In the fight against climate change, carbon credits have emerged as a critical tool for regulating and reducing greenhouse gas (GHG) emissions. These tradable certificates represent the right to emit one metric ton of carbon dioxide or an equivalent amount of another GHG. The concept, rooted in the principle of cap-and-trade, offers a market-based mechanism to incentivize entities to lower their carbon footprint. This article delves into the intricacies of carbon credits, their types, market dynamics, and how entities can strategically leverage them.

In the fight against climate change, carbon credits have emerged as a critical tool for regulating and reducing greenhouse gas (GHG) emissions. These tradable certificates represent the right to emit one metric ton of carbon dioxide or an equivalent amount of another GHG. The concept, rooted in the principle of cap-and-trade, offers a market-based mechanism to incentivize entities to lower their carbon footprint. This article delves into the intricacies of carbon credits, their types, market dynamics, and how entities can strategically leverage them.

The Fundamentals of Carbon Credits

What Are Carbon Credits?

A carbon credit is a financial instrument representing permission to emit a defined amount of GHGs, typically measured in metric tons of carbon dioxide equivalent (CO₂e). Carbon credits play a pivotal role in climate change mitigation by placing a cost on emissions, encouraging entities to adopt greener practices.

The Principle of Cap-and-Trade

The cap-and-trade system establishes a maximum allowable limit (cap) on emissions for industries, organizations, or regions. Those emitting below their cap can trade their surplus allowances as carbon credits with entities exceeding their limits. This system fosters economic efficiency while promoting sustainable environmental practices.

Types of Carbon Credit Markets

- Compliance Markets

- Operate under regulatory frameworks established by governments or international agreements.

- Participants must adhere to specific emission reduction targets and use carbon credits to offset excess emissions.

- Key examples include the European Union Emissions Trading System (EU ETS) and California’s Cap-and-Trade Program.

- Voluntary Markets

- Unregulated by governments, allowing entities or individuals to voluntarily offset their emissions.

- Motivated by corporate social responsibility (CSR), branding strategies, or environmental stewardship.

- Governed by independent standards like the Verified Carbon Standard (VCS) and Gold Standard to ensure credibility and transparency.

Generating Carbon Credits

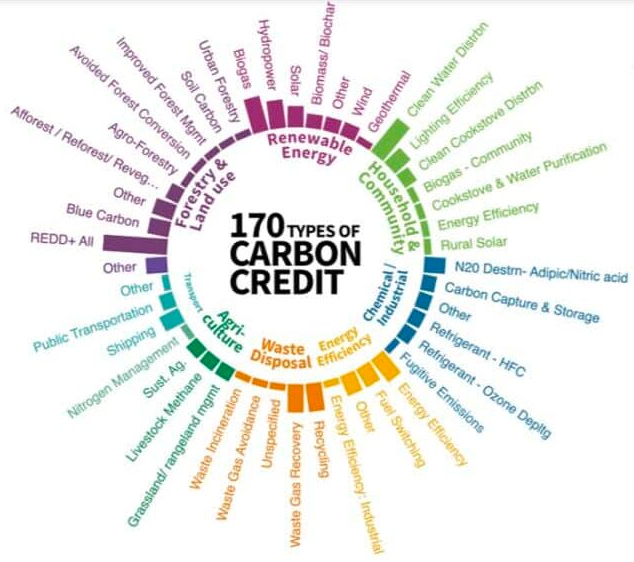

Carbon credits are created through projects that reduce, avoid, or sequester GHG emissions. Common initiatives include:

- Renewable Energy Projects: Installing wind turbines, solar farms, or hydroelectric plants to replace fossil fuel-based energy sources.

- Reforestation and Afforestation: Planting trees to absorb carbon dioxide from the atmosphere.

- Energy Efficiency Improvements: Upgrading industrial processes, appliances, or buildings to consume less energy.

- Methane Capture: Capturing methane emissions from landfills, agriculture, or wastewater treatment facilities.

Each project undergoes rigorous validation and verification to ensure measurable, additional, and permanent emission reductions before being certified for carbon credits.

Trading and Profiting from Carbon Credits

Mechanisms to Leverage Carbon Credits

- Selling Excess Credits

- Entities emitting below their cap can sell surplus credits in compliance markets.

- This creates a financial incentive for organizations to invest in emission-reduction technologies.

- Developing Emission Reduction Projects

- Investing in projects that generate carbon credits offers dual benefits: reducing emissions and creating a tradable asset.

- Certified credits from these projects can be sold in compliance or voluntary markets, often at a premium.

- Carbon Credit Trading

- Entities and investors can engage in carbon credit trading, buying at lower prices and selling at higher ones.

- This activity mirrors traditional financial markets, with trading conducted via spot transactions or futures contracts.

- Carbon Offsetting

- Companies and individuals in voluntary markets purchase carbon credits to offset emissions from travel, operations, or manufacturing.

- Offsetting not only aligns with CSR goals but also enhances brand reputation and consumer loyalty.

- Consulting and Verification Services

- The growing complexity of carbon credit markets creates demand for expertise in project design, certification, and validation.

- Firms with specialized knowledge can profit by advising and supporting market participants.

Key Considerations for Success in Carbon Credit Markets

- Monitoring Market Trends

- Staying updated on price fluctuations, regulatory developments, and technological advancements is crucial for maximizing returns.

- Ensuring Compliance

- Adhering to market-specific rules and standards is essential to maintain credibility and avoid penalties.

- Investing in Innovation

- Supporting emerging technologies, such as carbon capture and storage (CCS) or blockchain-based tracking, can create competitive advantages.

- Building Strategic Partnerships

- Collaborating with industry peers, certification bodies, and government agencies can streamline project development and market access.

Dawgen Global’s Role in the Carbon Credit Ecosystem

At Dawgen Global, we recognize that carbon credits are not just an environmental initiative—they are an economic opportunity and a strategic imperative for organizations striving to achieve sustainability goals while maintaining a competitive edge. With a deep understanding of global market dynamics and regulatory frameworks, our multidisciplinary team is uniquely positioned to help you navigate this evolving landscape effectively.

Our Expertise and Services

- Project Development

- We assist organizations in identifying and developing carbon-reduction projects that align with their operational goals and sustainability commitments.

- From renewable energy installations and energy efficiency upgrades to reforestation and methane capture initiatives, we design projects that generate high-quality carbon credits.

- Our team ensures that each project delivers measurable and additional benefits while meeting the rigorous standards required for certification.

- Market Strategy

- Dawgen Global provides tailored advice on trading opportunities in both compliance and voluntary carbon markets.

- We help entities maximize the financial benefits of their carbon credits by analyzing market trends, pricing dynamics, and emerging opportunities.

- Whether you are a buyer, seller, or trader, our strategies ensure that you achieve optimal value in this competitive marketplace.

- Certification and Verification Support

- Achieving certification is critical for the credibility and marketability of carbon credits.

- We guide you through the entire certification process, ensuring compliance with global standards like the Verified Carbon Standard (VCS), Gold Standard, and Clean Development Mechanism (CDM).

- Our team also assists in engaging third-party verification bodies to validate the environmental integrity of your projects.

- Training and Capacity Building

- As the carbon credit ecosystem evolves, staying informed is vital.

- We offer customized training programs to enhance your team’s understanding of carbon markets, project development, trading mechanisms, and compliance requirements.

- These sessions empower your organization to make informed decisions and remain agile in the face of regulatory and market shifts.

- Regulatory Advisory

- Navigating the complex regulatory frameworks governing carbon markets can be challenging.

- Dawgen Global provides expert advice on compliance with international agreements, regional trading systems, and local environmental policies.

- We keep you updated on changes in regulatory environments, ensuring that your strategies remain aligned with legal and market requirements.

- Technological Integration

- Leveraging advanced technologies is essential for tracking and optimizing carbon credit performance.

- Dawgen Global integrates tools like blockchain for transparent credit tracking and data analytics for predictive market insights.

Driving Sustainability Through Partnerships

We believe collaboration is key to scaling impact. Dawgen Global actively partners with governments, non-profits, and private sector entities to foster innovation and drive collective action toward a low-carbon future.

Conclusion

Carbon credits are at the forefront of balancing economic growth with environmental responsibility, offering businesses a tangible way to reduce their carbon footprint and achieve financial returns. With Dawgen Global as your trusted partner, you gain access to a comprehensive suite of services designed to ensure success in the carbon credit ecosystem.

Whether you’re embarking on your sustainability journey, scaling up existing initiatives, or seeking to trade and profit from carbon credits, Dawgen Global is here to guide you every step of the way.

Let’s work together to unlock the potential of carbon credits and contribute meaningfully to global climate goals.

Take the first step today!

🔗 Dive Deeper: https://dawgen.global/

📧 Connect with Us: [email protected]

📞 Caribbean: 876-9293670 | 876-9293870

📞 USA: 855-354-2447

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📞 USA Office: 855-354-2447 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements