Manual processing in accounts payable (AP) presents significant challenges when it comes to tracking and analyzing key performance indicators (KPIs). The lack of accurate data often leads to inefficiencies, making it difficult to gain valuable insights into company spending and supplier relationships.

Manual processing in accounts payable (AP) presents significant challenges when it comes to tracking and analyzing key performance indicators (KPIs). The lack of accurate data often leads to inefficiencies, making it difficult to gain valuable insights into company spending and supplier relationships.

According to the Institute of Finance & Management, only 9% of finance professionals believe their method of measuring AP metrics is extremely effective. Furthermore, 66% of businesses still rely on Excel spreadsheets, while 38% use whiteboards, emails, or have no tracking system at all.

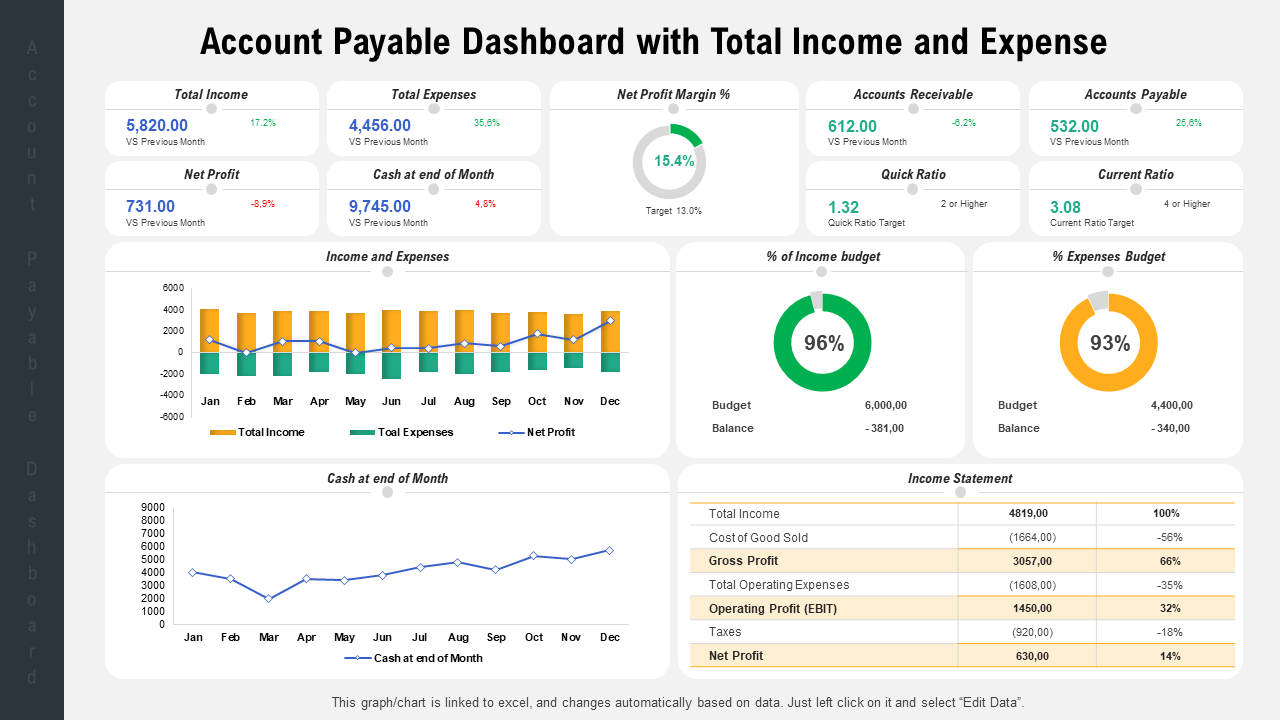

To streamline reporting and optimize AP metrics, businesses should consider implementing AP dashboards. These dashboards simplify data visualization, improve efficiency, and minimize errors, enabling businesses to make strategic financial decisions.

Understanding Accounts Payable Metrics

Accounts payable metrics are essential benchmarks that provide insights into spending patterns, inefficiencies, and overall AP performance. These metrics help finance teams optimize operations, strengthen supplier relationships, and identify cost-saving opportunities.

By leveraging AP automation platforms with built-in analytics, businesses can monitor key metrics in real-time, reducing manual errors and enhancing financial decision-making.

Strategies to Improve Accounts Payable Efficiency

Organizations seeking to enhance AP efficiency should consider transitioning to an automated, paperless process. Automation not only accelerates invoice approvals and payments but also improves reporting accuracy and strategic planning.

For companies not ready for full automation, it is crucial to establish KPIs aligned with business goals. AP teams should determine their priorities—such as vendor management, cash flow optimization, or payment cycle efficiency—and measure their progress using relevant metrics.

Key Accounts Payable Metrics for Performance Measurement

Tracking the right AP metrics is essential for assessing performance and optimizing efficiency. Below are eight critical AP metrics that businesses should monitor:

1. Total Number of Invoices Received

Tracking the number of invoices received over a set period (daily, weekly, monthly, or yearly) helps businesses identify trends and prepare for high-volume periods, such as the end of a fiscal quarter.

2. Total Number of Invoices Processed

Comparing the number of invoices processed with the total received highlights bottlenecks in workflow efficiency. A low processing rate may indicate manual inefficiencies that slow down approvals and payments.

3. Average Cost Per Invoice

This metric helps businesses determine their total AP expenses, including labor, software, paper processing, and postage costs. Companies can cut costs by eliminating unnecessary manual steps and adopting electronic payment solutions.

4. Average Time to Process an Invoice

A longer processing time increases labor costs and slows down supplier payments. Businesses should track this metric alongside cost per invoice to pinpoint areas for process improvement.

5. Rate of Errors in Invoice Payments

High error rates indicate inefficiencies such as duplicate payments, overpayments, or missing invoices. Automating AP processes can reduce errors and prevent financial losses.

6. Discounts Captured vs. Offered

This metric evaluates how many early payment discounts were successfully obtained versus how many were available. Businesses can maximize savings by improving payment cycles and reducing approval delays.

7. Electronic vs. Paper Invoices

Tracking the ratio of electronic invoices to paper invoices helps businesses identify opportunities to transition toward digital invoicing. Electronic invoices are faster, cheaper, and reduce processing errors.

8. Days Payable Outstanding (DPO)

DPO measures how long it takes a company to pay suppliers. While a higher DPO can improve cash flow, delayed payments may strain supplier relationships. Businesses should aim for a balanced approach that maintains financial flexibility without jeopardizing supplier trust.

Transforming AP Processes with Dawgen Global

Effective Accounts Payable (AP) management is essential for financial efficiency, cost control, and supplier relationship management. However, many businesses struggle with manual processing inefficiencies, limited data visibility, and ineffective tracking of key performance indicators (KPIs). To address these challenges, real-time tracking, automation, and strategic KPI measurement are critical to optimizing AP functions.

Businesses can significantly enhance their AP processes by:

✅ Implementing AP dashboards for real-time tracking and data visualization

✅ Reducing manual processes through automation to improve speed and accuracy

✅ Setting measurable KPIs aligned with broader business goals for continuous improvement

By monitoring key AP metrics, such as invoice processing times, cost per invoice, error rates, and days payable outstanding (DPO), finance teams can gain actionable insights to streamline operations, minimize costs, and strengthen supplier relationships. These improvements not only drive business success but also enhance overall financial health.

How Dawgen Global Can Assist Clients in Optimizing Accounts Payable Efficiency

At Dawgen Global, we specialize in enhancing financial efficiency through our comprehensive AP automation, accounting, and financial advisory solutions. Our expert team provides businesses with tailored strategies, technology-driven solutions, and process improvements that ensure a seamless, data-driven AP function.

1. Implementing AP Dashboards for Real-Time Insights

Our team assists businesses in deploying customized AP dashboards that provide:

📊 Real-time monitoring of invoices, payments, and outstanding liabilities

📈 Advanced analytics to track trends and optimize cash flow

🚀 Customizable KPI tracking to align with business goals

💡 Seamless integration with ERP and accounting systems

By using AP dashboards, companies can reduce errors, accelerate invoice approvals, and enhance financial decision-making.

2. Automating AP Processes for Greater Efficiency

Manual AP processes are prone to delays, errors, and inefficiencies. Dawgen Global helps clients transition to paperless, automated AP workflows, including:

✅ Invoice digitization & automated approvals to eliminate manual bottlenecks

✅ AI-powered fraud detection to prevent duplicate or erroneous payments

✅ Automated payment processing for seamless vendor transactions

✅ Supplier e-invoicing solutions to reduce processing time and costs

By embracing AP automation, businesses can significantly cut down processing time, lower operational costs, and improve supplier satisfaction.

3. Setting & Monitoring AP KPIs for Continuous Improvement

We work closely with businesses to identify, set, and track critical AP KPIs, ensuring:

📌 Reduced cost-per-invoice through process optimization

📌 Faster invoice approvals to capture early payment discounts

📌 Lower payment error rates to prevent financial losses

📌 Optimized Days Payable Outstanding (DPO) for better cash flow management

With our data-driven approach, businesses can track performance, identify inefficiencies, and implement strategic improvements for long-term success.

4. Enhancing Supplier Relationship Management

Dawgen Global understands that strong supplier relationships are crucial for a well-functioning AP process. We help businesses:

🤝 Improve vendor communication through automated portals

💳 Ensure timely payments to maintain credibility and leverage early payment discounts

🔍 Implement contract management solutions to streamline supplier agreements

📑 Optimize procurement-to-payment cycles to ensure compliance and cost savings

By strengthening supplier partnerships, businesses gain better negotiation power, cost advantages, and improved supply chain efficiency.

5. Tailored Advisory & Compliance Support

Beyond technology and automation, Dawgen Global provides expert guidance on:

🔹 Regulatory compliance to ensure AP processes align with financial regulations

🔹 Fraud prevention strategies to safeguard against financial mismanagement

🔹 Cash flow management solutions to optimize working capital

🔹 Custom AP audits & reviews to assess and enhance existing processes

Our team works with businesses of all sizes across various industries, providing personalized AP solutions to meet their unique financial and operational needs.

Are you ready to transform your AP function, reduce costs, and enhance efficiency? Dawgen Global is here to help. Our expert accountants, auditors, and business advisors will work with you to implement AP best practices, automate workflows, and drive financial success.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670/876-9265210 📲 WhatsApp Global: +1 876 5544445

📞 USA Office: 855-354-2447

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements