In the complex economic tapestry of developed nations, tax revenue acts as a critical thread, intertwining individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes to form the fiscal fabric that supports government functions and services. The recent pandemic has undeniably stressed this fabric, challenging countries within the Organisation for Economic Co-operation and Development (OECD) to reassess and recalibrate their tax systems in the face of fluctuating revenue streams. As these nations edge towards recovery, the strategic choices in tax policy could significantly influence their economic resurgence and long-term financial stability.

Tax Revenue Composition in OECD Countries:

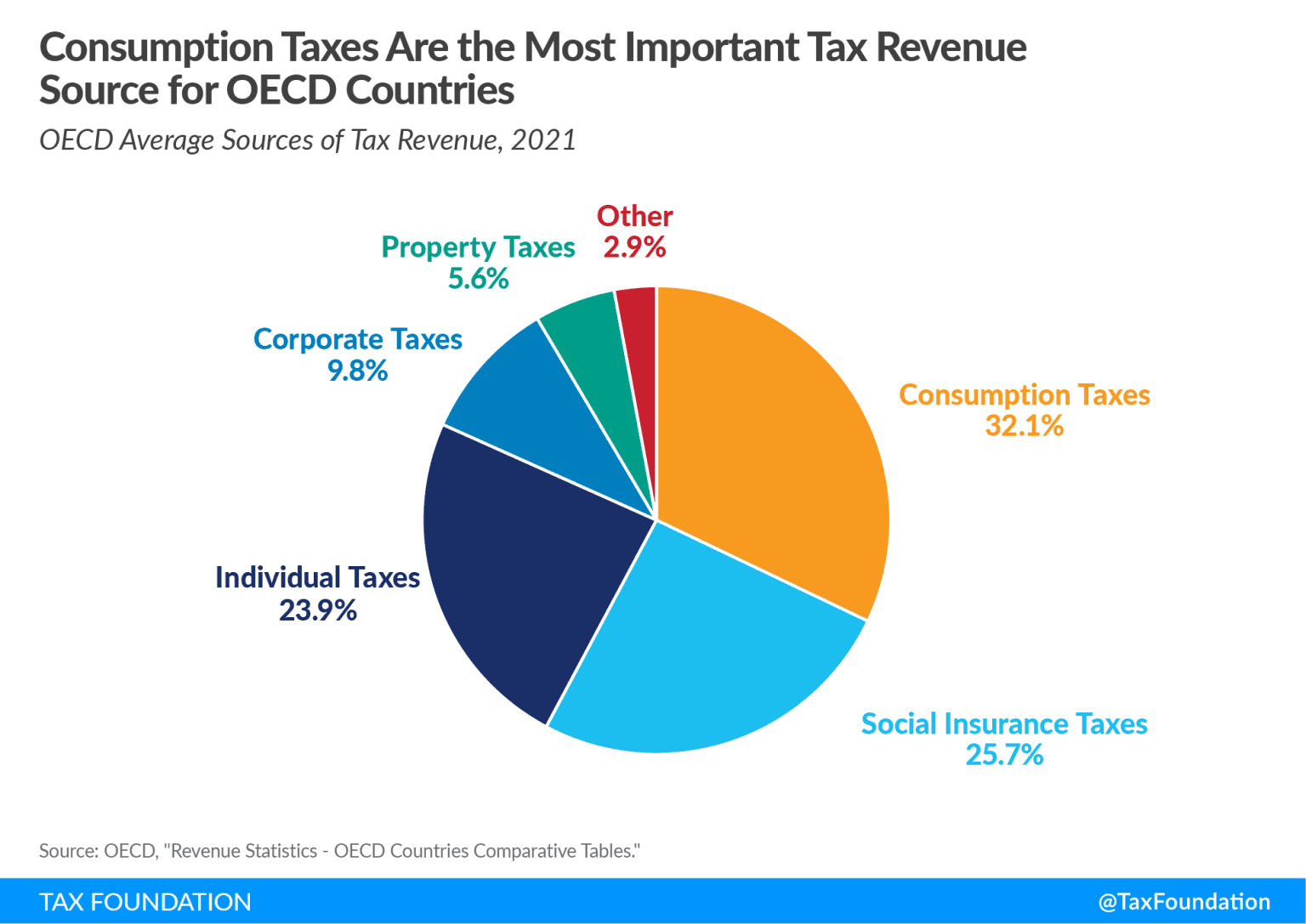

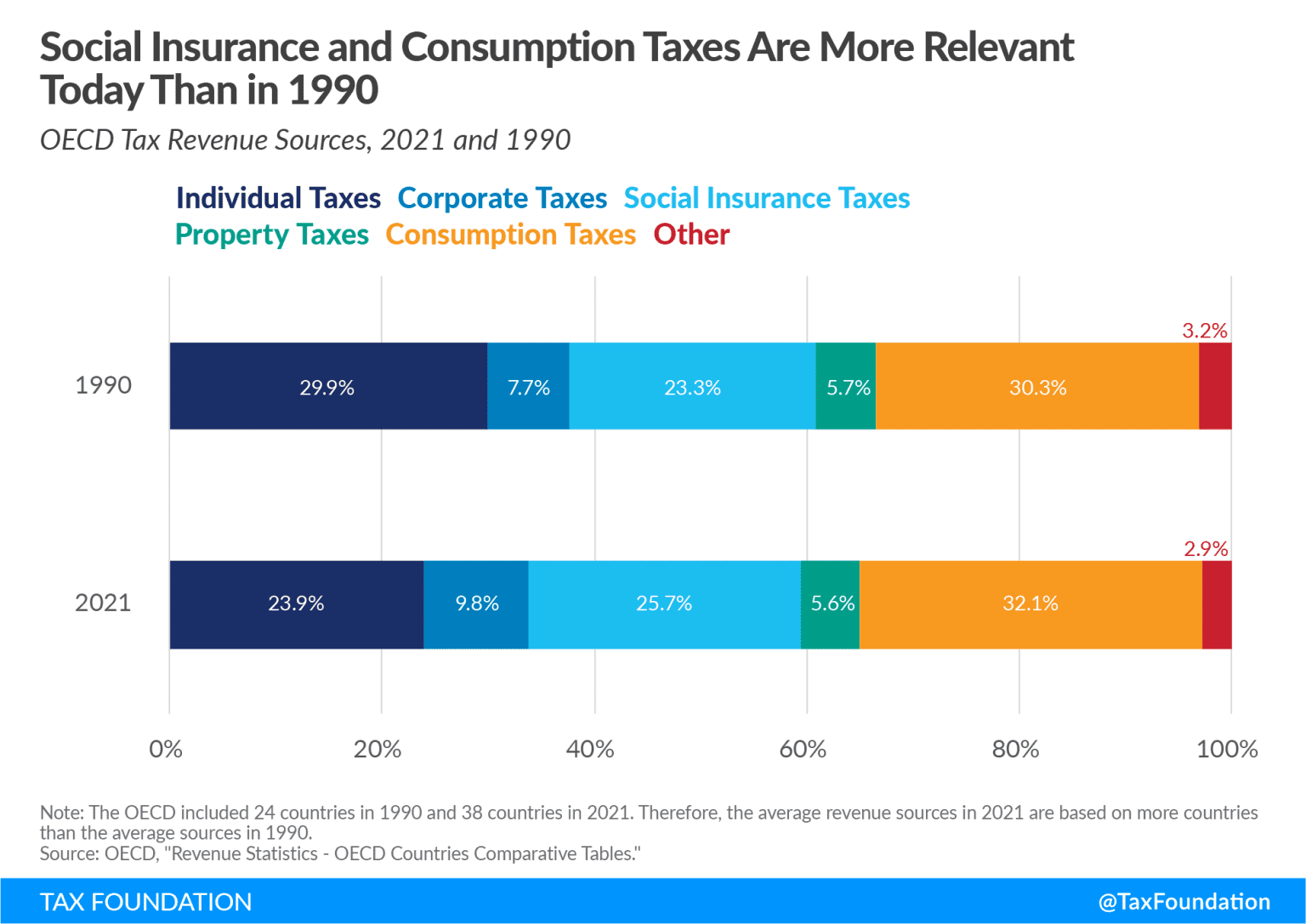

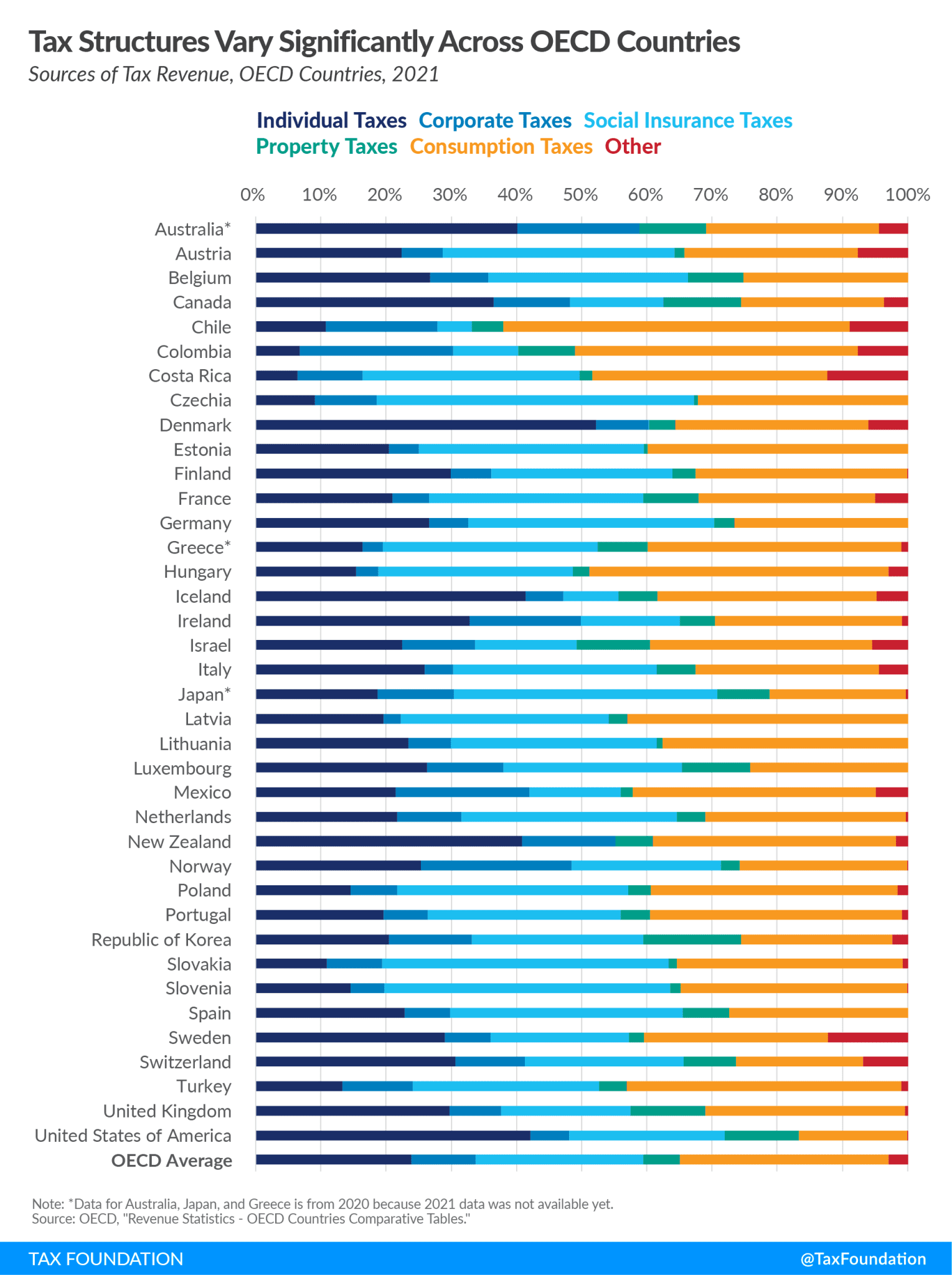

OECD countries exhibit a diverse mix in their tax revenue sources, generally leaning more towards consumption taxes (32.1%), social insurance taxes (25.7%), and individual income taxes (23.9%) compared to corporate income taxes (9.8%) and property taxes (5.6%). This composition is not only a reflection of policy preferences but also of economic strategies aimed at minimizing distortion while maximizing revenue. The emphasis on consumption taxes as a primary revenue source indicates a shift towards taxing spending rather than earning, which is seen as less likely to impact economic decisions negatively.

Impact of Policy Changes:

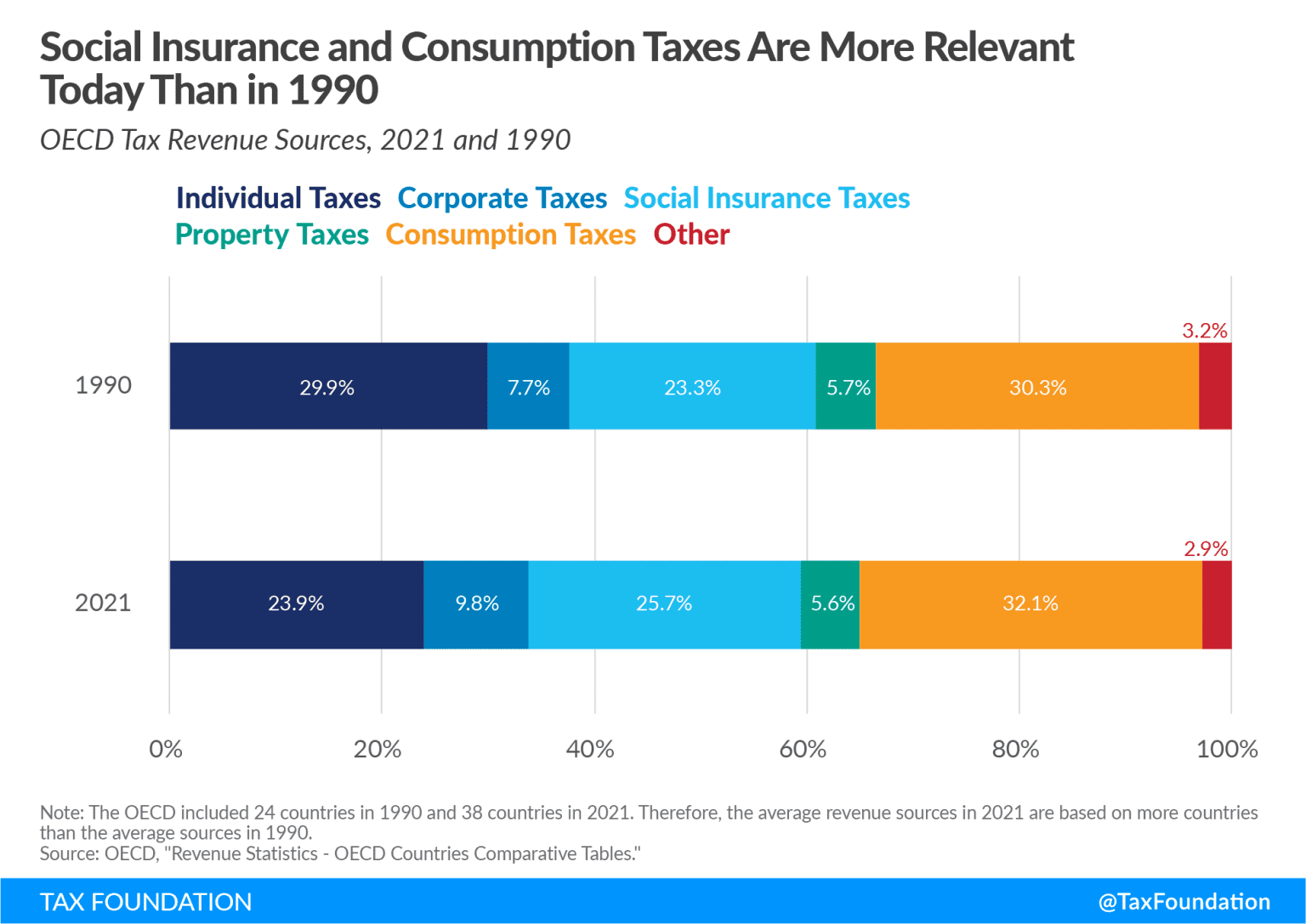

Over the years, a notable shift has been observed within OECD countries. There has been an increase in reliance on social insurance taxes by 2.4 percentage points and a decrease in dependence on individual income taxes by 6 percentage points since 1990. This shift suggests a strategic move towards broadening tax bases and lowering rates, which could potentially reduce the distortive effects on economic decisions. Additionally, the increasing reliance on corporate income tax revenue, despite falling corporate tax rates globally, highlights the evolving economic landscapes and membership dynamics within the OECD.

Country-Specific Insights:

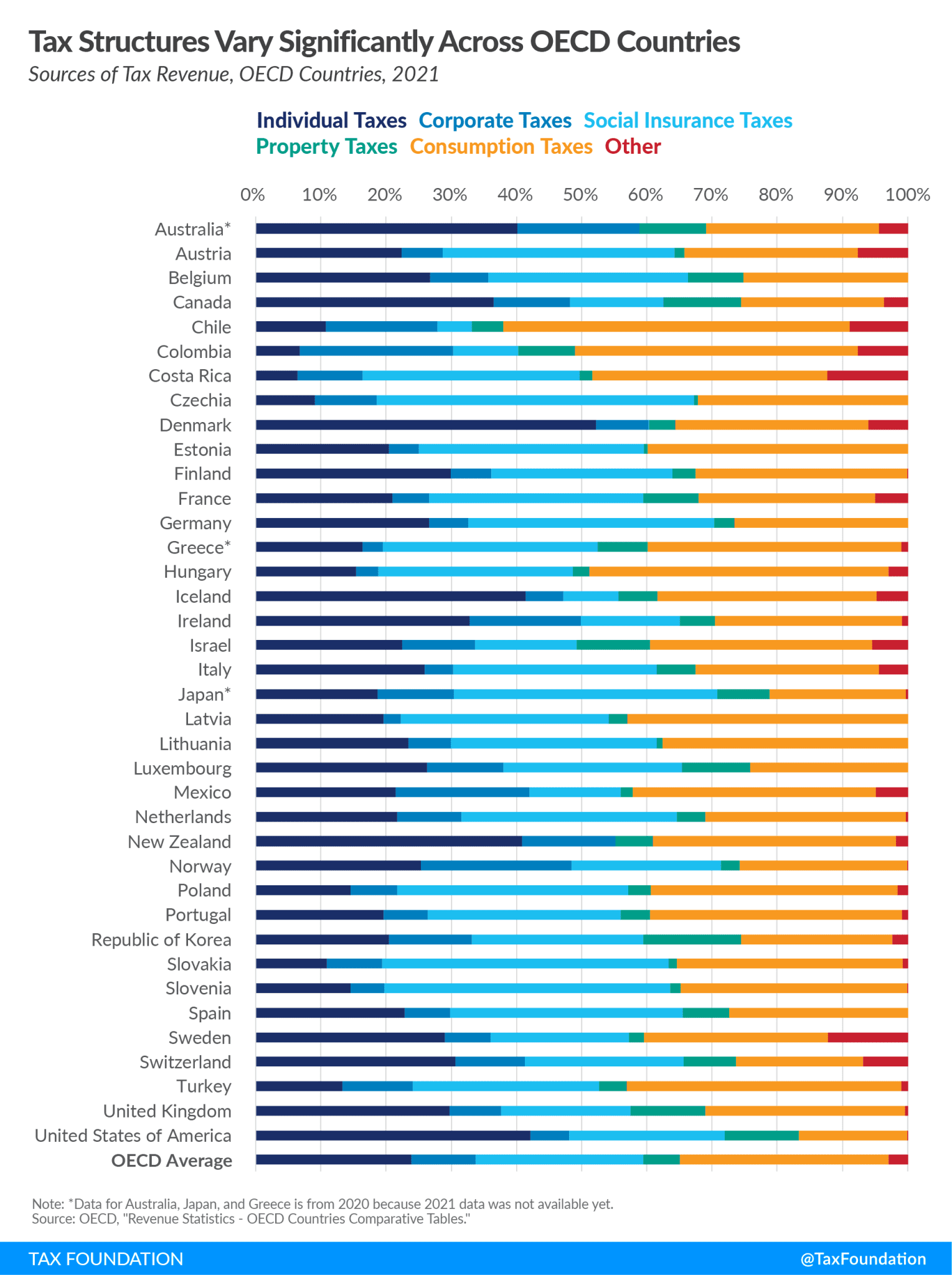

The data presents intriguing country-specific narratives. For instance, the United States stands out as the only OECD country without a Value-Added Tax (VAT), relying more heavily on retail sales and excise taxes. This makes the U.S. an anomaly, with its 16.6% revenue from consumption taxes being nearly half the OECD average. Conversely, countries like Colombia and Mexico significantly depend on corporate income taxes, raising more than 20% of their revenue from this source, which is twice the OECD average for corporate tax revenue.

- Economic Implications:

The choice of tax structure has profound implications for economic behavior and recovery. Taxes on income, especially when high, can deter work and investment, whereas taxes on consumption and property are generally considered less distortive. As countries navigate post-pandemic recovery, aligning tax systems to support economic activity while ensuring adequate revenue will be a delicate balance to strike.

Government Tax Revenue by Country in the OECD, 2021

| Country |

Individual Taxes |

Corporate Taxes |

Social Insurance Taxes |

Property Taxes |

Consumption Taxes |

Other |

| Australia* |

40.1 |

18.8 |

0 |

10.1 |

26.5 |

4.5 |

| Austria |

22.4 |

6.3 |

35.5 |

1.5 |

26.7 |

7.6 |

| Belgium |

26.7 |

9 |

30.6 |

8.5 |

25.2 |

0 |

| Canada |

36.5 |

11.7 |

14.3 |

11.9 |

22 |

3.6 |

| Chile |

10.8 |

17.1 |

5.3 |

4.8 |

53.1 |

8.9 |

| Colombia |

6.7 |

23.6 |

10 |

8.7 |

43.3 |

7.7 |

| Costa Rica |

6.4 |

10 |

33.2 |

2 |

36 |

12.3 |

| Czechia |

9.1 |

9.5 |

48.6 |

0.6 |

32.2 |

0 |

| Denmark |

52.2 |

8 |

0.1 |

4 |

29.7 |

6 |

| Estonia |

20.4 |

4.6 |

34.6 |

0.6 |

39.9 |

0 |

| Finland |

29.9 |

6.2 |

27.8 |

3.5 |

32.5 |

0.1 |

| France |

21 |

5.6 |

32.8 |

8.5 |

27.1 |

5 |

| Germany |

26.6 |

5.9 |

37.7 |

3.1 |

26.6 |

0 |

| Greece* |

16.3 |

3.1 |

32.8 |

7.7 |

38.7 |

1 |

| Hungary |

15.4 |

3.4 |

29.8 |

2.6 |

45.9 |

2.9 |

| Iceland |

41.4 |

5.7 |

8.5 |

5.9 |

33.6 |

4.8 |

| Ireland |

32.8 |

17.1 |

15.2 |

5.4 |

28.7 |

0.9 |

| Israel |

22.5 |

11.1 |

15.7 |

11.2 |

34.1 |

5.5 |

| Italy |

25.9 |

4.4 |

31.2 |

5.9 |

28.1 |

4.5 |

| Japan* |

18.7 |

11.7 |

40.4 |

8.1 |

20.9 |

0.3 |

| Latvia |

19.6 |

2.7 |

31.8 |

2.9 |

43 |

0 |

| Lithuania |

23.4 |

6.5 |

31.6 |

0.9 |

37.6 |

0 |

| Luxembourg |

26.2 |

11.7 |

27.4 |

10.4 |

24.1 |

0,,1 |

| Mexico |

21.4 |

20.5 |

14 |

1.8 |

37.3 |

4.9 |

| Netherlands |

21.7 |

9.8 |

33.1 |

4.3 |

30.8 |

0.3 |

| New Zealand |

40.8 |

14.4 |

0 |

5.7 |

37.3 |

1.8 |

| Norway |

25.4 |

23 |

22.9 |

2.9 |

25.7 |

0.1 |

| Poland |

14.6 |

7.1 |

35.4 |

3.5 |

37.8 |

1.6 |

| Portugal |

19.6 |

6.8 |

29.6 |

4.4 |

38.7 |

0.9 |

| Republic of Korea |

20.4 |

12.8 |

26.2 |

15.1 |

23.1 |

2.4 |

| Slovakia |

10.9 |

8.5 |

43.9 |

1.3 |

34.6 |

0.8 |

| Slovenia |

14.5 |

5.2 |

43.8 |

1.6 |

34.7 |

0.1 |

| Spain |

22.8 |

7 |

35.6 |

7.1 |

27.4 |

0 |

| Sweden |

29 |

7.1 |

21.2 |

2.3 |

28.2 |

12.3 |

| Switzerland |

30.6 |

10.7 |

24.3 |

8 |

19.6 |

6.8 |

| Turkey |

13.3 |

10.8 |

28.6 |

4.2 |

42.1 |

1 |

| United Kingdom |

29.7 |

7.9 |

19.9 |

11.4 |

30.7 |

0.4 |

| United States of America |

42.1 |

6 |

23.8 |

11.4 |

16.6 |

0.1 |

| OECD Average |

23.9 |

9.8 |

25.7 |

5.6 |

32.1 |

2.9 |

| Note: Data for Australia, Japan, and Greece is from 2020 because 2021 data was not available yet.

Source: OECD, “Revenue Statistics – OECD Countries Comparative Tables.” |

The landscape of tax revenue in OECD countries is a complex and evolving picture, reflecting a range of economic philosophies and strategies. The pandemic has acted as a catalyst for change, prompting nations to reconsider their approaches to taxation. As these countries move forward, the challenge will be to design and implement tax policies that not only recover lost revenue but also foster a conducive environment for sustainable economic growth and resilience.

Policymakers should continue to monitor and adapt their tax structures, considering the balance between revenue generation and economic vitality. Emphasizing less distortive taxes, broadening tax bases, and ensuring tax compliance are strategic avenues to explore. Additionally, countries should consider the long-term implications of their tax policies on international competitiveness and economic equity.