a 10% baseline tariff across all imports, with significantly higher duties targeting specific countries—24% on Japan, 26% on India, and 49% on Cambodia. These proposed changes aim to curb trade deficits and encourage domestic production but signal a clear retreat from multilateral trade norms.

The revised tariffs push the U.S. trade-weighted average from 2.2% to a range between 10–25%, placing the country well above the global average. In contrast, major economies like Germany (2.7%), China (3.0%), and the UK (3.3%) maintain far more moderate levels. This significant increase not only alters America’s position in global trade dynamics but also sets the stage for retaliatory trade measures from affected nations.

The European Union, for instance, has already hinted at potential reciprocal tariffs, especially if these actions are perceived as violating WTO rules or unfairly disadvantaging their exporters. Such tit-for-tat measures could escalate into broader trade conflicts, reminiscent of earlier trade wars that disrupted global markets and investment flows.

Implications for Businesses

The reimposition and intensification of tariffs by the U.S. will have profound implications for global commerce—especially for businesses that are reliant on cross-border supply chains, import/export models, or foreign raw materials.

Key implications include:

-

Increased Import Costs: Businesses importing goods into the U.S. will now face steeper duties, driving up operational and production costs. For example, U.S.-based manufacturers sourcing components from Japan or India may need to pass these costs onto consumers or seek alternative supply chains.

-

Shifting Export Strategies: Exporters in countries like Japan, India, and Cambodia will encounter new market access challenges. This may trigger a redirection of goods toward alternative markets, impacting global trade flows.

-

Supply Chain Realignments: Companies may be forced to reevaluate sourcing strategies, relocate production facilities, or negotiate new regional trade deals to remain competitive in light of increased duties.

-

Greater Uncertainty for Long-Term Planning: With tariff policies subject to political shifts, businesses face heightened uncertainty. Strategic planning will now require built-in flexibility to navigate rapid policy changes and unexpected trade barriers.

For businesses in the Caribbean and Latin America, which often depend on the U.S. as a major trading partner, these shifts could disrupt existing contracts, delay shipments, and reduce demand for exports. There’s also the risk of being caught in the crossfire of broader global retaliations, impacting investor confidence and regional economic stability.

Let’s Navigate These Changes Together

At Dawgen Global, we recognize the complexity and urgency of responding to evolving global trade policies. As a leading multidisciplinary advisory firm in the Caribbean, we support clients across industries with:

✅ Strategic Trade Advisory – Helping clients assess the impact of new tariffs and develop agile trade and sourcing strategies.

✅ Customs & Compliance Guidance – Ensuring businesses meet import/export regulations in the U.S. and other key markets.

✅ Tax Structuring & Planning – Minimizing financial exposure from rising tariffs through smart structuring.

✅ Supply Chain Optimization – Identifying opportunities for cost savings, reshoring, or diversification.

In a volatile trade environment, adaptability is key. Dawgen Global is here to help your business stay informed, compliant, and competitive. Whether you’re an exporter in Asia or an importer in the Caribbean, we help you make Smarter and More Effective Decisions.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670/876-9265210 📲 WhatsApp Global: +1 876 5544445

📞 USA Office: 855-354-2447

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements