The auditing of payables is a fundamental aspect of financial audits, serving to confirm the accuracy, completeness, and appropriate disclosure of amounts owed by a company to its suppliers or creditors. Payables, which include accounts payable and trade payables, represent liabilities incurred through the purchase of goods or services on credit. Given their significance in financial reporting, verifying payables ensures the integrity of a company’s financial position and supports the confidence of stakeholders in its financial health.

The auditing of payables is a fundamental aspect of financial audits, serving to confirm the accuracy, completeness, and appropriate disclosure of amounts owed by a company to its suppliers or creditors. Payables, which include accounts payable and trade payables, represent liabilities incurred through the purchase of goods or services on credit. Given their significance in financial reporting, verifying payables ensures the integrity of a company’s financial position and supports the confidence of stakeholders in its financial health.

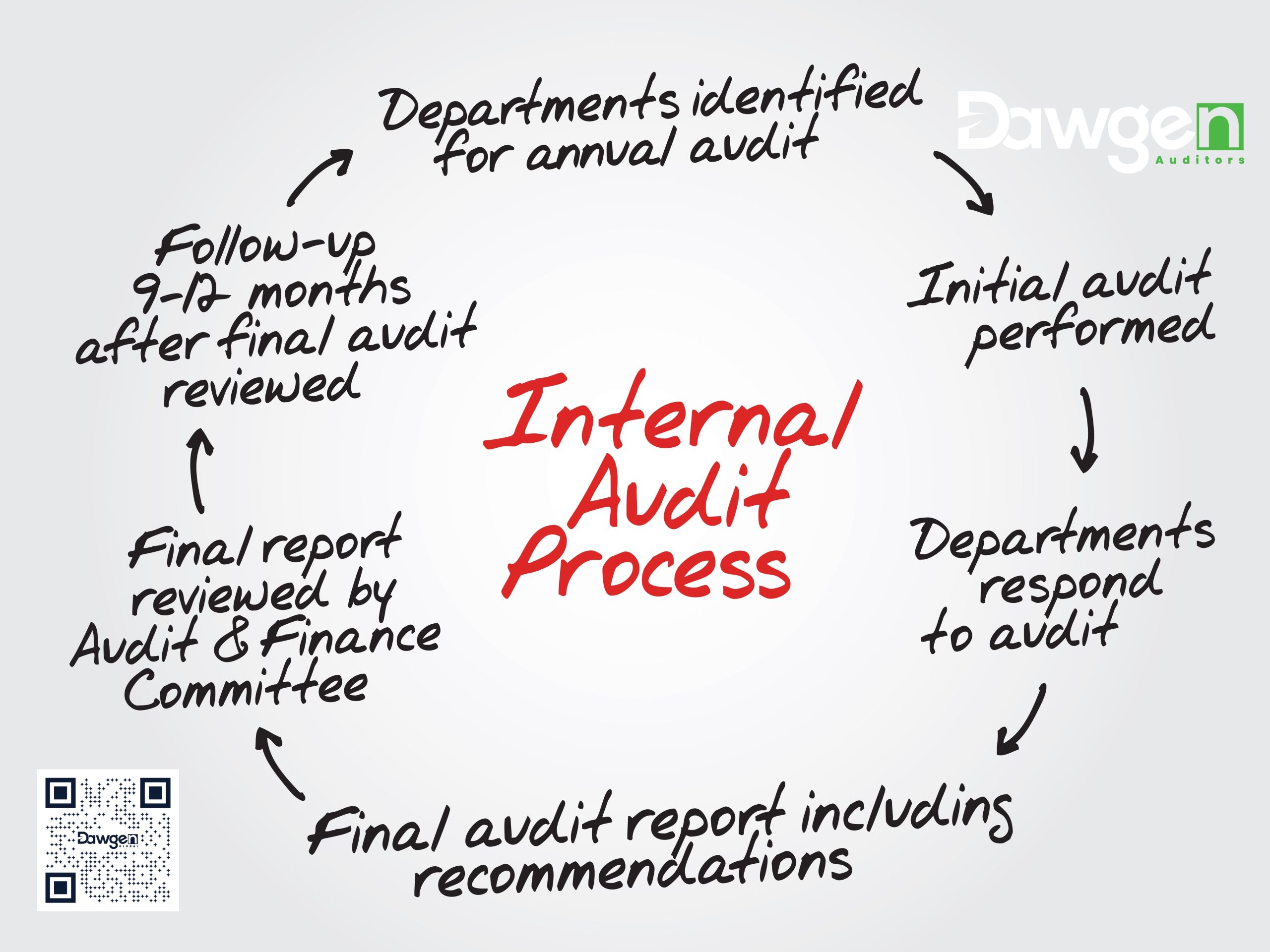

Below, we delve into the expanded and detailed steps involved in auditing payables:

1. Obtaining a Comprehensive Payables List

Auditors begin by requesting a detailed list of payables from management. This list serves as the foundation for the verification process and typically includes:

- Invoice Details: Invoice numbers, dates, and payment terms.

- Creditor Information: Names and addresses of suppliers or creditors.

- Amounts Owed: Breakdown of principal amounts, taxes, and any accrued interest or penalties.

- Aging Analysis: Classification of payables based on due dates, such as current, 30 days overdue, 60 days overdue, etc.

This document must align with the company’s internal records and is cross-referenced during subsequent steps.

2. Reconciliation with Accounting Records

Reconciliation involves matching the provided payables list with the company’s general ledger and trial balance. This step helps to:

- Identify discrepancies between subsidiary ledgers and the general ledger.

- Highlight adjustments made post-period that might obscure the true financial position.

- Reveal unusual patterns, such as missing or duplicated entries, which may indicate fraud or mismanagement.

Auditors may also reconcile balances with supporting schedules prepared by management to ensure all liabilities are properly captured.

3. Examination of Supporting Documents

Auditors select a representative sample of payables and review associated documentation to validate their authenticity. This step typically includes:

- Invoices: Confirming the amounts, terms, and supplier details match the recorded entries.

- Purchase Orders: Ensuring purchases were properly authorized and align with company procurement policies.

- Receiving Reports: Verifying that goods or services were received as stated, in the correct quantity and condition.

This process ensures that all payables are valid, reflect actual transactions, and are properly authorized.

4. External Confirmations

External confirmations are sent to suppliers or creditors to verify outstanding balances. This step is crucial for:

- Detecting Fraud: Identifying fictitious payables recorded to inflate liabilities or cover misappropriated funds.

- Confirming Terms: Verifying payment terms and any special arrangements not documented internally.

- Assessing Completeness: Ensuring all liabilities to external parties have been accounted for, particularly in cases where disputes or unusual terms may exist.

Auditors may tailor their confirmation requests to specific risks identified during the audit planning stage.

5. Reviewing Subsequent Payments

Auditors analyze bank statements and disbursement records for payments made after the balance sheet date to:

- Verify the settlement of payables recorded as outstanding.

- Identify any liabilities omitted from the period under audit.

- Assess the company’s liquidity and ability to meet its obligations.

This review may extend several months post-period, depending on the nature of the payables and the company’s payment cycle.

6. Analytical Procedures

Analytical procedures are used to identify anomalies or trends in the payables account. These procedures include:

- Trend Analysis: Comparing payables balances across periods to identify unusual spikes or drops.

- Aging Analysis: Reviewing the aging schedule for signs of delays in payment or excessive overdue balances.

- Turnover Ratios: Comparing the company’s payables turnover ratio to industry benchmarks to assess efficiency in managing liabilities.

Significant deviations or unexpected trends may prompt further investigation.

7. Performing Cut-Off Testing

Cut-off tests ensure that payables are recorded in the correct accounting period. Auditors examine transactions around the period-end to confirm:

- Liabilities incurred before the balance sheet date are recorded as payables.

- Transactions after the balance sheet date are excluded unless they reflect liabilities related to the audit period.

This step prevents the manipulation of financial results, such as delaying the recognition of liabilities to inflate earnings.

8. Evaluating Adequacy of Disclosure

Auditors review the financial statements to confirm that payables are adequately disclosed. Key considerations include:

- Terms and Conditions: Clear disclosure of payment terms, including any penalties for late payment or early settlement discounts.

- Contingent Liabilities: Noting obligations dependent on future events, such as disputed amounts or guarantees.

- Related Party Transactions: Ensuring all payables to related entities are transparently disclosed to avoid conflicts of interest.

Proper disclosure enhances the transparency and reliability of financial reports.

9. Assessing Internal Controls

Auditors evaluate the robustness of internal controls over the accounts payable process, focusing on:

- Authorization: Ensuring all purchases and payments are properly approved.

- Segregation of Duties: Verifying that responsibilities for recording, approving, and disbursing payments are appropriately separated.

- Monitoring: Assessing whether the company has effective procedures for detecting and addressing errors or fraud.

Weak internal controls increase the risk of material misstatements or fraudulent activity.

10. Risk Assessment and Additional Testing

Auditors conclude by assessing the overall risk of material misstatement in the payables account. If the risk is deemed high, they may:

- Expand the sample size for testing.

- Conduct in-depth reviews of high-risk transactions.

- Modify the audit opinion to reflect uncertainties or potential issues.

Enhancing Financial Confidence with Expert Guidance

The verification of payables is a meticulous and essential component of financial auditing, safeguarding the accuracy and integrity of a company’s financial reporting. Through comprehensive steps—such as reconciling detailed records, examining supporting documentation, performing external confirmations, and conducting analytical procedures—auditors ensure that a company’s liabilities are properly recorded and accurately represented. This process is critical in mitigating risks of errors, misstatements, or fraud and supports the transparency needed for informed decision-making.

Beyond addressing compliance requirements, the effective auditing of payables fosters confidence among stakeholders, reinforcing trust in a company’s governance, financial management, and long-term stability. Accurate reporting ensures that investors, creditors, and regulatory bodies can rely on the financial statements to reflect a company’s true financial health.

How Dawgen Auditors Support Payables and Vendor Ledger Verification

At Dawgen Global, our auditing team offers tailored solutions to assist clients with their payables and vendor ledger verification processes. Leveraging our expertise and cutting-edge tools, we provide a systematic and value-driven approach to ensure the accuracy and reliability of financial data. Here’s how we help:

1. Comprehensive Payables Reconciliation

Our auditors work closely with clients to reconcile payables against their general ledger, trial balance, and vendor statements. This reconciliation identifies discrepancies, ensures accurate reporting, and provides a clear view of outstanding obligations.

2. Detailed Vendor Ledger Analysis

We perform an in-depth review of vendor accounts, highlighting unusual transactions, duplicate payments, or inconsistencies. By analyzing aging reports and transaction trends, we help clients identify and address potential risks or inefficiencies in their payable processes.

3. Verification of Supporting Documentation

Our team reviews purchase orders, invoices, and receiving reports to validate the legitimacy of payables and ensure that transactions comply with the client’s procurement policies. This step is crucial in maintaining financial discipline and avoiding disputes with suppliers.

4. External Confirmation Management

Dawgen auditors facilitate the external confirmation process by directly engaging with suppliers or creditors to verify outstanding balances. This independent verification adds credibility to the payables data and strengthens stakeholders’ trust in the financial statements.

5. Analytical Procedures and Benchmarking

We perform advanced analytical procedures to detect anomalies in payables accounts. By comparing turnover ratios and payment cycles to industry standards, Dawgen helps clients identify opportunities for optimizing cash flow management and improving vendor relationships.

6. Internal Control Assessments

Dawgen Global evaluates the effectiveness of internal controls related to payables, such as authorization processes, segregation of duties, and monitoring mechanisms. We provide actionable recommendations to strengthen these controls, reducing the risk of errors and fraud.

7. Customized Reporting and Insights

Our auditors deliver detailed reports highlighting findings and actionable insights. These reports provide clients with a comprehensive understanding of their payables status, helping them make informed decisions to enhance financial performance.

8. Digital Tools and Automation Support

Dawgen Global integrates technology-driven solutions, including data analytics tools, to streamline payables verification. We assist clients in adopting automated systems to reduce manual errors, improve accuracy, and enable real-time monitoring of payables.

Building Long-Term Trust and Financial Excellence

With Dawgen Global as a trusted partner, clients benefit from a thorough and tailored approach to payables verification, ensuring compliance with accounting standards and best practices. Our expertise not only minimizes financial risks but also positions organizations for sustainable growth by enhancing their operational efficiency and financial transparency.

By choosing Dawgen Global, companies gain more than just an audit service; they gain a strategic partner committed to fostering accountability, trust, and excellence in financial management. Together, we help businesses achieve their goals while meeting the highest standards of financial integrity.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📞 USA Office: 855-354-2447 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements