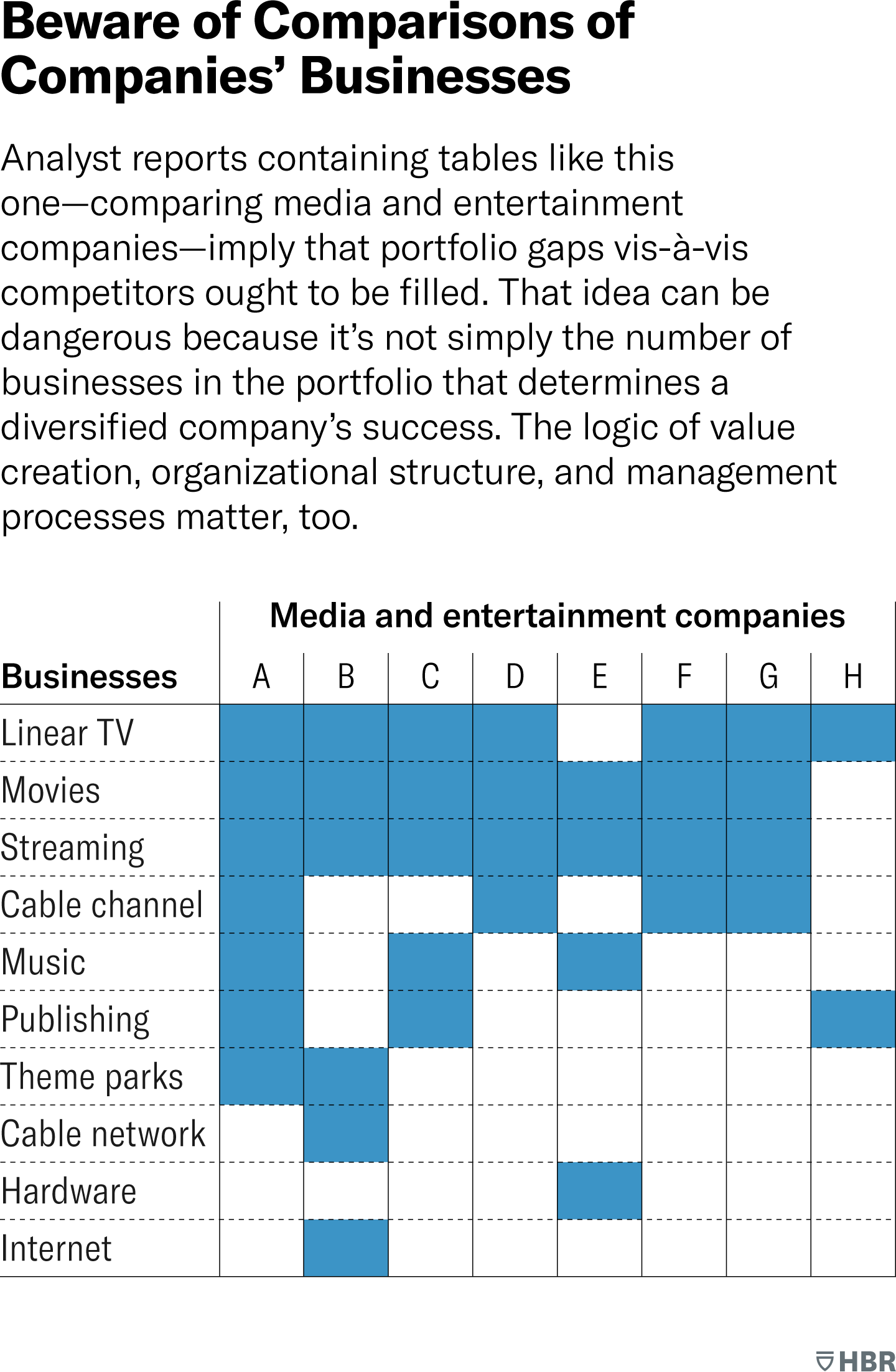

When analysts examine media and entertainment companies, they often rely on tables that compare the portfolios of various businesses, such as linear TV, movies, streaming, cable channels, music, and more. These comparisons might suggest that gaps in a company’s portfolio—relative to its competitors—represent weaknesses that should be addressed. However, this approach can be misleading and even harmful to strategic decision-making.

When analysts examine media and entertainment companies, they often rely on tables that compare the portfolios of various businesses, such as linear TV, movies, streaming, cable channels, music, and more. These comparisons might suggest that gaps in a company’s portfolio—relative to its competitors—represent weaknesses that should be addressed. However, this approach can be misleading and even harmful to strategic decision-making.

Beyond the Surface: Understanding Diversified Success

A closer look reveals that the success of a diversified company isn’t merely about the number of business units it operates. More critical are the underlying factors such as value creation logic, organizational structure, and management processes. Each of these plays a pivotal role in determining how well a company can leverage its portfolio for sustainable growth and competitive advantage.

For instance, a company like Company A in the media landscape may have a strong presence across linear TV, movies, streaming, and cable channels, while Company B might be heavily invested in streaming, music, and publishing. A superficial analysis might suggest that Company B should expand into linear TV or cable channels to “fill the gaps.” However, if Company B’s strengths lie in digital content and global music distribution, expanding into less familiar territories could dilute its core competencies and strategic focus.

The Danger of Imitative Strategy

Attempting to mirror a competitor’s portfolio without considering the unique strategic position and capabilities of one’s own company can lead to suboptimal outcomes. For example, if a company specializing in streaming decides to branch into hardware because a competitor is doing so, without understanding the complexities and capital requirements of the hardware business, it could face significant losses. The decision might not align with the company’s core competencies, ultimately leading to inefficiencies and a fragmented strategy.

Strategic Fit Over Portfolio Completeness

Instead of pursuing portfolio completeness, companies should focus on ensuring that each business unit aligns with their overarching strategy and capabilities. A well-structured portfolio is less about the breadth of coverage across different business categories and more about coherence, synergy, and the ability to create value in a way that competitors cannot easily replicate.

For instance, a company with strong capabilities in theme park operations might find greater success by enhancing its existing assets or exploring new geographic markets, rather than entering unrelated sectors like publishing or hardware. Similarly, a company with a dominant position in streaming might prioritize deepening its content library or investing in innovative digital technologies rather than expanding into theme parks or cable networks.

Conclusion: A Strategic Perspective

In conclusion, while analyst reports and portfolio comparisons can provide valuable insights into the competitive landscape, they should not be the sole basis for making strategic decisions. Companies, particularly in dynamic sectors like media and entertainment, must carefully evaluate their unique strengths, market opportunities, and long-term objectives. Rather than merely aiming to fill perceived gaps in their portfolios, companies should focus on strategic fit—ensuring that their business units are coherent, synergistic, and capable of creating value in ways that competitors find hard to replicate. This approach will better position them for sustainable success in an ever-evolving market.

How Dawgen Global’s Strategy Consultants Empower Organizations

At Dawgen Global, our team of seasoned strategy consultants plays a pivotal role in guiding organizations through this complex landscape of strategic decision-making. Here’s how we assist companies in making informed, strategic choices that drive growth and long-term success:

- Comprehensive Business Analysis: Our consultants begin with a deep dive into the organization’s current portfolio and operations. This involves a thorough analysis of existing business units, core competencies, market positioning, and financial performance. By understanding the intricacies of the company’s strengths and challenges, we can identify areas of strategic advantage.

- Market Opportunity Assessment: Dawgen Global’s experts conduct extensive market research to uncover new opportunities for growth and diversification. This includes analyzing emerging trends, consumer behaviors, and competitive dynamics within the industry. We help organizations identify not just where they can expand, but where they should expand, aligning potential opportunities with their strategic goals and capabilities.

- Strategic Fit Evaluation: One of the core principles of our approach is assessing the strategic fit of new opportunities or potential acquisitions. We work closely with organizations to evaluate whether expanding into a new market or business line aligns with their long-term vision and enhances their value proposition. Rather than pursuing expansion for the sake of it, we ensure every move contributes meaningfully to the organization’s overall strategy.

- Value Creation Strategies: Our consultants help companies develop and implement value creation strategies that go beyond conventional portfolio expansion. This might involve optimizing current operations, exploring innovative revenue streams, or enhancing customer experiences. By focusing on areas where the company can excel uniquely, we drive sustainable competitive advantages.

- Scenario Planning and Risk Management: In today’s volatile market environment, understanding potential risks and preparing for various scenarios is crucial. Dawgen Global assists organizations in scenario planning, helping them anticipate changes in market conditions, regulatory environments, and competitive actions. This proactive approach enables companies to remain agile and responsive, safeguarding their strategic initiatives.

- Execution Roadmap and Change Management: Strategic decisions are only as good as their execution. Our consultants work with organizations to develop clear, actionable roadmaps for implementing new strategies. We provide support in change management, ensuring that organizational structures, processes, and cultures are aligned with the new strategic direction. This holistic approach minimizes resistance and enhances the likelihood of successful strategy implementation.

- Continuous Monitoring and Adaptation: Strategy is not a one-time event but an ongoing process. Dawgen Global’s consultants stay engaged with organizations to continuously monitor the performance of implemented strategies. We provide insights and recommendations for adjustments as needed, ensuring that companies remain on track to achieve their strategic objectives.

The Dawgen Global Advantage

Partnering with Dawgen Global offers organizations a unique advantage. Our team combines deep industry knowledge with a tailored, client-centric approach, ensuring that every strategic decision is informed, aligned with the company’s core values, and designed to maximize long-term success. In an environment where market dynamics are constantly shifting, having a trusted advisor like Dawgen Global can make all the difference in staying ahead of the curve and achieving sustained growth.

By focusing on strategic fit and leveraging our comprehensive suite of consulting services, companies can navigate the complexities of their industries more effectively, driving performance and achieving their growth ambitions.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670 📲 WhatsApp Global: +1 876 5544445

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements